Supercuts 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

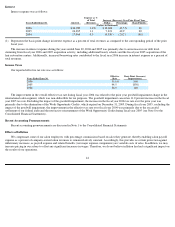

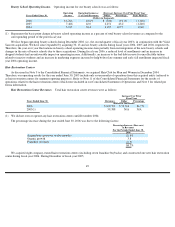

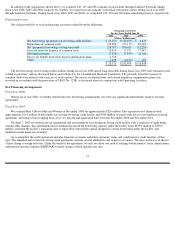

exercise of stock options was presented as an operating activity (included within accrued expenses) and totaled $9.1 and $8.3 million for the

years ended June 30, 2005 and 2004, respectively.

During fiscal year 2005, accounts payable and accrued expenses increased primarily due to an increase in inventory, as well as the timing

of advertising expenses and income tax payments. Inventories increased due to growth in the number of salons, as well as lower than expected

same-store product sales. The asset and goodwill impairment was primarily comprised of a goodwill impairment charge of $38.3 million

resulting from a write-off related to the international salon segment. During fiscal year 2004, deferred income taxes increased primarily due to

differences in the book and tax treatment of depreciation and amortization methodologies associated with property and equipment and

goodwill.

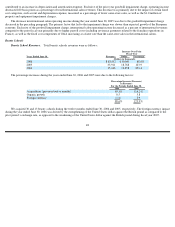

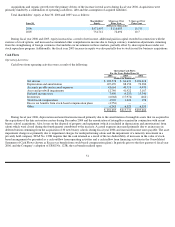

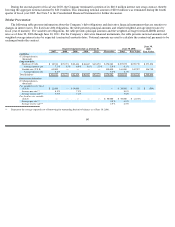

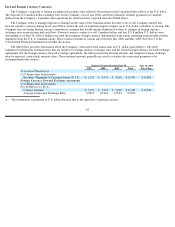

Investing Activities

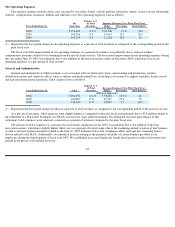

Net cash used in investing activities was the result of the following:

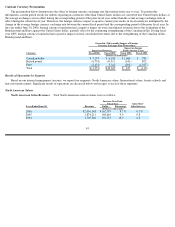

During fiscal year 2006, we entered into a credit agreement with a third party, under which we lent $6.0 million. Refer to Note 3,

“Acquisitions and Investments,” of Notes to Consolidated Financial Statements for further details surrounding this arrangement.

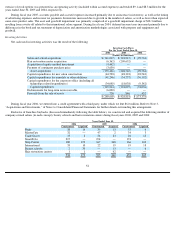

Exclusive of franchise buybacks (discussed immediately following the table below), we constructed and acquired the following number of

company-owned salons (in each concept), beauty schools and hair restoration centers during fiscal years 2006, 2005 and 2004:

52

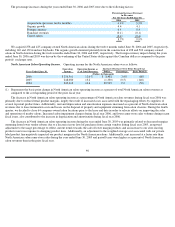

Investing Cash Flows

For the Years Ended June 30,

2006

2005

2004

(Dollars in thousands)

Salon and school acquisitions

$

(141,047

)

$

(118,915

)

$

(99,734

)

Hair restoration center acquisition

(6,362

)

(209,652

)

—

Acquisition of equity method investment

(4,442

)

—

—

Payment of contingent purchase price

(3,630

)

—

—

Asset acquisitions

(155,481

)

(328,567

)

(99,734

)

Capital expenditures for new salon construction

(44,583

)

(48,322

)

(28,542

)

Capital expenditures for remodels or other additions

(41,246

)

(34,737

)

(36,192

)

Capital expenditures for the corporate office (including all

technology related expenditures)

(34,085

)

(18,038

)

(9,342

)

Capital expenditures

(119,914

)

(101,097

)

(74,076

)

Disbursement for long

-

term note receivable

(6,000

)

—

—

Proceeds from the sale of assets

730

846

432

$

(280,665

)

$

(428,818

)

$

(173,378

)

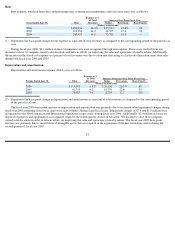

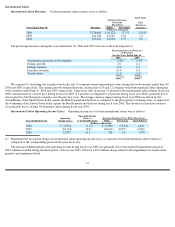

Years Ended June 30,

2006

2005

2004

Constructed

Acquired

Constructed

Acquired

Constructed

Acquired

Regis

38

14

39

13

33

4

MasterCuts

32

—

47

2

34

3

Trade Secret

33

2

56

23

26

12

SmartStyle

215

—

194

—

174

—

Strip Center

180

122

167

248

166

162

International

33

10

22

19

19

18

Beauty schools

2

30

—

13

—

6

Hair restoration centers

1

1

—

42

—

—

534

179

525

360

452

205