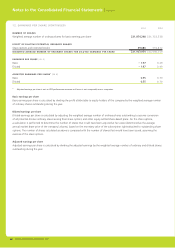

TomTom 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

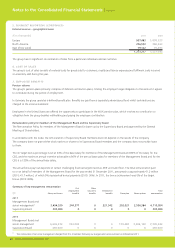

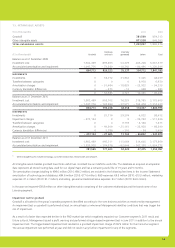

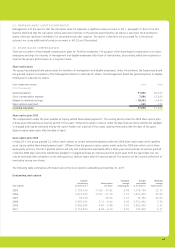

9. FINANCIAL INCOME AND EXPENSES (CONTINUED)

The foreign exchange line item is composed of results related to hedging contracts and balance sheet item revaluations. Hedging contracts

are entered to protect the group from adverse exchange rate fl uctuations that may result from USD, GBP, AUD, CHF and SEK exposures.

The interest expense relates to interest paid on our borrowings and amortised transaction costs (see note 24).

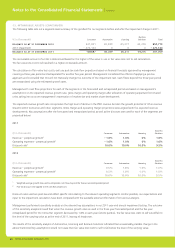

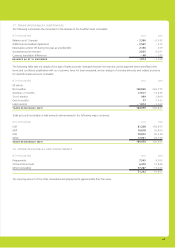

10. INCOME TAX

The activities of the group are subject to corporate income tax in several countries, depending on presence and activity. The applicable

statutory tax rates vary between 12.5% and 41.0%. The different tax jurisdictions in which we operate can cause the effective tax rate to

differ from the Dutch corporate tax rate.

(€ in thousands) 2011 2010

Current tax expense 9,876 31,345

Deferred tax – 11,795 – 4,989

INCOME TAX EXPENSE – 1,919 26,356

The effective tax rate, based on income before taxes excluding impairment was 12.9% (2010: 19.7%). The reconciliation between the tax

charge on the basis of the Dutch tax rate and the effective tax rate is as follows:

2011 2010

DUTCH TAX RATE 25.0% 25.5%

Higher weighted average statutory rate on group activities 8.2% 4.9%

Income exempted from tax – 8.8% – 7.6%

Non tax deductible share options 1.7% 1.4%

Utilisation of losses not previously capitalised – 5.9% 0.0%

Prior year adjustments1– 3.7% 0.0%

Other – 3.6% – 4.5%

EFFECTIVE TAX RATE 12.9% 19.7%

1 Following the completion of tax returns related to previous years in 2011.

2011 2010

Effective tax rate including impairment – 0.4% 19.7%

Tax effect of impairment charge 13.3% 0%

Effective tax rate excluding impairment 12.9% 19.7%

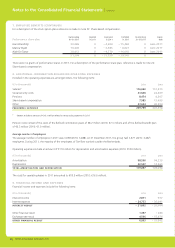

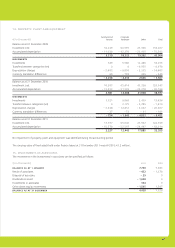

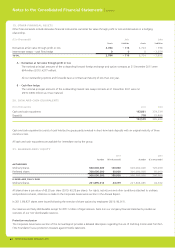

11. GOVERNMENT GRANTS

The group recognised as income a government grant of €9.9 million (2010: €9.5 million) in respect of research and development activities

performed by the group. The group is not obliged to refund these amounts. Government grants are reported as income within operating

expenses.

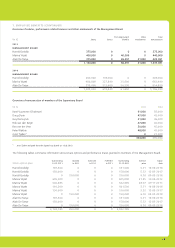

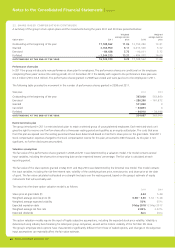

12. EARNINGS PER SHARE

The calculation of basic and diluted earnings per share is based on the following data:

(€ in thousands) 2011 2010

EARNINGS

Earnings (net result attributed to equity holders) – 437,844 107,768

ADJUSTED EARNINGS

Net result – 437,844 107,768

Impairment charge 511,936 0

Amortisation of acquired intangibles 63,529 61,136

Restructuring expenses 14,798 3,344

Tax effect of adjustments – 30,699 – 16,442

ADJUSTED EARNINGS 121,720 155,806