Supercuts 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

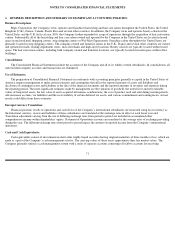

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

Beauty school revenues consist primarily of tuition revenue, revenues from services performed by students at the beauty schools and

revenues from product sold to customers and students. Beauty school revenues from services performed by students or product sold to

customers or students are recognized at the time of sale, as this is when the services have been provided or, in the case of product revenues,

delivery has occurred, and the school receives payment. The Company records deferred revenue for tuition prior to the classes taking place.

The earnings process is culminated once the Company performs under the terms of the contract (i.e., holds the classes). Service revenue is

recognized proportionally based on actual or scheduled classroom hours through the reversal of the deferred revenue.

Company-owned hair restoration center revenues stem primarily from servicing hair systems and surgical procedures, as well as through

product and hair system sales. The Company records deferred revenue for contracts related to the servicing of hair systems and recognizes the

revenue ratably over the term of the service contract. Revenues are recognized related to surgical procedures when the procedure is performed.

Product revenues, including sales of hair systems, are recognized at the time of sale, as this is when delivery occurs and payment is probable.

Franchise revenues primarily include royalties, initial franchise fees and net rental income (see Note 6). Royalties are recognized as

revenue in the month in which franchisee services are rendered or products are sold to franchisees. The Company recognizes revenue from

initial franchise fees at the time franchise locations are opened, as this is generally when the Company has performed all initial services

required under the franchise agreement.

Consideration Received from Vendors:

The Company receives consideration for a variety of vendor-sponsored programs. These programs primarily include volume rebates and

promotion and advertising reimbursements. Promotion and advertising reimbursements are discussed under Advertising within this note.

With respect to volume rebates, the Company estimates the amount of rebate it will receive and accrues it as a reduction of the cost of

inventory over the period in which the rebate is earned based upon historical purchasing patterns and the terms of the volume rebate program.

A periodic analysis is performed, at least quarterly, in order to ensure that the estimated rebate accrued is reasonable, and any necessary

adjustments are recorded.

Shipping and Handling Costs:

Shipping and handling costs are incurred to store, move and ship product from the Company’s distribution centers to company-owned and

franchise locations, and include an allocation of internal overhead. Such shipping and handling costs related to product shipped to company-

owned locations are included in general and administrative expenses in the Consolidated Statement of Operations. Shipping and handling costs

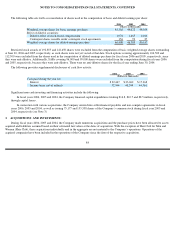

related to shipping product to franchise locations totaled $2.4, $2.5 and $2.3 million during fiscal years 2006, 2005 and 2004, respectively,

which are also included within general and administrative expenses. Any amounts billed to the franchisee for shipping and handling are

included in product revenues within the Consolidated Statement of Operations.

Advertising:

Advertising costs, including salon collateral material, are expensed as incurred. Net advertising costs expensed were $61.5, $57.8 and

$46.6 million in fiscal years 2006, 2005 and 2004, respectively. The Company participates in cooperative advertising programs under which

the vendor reimburses the

75