TomTom 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TomTom Annual Report and Accounts 2011

64

Notes to the Consolidated Financial Statements | continued

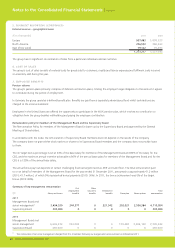

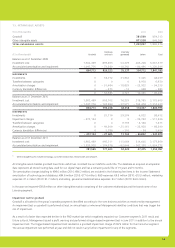

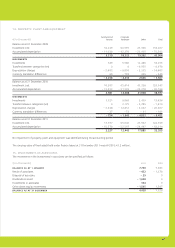

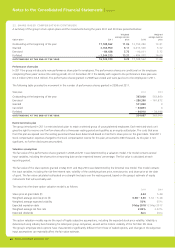

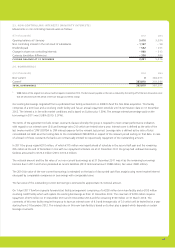

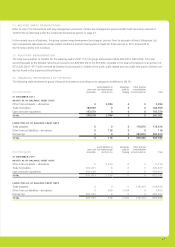

19. OTHER FINANCIAL ASSETS

Other fi nancial assets include derivative fi nancial instruments carried at fair value through profi t or loss and derivatives in a hedging

relationship.

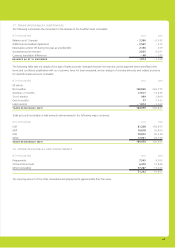

(€ in thousands) 2011 2010

Assets Liabilities Assets Liabilities

Derivatives at fair value through profi t or loss 2,784 – 116 5,724 – 598

Interest rate swaps – cash fl ow hedge 0 0 0 – 3,354

TOTAL 2,784 – 116 5,724 – 3,952

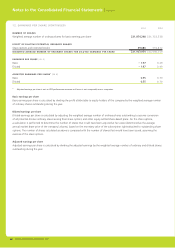

A – Derivatives at fair value through profi t or loss

The notional principal amounts of the outstanding forward foreign exchange and option contracts at 31 December 2011 were

€64 million (2010: €277 million).

All our outstanding options and forwards have a contractual maturity of less than one year.

B – Cash fl ow hedge

The notional principal amounts of the outstanding interest rate swap contracts at 31 December 2011 were nil

(2010: €600 million) as it has matured.

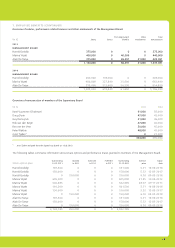

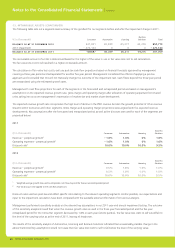

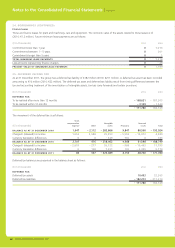

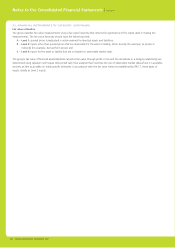

20. CASH AND CASH EQUIVALENTS

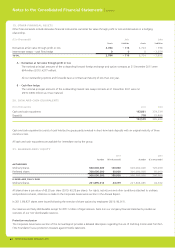

(€ in thousands) 2011 2010

Cash and cash equivalents 192,861 279,734

Deposits 718 25,866

193,579 305,600

Cash and cash equivalents consist of cash held by the group partly invested in short-term bank deposits with an original maturity of three

months or less.

All cash and cash equivalents are available for immediate use by the group.

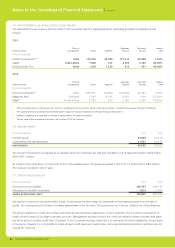

21. SHAREHOLDERS’ EQUITY

2011 2010

Number (€ in thousands) Number (€ in thousands)

AUTHORISED

Ordinary shares 600,000,000 120,000 600,000,000 120,000

Preferred shares 300,000,000 60,000 300,000,000 60,000

900,000,000 180,000 900,000,000 180,000

ISSUED AND FULLY PAID

Ordinary shares 221,895,012 44,379 221,808,085 44,362

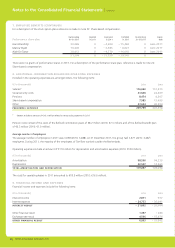

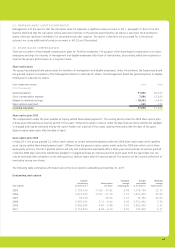

All shares have a par value of €0.20 per share (2010: €0.20 per share). For rights, restrictions and other conditions attached to ordinary

and preference shares, reference is made to the Corporate Governance section in the Annual Report.

In 2011, 86,927 shares were issued following the exercise of share options by employees (2010: 90,011).

Our reserves are freely distributable except for €70.1 million of legal reserves. Note 6 in our company fi nancial statements provides an

overview of our non-distributable reserves.

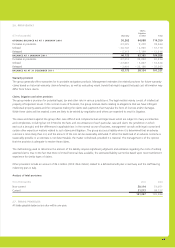

Protection mechanism

The Corporate Governance section of this Annual Report provides a detailed description regarding the use of Stichting Continuiteit TomTom

(‘the Foundation’) as a protection measure against hostile takeovers.