TomTom 2011 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2011 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TomTom Annual Report and Accounts 2011

10

Taxation

—

Excluding the tax effect of the impairment and restructuring

charges, the income tax charge for the year was €13 million

compared to €27 million in 2010. The effective tax rate for 2011

was 15.0% as compared to 19.8% last year. The decrease in

group effective tax rate is mainly due to utilisation of losses not

previously capitalised and prior period adjustments, following the

completion of tax returns related to previous years in 2011.

Net result

—

The net result for the year was €73 million, down by €37 million

as compared to €110 million in 2010. The decrease was due

to the lower revenue, which was partly compensated by lower

operating and interest expenses as well as positive foreign

exchange results.

Liquidity and capital resources

—

During 2011 we generated €195 million in cash from operations

as compared to €265 million in 2010. The decrease was mainly

driven by lower operating results offset by lower investments in

working capital.

We invested €58 million in intangible assets during 2011 as part

of our commitment to continuous innovation mainly in technology

and database development projects. Moreover, we also invested

in property, plant and equipment, and on buying out some local

map making partners which gave TomTom full control of map

operations in certain additional geographical markets.

With regard to debt fi nancing, we repaid €210 million of

outstanding borrowings during 2011 in line with our debt

repayment schedule.

Management Board Report | continued

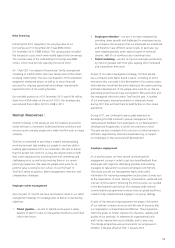

700

600

500

400

300

200

100

200920102011

01111131388

189

189

197

197202202

86

86

105

105

77

77

139

139

162

162

167

167

75

75

78

78

85

85

Research & development expenses

Amortisation of technology and databases

Marketing expenses

Selling, general and administrative expenses

Stock compensation

11138

189

197202

86

105

77

139

162

167

75

78

85

560

480

400

320

240

160

80

0

Cash position

31 December

2010

Operating

result

Depreciation

&

Amortisation

Working

capital

movement

Other

non-

cash

items

Interests,

taxes and

other

Investments Repayment

of

borrowings

Cash position

31 December

2011

306

87

119 – 13

2– 24 – 73

– 210

194

Operating expenses (€ in millions)

For comparative reasons we have excluded

impairment and restructuring expenses.

Cash fl ow development

(€ in millions)

1

1 Operating result adjusted for impairment charge.