TomTom 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

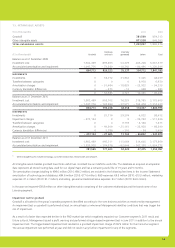

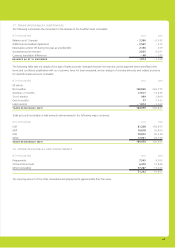

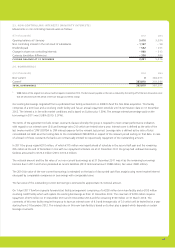

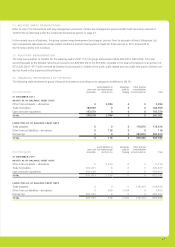

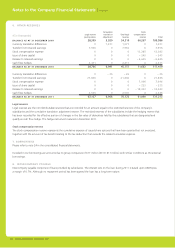

26. PROVISIONS

(€ in thousands) Warranty

Claims,

litigation

& other Total

OPENING BALANCE AS AT 1 JANUARY 2010 50,262 64,088 114,350

Increases in provisions 29,325 9,239 38,564

Utilised – 28,147 – 2,963 – 31,110

Released – 5,317 – 7,199 – 12,516

BALANCE AT 1 JANUARY 2011 46,123 63,165 109,288

Increases in provisions 27,312 34,022 61,334

Utilised – 27,861 – 5,867 – 33,728

Released – 2,401 – 33,166 – 35,567

BALANCE AS AT 31 DECEMBER 2011 43,173 58,154 101,327

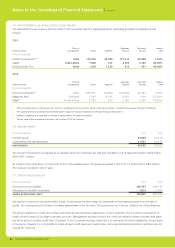

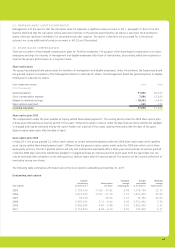

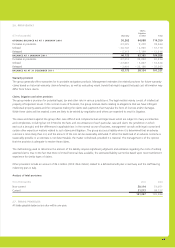

Warranty provision

The group generally offers warranties for its portable navigation products. Management estimates the related provision for future warranty

claims based on historical warranty claim information, as well as evaluating recent trends that might suggest that past cost information may

differ from future claims.

Claims, litigation and other provision

The group made a provision for potential legal, tax and other risks in various jurisdictions. The legal matters mainly consist of intellectual

property infringement issues. In the normal course of business, the group receives claims relating to allegations that we have infringed

intellectual property assets and the companies making the claims seek payments that may take the form of licences and/or damages.

While these claims will be resisted, some are likely to be settled by negotiation and others are expected to result in litigation.

The cases and claims against the group often raise diffi cult and complex factual and legal issues which are subject to many uncertainties

and complexities, including but not limited to the facts and circumstances of each particular case and claim, the jurisdiction in which

each suit is brought, and the differences in applicable law. In the normal course of business, management consults with legal counsel and

certain other experts on matters related to such claims and litigation. The group accrues a liability when it is determined that an adverse

outcome is more likely than not, and the amount of the loss can be reasonably estimated. If either the likelihood of an adverse outcome is

reasonably possible or an estimate is not determinable, the matter is disclosed, provided it is material. The management is of the opinion

that the provision is adequate to resolve these claims.

The methodology used to determine the amount of the liability requires signifi cant judgments and estimates regarding the costs of settling

asserted claims. Due to the fact that there is limited historical data available, the estimated liability cannot be based upon recent settlement

experience for similar types of claims.

Other provisions include an amount of €6.3 million (2010: €6.4 million) related to a defi ned benefi t plan in Germany and the staff leaving

indemnity plan in Italy.

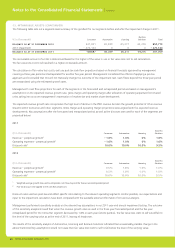

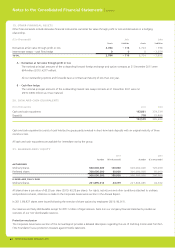

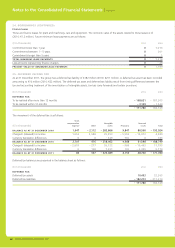

Analysis of total provisions

(€ in thousands) 2011 2010

Non-current 50,114 51,051

Current 51,213 58,237

101,327 109,288

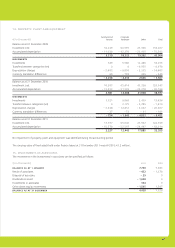

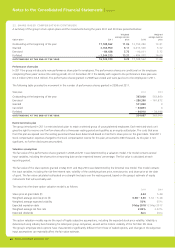

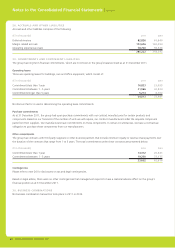

27. TRADE PAYABLES

All trade payable balances are due within one year.