Supercuts 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

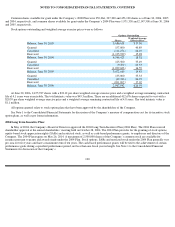

In addition to the amounts listed in the table above, the Company is guarantor on a limited number of equipment lease agreements

between its franchisees and leasing companies. If the franchisee should fail to make payments, in accordance with the lease, the Company will

be held liable under such agreements and retains the right to possess the related salon operations. The Company believes the fair value of the

salon operations exceeds the maximum potential amount of future lease payments for which it could be held liable. The existing guaranteed

lease obligations, which have an aggregate undiscounted value of $1.0 million at June 30, 2006, terminate at various dates between June 2007

and May 2011. Management has not experienced and does not expect any material loss to result from these arrangements.

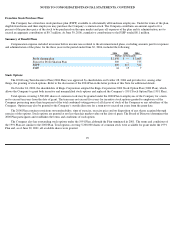

Salon Development Program:

As a part of its salon development program, the Company continues to negotiate and enter into leases and commitments for the acquisition

of equipment and leasehold improvements related to future salon locations, and continues to enter into transactions to acquire established hair

care salons and beauty schools.

Contingencies:

The Company is self-insured for most workers’ compensation and general liability losses subject to per occurrence and aggregate annual

liability limitations. The Company is insured for losses in excess of these limitations. The Company is also self-insured for health care claims

for eligible participating employees subject to certain deductibles and limitations. The Company determines its liability for claims incurred but

not reported on an actuarial basis.

7. LITIGATION

The Company is a defendant in various lawsuits and claims arising out of the normal course of business. Like certain other large retail

employers, the Company has been faced with allegations of purported class-wide wage and hour violations. Litigation is inherently

unpredictable and the outcome of these matters cannot presently be determined. Although company counsel believes that the Company has

valid defenses in these matters, it could in the future incur judgments or enter into settlements of claims that could have a material adverse

effect on its results of operations in any particular period. In June, 2006, without admitting any liability, the Company settled the collective

action lawsuit in which violations of the Fair Labor Standards Act (FLSA) were alleged.

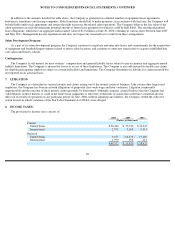

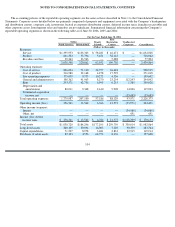

8. INCOME TAXES:

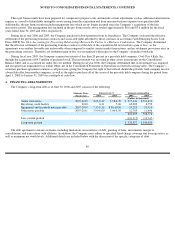

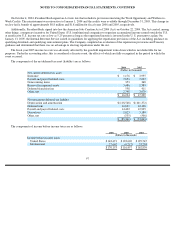

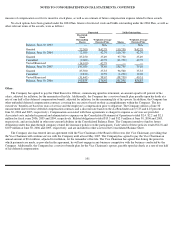

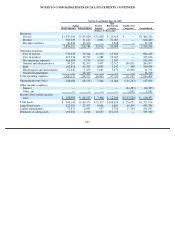

The provision for income taxes consists of:

96

2006

2005

2004

(Dollars in thousands)

Current:

United States

$

50,426

$

55,732

$

33,947

International

2,795

5,618

9,313

Deferred:

United States

5,555

(10,476

)

15,149

International

1,799

952

212

$

60,575

$

51,826

$

58,621