TomTom 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TomTom Annual Report and Accounts 2011

66

Notes to the Consolidated Financial Statements | continued

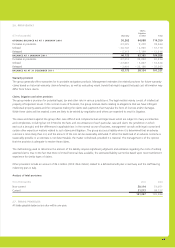

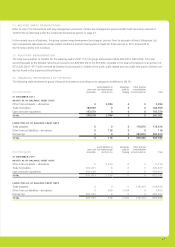

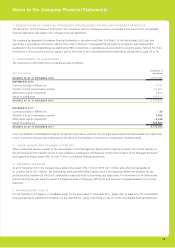

22. SHARE-BASED COMPENSATION (CONTINUED)

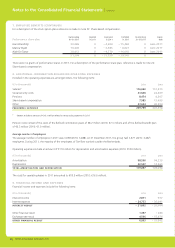

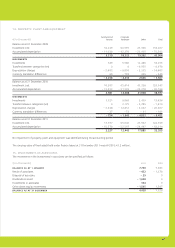

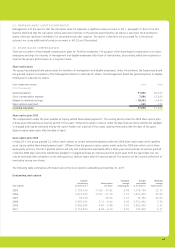

A summary of the group’s stock option plans and the movements during the years 2011 and 2010 are presented below:

Option plans 2011

Weighted

average exercise

price 2010

Weighted

average exercise

price

Outstanding at the beginning of the year 17,188,562 11.06 12,159,280 13.81

Granted 3,164,950 6.11 6,013,500 5.32

Exercised – 84,428 5.72 – 90,011 5.72

Forfeited – 3,544,335 15.31 – 894,207 16.00

OUTSTANDING AT THE END OF THE YEAR 16,724,749 9.25 17,188,562 11.06

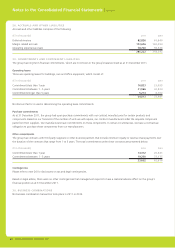

Performance share plan

In 2011 the group introduced a new performance share plan for employees. The performance shares are conditional on the employee

completing three years’ service (the vesting period). On 31 December 2011 the liability with regard to the performance share plan was

€ 0.3 million (2010: €2.4 million). The performance shares granted in 2008 have vested and were paid out to the employees in 2011.

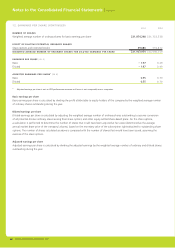

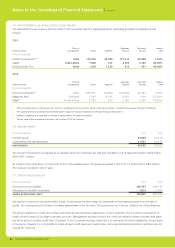

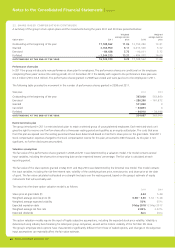

The following table provides the movement in the number of performance shares granted in 2008 and 2011.

Share plans 2011 2010

Outstanding at the beginning of the year 363,000 563,860

Exercised – 280,390 – 161,872

Granted 571,800 0

Cancelled – 24,833 0

Forfeited – 94,910 – 38,988

OUTSTANDING AT THE END OF THE YEAR 534,667 363,000

Restricted stocks plan

The group introduced in 2011 a restricted stock plan to retain a selected group of young talented employees. Each restricted-stock unit

gives the right to receive one TomTom share after a three-year vesting period and qualifi es as an equity-settled plan. The costs that arise

from this plan are spread over the vesting period and have been determined based on TomTom’s share price on the grant date. Total 2011

stock compensation expenses charged to the stock compensation reserve for this plan amounted to €60 thousand. As this plan is not

signifi cant, no further disclosures are provided.

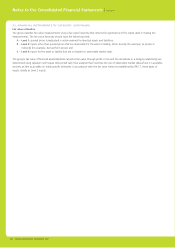

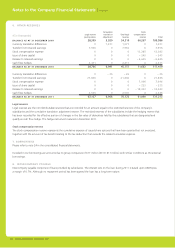

Valuation assumptions

The fair value of the performance shares granted in 2008 and 2011 was determined by a valuation model. The model contains several

input variables, including the share price at reporting date and an expected leavers’ percentage. The fair value is calculated at each

reporting period.

The fair value of the share options granted in May 2011 and May 2010 was determined by the binomial tree model. This model contains

the input variables, including the risk-free interest rate, volatility of the underlying share price, exercise price, and share price at the date

of grant. The fair value calculated is allocated on a straight-line basis over the vesting period, based on the group’s estimate of equity

instruments that will eventually vest.

The input into the share option valuation model is as follows:

2011 2010

Share price at grant date (€) 6.04 5.48

Weighted average exercise price (€) 6.08 – 6.20 5.32 – 5.48

Weighted average expected volatility 50% 55%

Expected expiration date 9 May 2018 12 May 2017

Weighted average risk free rate 2.82% 2.42%

Expected dividends Zero Zero

The option valuation models require the input of highly subjective assumptions, including the expected stock price volatility. Volatility is

determined using industry benchmarking for listed peer group companies, as well as the historic volatility of the TomTom NV stock.

The group’s employee stock options have characteristics signifi cantly different from those of traded options, and changes in the subjective

input assumptions can materially affect the fair value estimate.