Supercuts 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

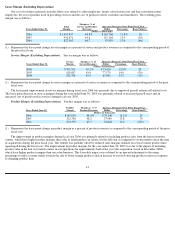

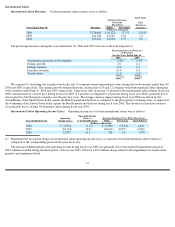

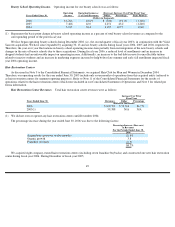

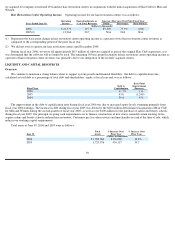

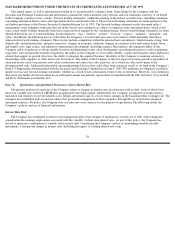

Beauty School Operating Income. Operating income for our beauty schools was as follows:

(1)

Represents the basis point change in beauty school operating income as a percent of total beauty school revenues as compared to the

corresponding period of the prior fiscal year.

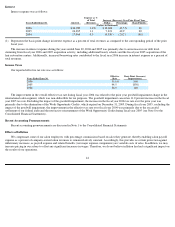

We first began operating beauty schools during December 2002 (i.e., the second quarter of fiscal year 2003), in conjunction with the Vidal

Sassoon acquisition. We have since expanded by acquiring 30, 13 and six beauty schools during fiscal years 2006, 2005 and 2004, respectively.

Therefore, the year over year fluctuations in beauty school operating income stem partially from our integration of the new beauty schools and

changes in the mix of beauty schools due to these acquisitions. During fiscal year 2006, a reduced level of enrollments and an increase in

dropped students had an unfavorable impact on operating income. Additionally, an increase to the bad debt reserve for uncollectible tuition

related to inactive students and an increase in marketing expenses incurred to help bolster late summer and early fall enrollment impacted fiscal

year 2006 operating income.

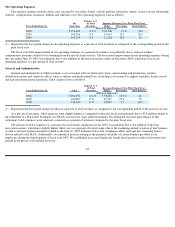

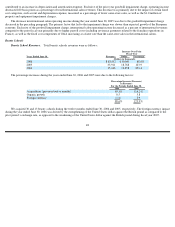

Hair Restoration Centers

As discussed in Note 3 to the Consolidated Financial Statements, we acquired Hair Club for Men and Women in December 2004.

Therefore, our operating results for the year ended June 30, 2005 include only seven months of operations from this acquired entity (referred to

as hair restoration centers for segment reporting purposes). Refer to Note 11 of the Consolidated Financial Statements for the results of

operations related to the hair restoration centers which were included in our Consolidated Statement of Operations and Note 3 for related pro

forma information.

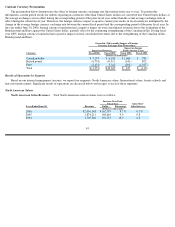

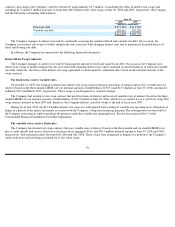

Hair Restoration Center Revenues. Total hair restoration center revenues were as follows:

(1)

We did not own or operate any hair restoration centers until December 2004.

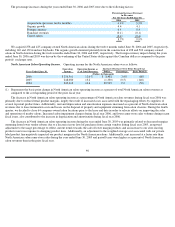

The percentage increase during the year ended June 30, 2006 was due to the following factors:

We acquired eight company-owned hair restoration centers (including seven franchise buybacks) and constructed one new hair restoration

center during fiscal year 2006. During December of fiscal year 2005,

49

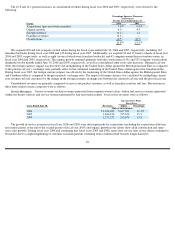

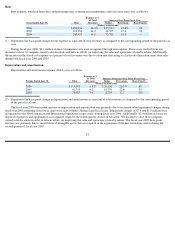

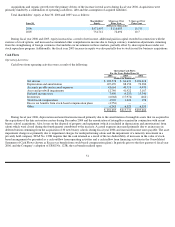

Operating

Operating Income as

(Decrease) Increase Over Prior Fiscal Year

Years Ended June 30,

Income

% of Total Revenues

Dollar

Percentage

Basis Point(1)

(Dollars in thousands)

2006

$

6,766

10.6

%

$

(700

)

(9.4

)%

(1,140

)

2005

7,466

22.0

2,251

43.2

(1,240

)

2004

5,215

34.4

4,187

407.3

1,040

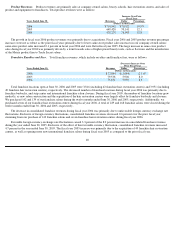

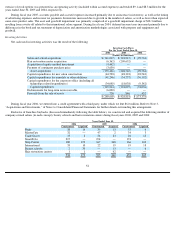

Increase Over Prior

Fiscal Year

Years Ended June 30,

Revenues

Dollar

Percentage

(Dollars in thousands)

2006

$

109,702

$

50,314

84.7

%

2005(1)

59,388

N/A

N/A

Percentage Increase (Decrease)

in Revenues

For the Periods Ended June 30,

2006

Acquisitions (previous twelve months)

81.4

%

Organic growth

3.8

Franchise revenues

(0.5

)

84.7

%