Supercuts 2006 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2006 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

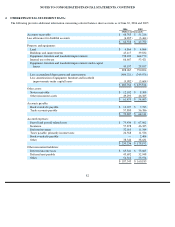

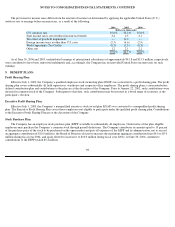

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

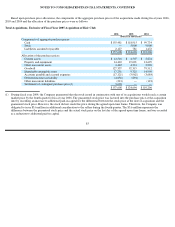

salon transactions and certain beauty school transactions is expected to be fully deductible for tax purposes and the goodwill recognized in the

international salon transactions is non-deductible for tax purposes. Goodwill generated in certain acquisitions, such as Hair Club (discussed

below), is not deductible for tax purposes due to the acquisition structure of the transaction.

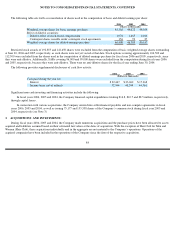

During May 2006, the Company acquired a 19.9 percent interest in the voting common stock of a privately held entity (the equity

investee) for $4.4 million. Based on the Company’s ability to exercise significant influence over the equity investee’s operational policies and

procedures, the Company is accounting for this investment under the equity method. Additionally, the Company and the entity that is the

majority corporate investor (“investor”) of this privately held investment (“investment”) entered into a credit agreement whereby the Company

agreed to lend up to $10.0 million to the investor of the investment. The lending arrangement is not a revolving credit agreement; each

individual loan will be evidenced by a note and the investor of the investment is not entitled to reborrow all or any portion of a loan which is

repaid. The Company charges interest on the amount lent at a rate equal to the annual rate of interest charged to the Company under its senior

bank facility at the date of the note, plus one percent. Several peripheral agreements were executed between the Company, the investor of the

investment and the subsidiaries of the investor in order to collateralize amounts lent by the Company to the investor of the investment. As of

June 30, 2006, the Company has $6.0 million in long-term notes receivable outstanding under this arrangement (included within other assets in

the Consolidated Balance Sheet), earning an average annual interest rate of 7.1 percent. The outstanding amount is due and payable by the

investor on or before December 31, 2007. The Company’s $4.4 million investment and $6.0 million loan are shown as investing activities

within the Consolidated Statement of Cash Flows.

In December 2004, the Company purchased Hair Club for approximately $210 million, financed with debt. Hair Club offers a

comprehensive menu of hair restoration solutions ranging from Extreme Hair Therapy(TM) to the non-surgical Bio-Matrix(R) Process and the

latest advancements in hair transplantation. This industry is highly fragmented, and we believe there is an opportunity to consolidate this

industry through acquisition.

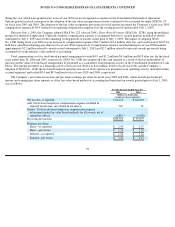

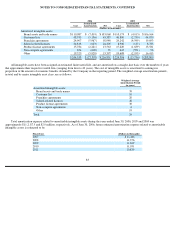

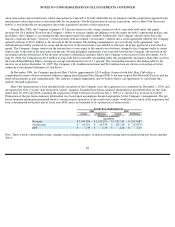

Hair Club operations have been included in the operations of the Company since the acquisition was completed on December 1, 2004, and

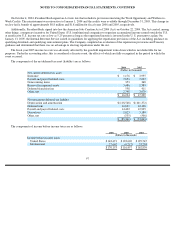

are reported in Note 11 in the “hair restoration centers” segment. Unaudited pro forma summary information is presented below for the years

ended June 30, 2005 and 2004, assuming the acquisition of Hair Club had occurred on July 1, 2003 (i.e., the first day of fiscal year 2004).

Preparation of the pro forma summary information was based upon assumptions deemed appropriate by the Company’s management. The pro

forma summary information presented below is not necessarily indicative of the results that actually would have occurred if the acquisition had

been consummated on the first day of fiscal year 2004, and is not intended to be a projection of future results.

Note: There were no extraordinary items, changes in accounting principles, or material nonrecurring items included in the pro forma amounts

above.

88

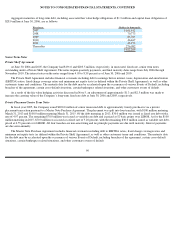

For the Years Ended June 30,

2005

2004

Actual

ProForma

Actual

ProForma

(Dollars in thousands)

(unaudited)

Revenue

$

2,194,294

$

2,243,290

$

1,923,143

$

2,013,683

Net Income

$

64,631

$

64,538

$

104,218

$

103,874

EPS

$

1.39

$

1.39

$

2.26

$

2.25