Supercuts 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

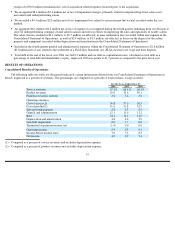

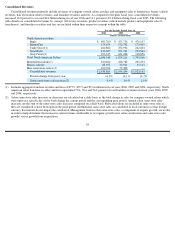

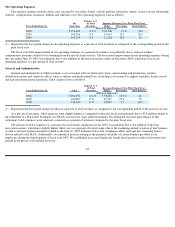

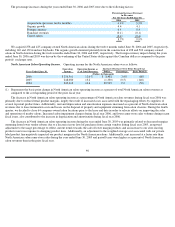

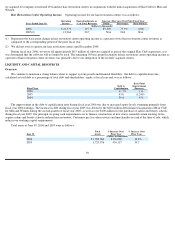

Interest

Interest expense was as follows:

(1)

Represents the basis point change in interest expense as a percent of total revenues as compared to the corresponding period of the prior

fiscal year.

The increase in interest expense during the years ended June 30, 2006 and 2005 was primarily due to an increase in our debt level

stemming from fiscal year 2006 and 2005 acquisition activity, including additional beauty schools and the fiscal year 2005 acquisition of the

hair restoration centers. Additionally, increased borrowing rates contributed to the fiscal year 2006 increase in interest expense as a percent of

total revenues.

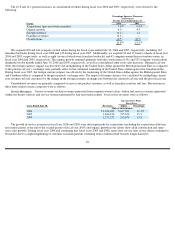

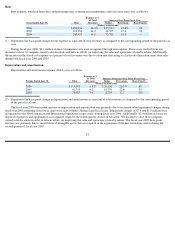

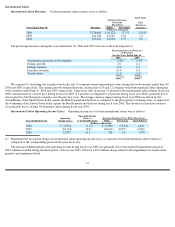

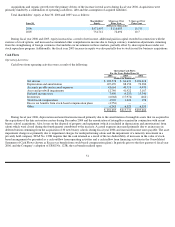

Income Taxes

Our reported effective tax rate was as follows:

The improvement in the overall effective tax rate during fiscal year 2006 was related to the prior year goodwill impairment charge in the

international salon segment, which was non-deductible for tax purposes. The goodwill impairment caused an 11.0 percent increase in the fiscal

year 2005 tax rate. Excluding the impact of the goodwill impairment, the increase in the fiscal year 2006 tax rate over the prior year was

primarily due to the elimination of the Work Opportunity Credits, which expired on December 31, 2005. During fiscal year 2005, excluding the

impact of the goodwill impairment, the improvement in the effective tax rate over fiscal year 2004 was primarily due to the successful

settlement of our federal audit and the retroactive reinstatement of the Work Opportunity Credit during fiscal year 2005 (see Note 8 to the

Consolidated Financial Statements).

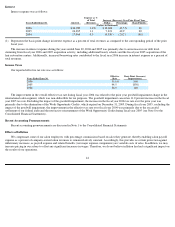

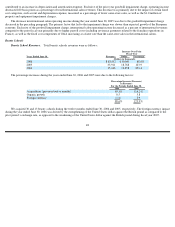

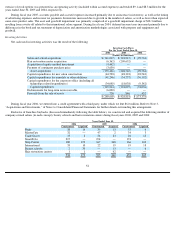

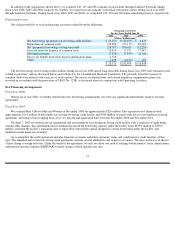

Recent Accounting Pronouncements

Recent accounting pronouncements are discussed in Note 1 to the Consolidated Financial Statements.

Effects of Inflation

We compensate some of our salon employees with percentage commissions based on sales they generate, thereby enabling salon payroll

expense as a percent of company-owned salon revenues to remain relatively constant. Accordingly, this provides us certain protection against

inflationary increases, as payroll expense and related benefits (our major expense components) are variable costs of sales. In addition, we may

increase pricing in our salons to offset any significant increases in wages. Therefore, we do not believe inflation has had a significant impact on

the results of our operations.

44

Expense as %

of Total

Increase (Decrease) Over Prior Fiscal Year

Years Ended June 30,

Interest

Revenues

Dollar

Percentage

Basis Point(1)

(Dollars in thousands)

2006

$

34,989

1.4

%

$

10,604

43.5

%

30

2005

24,385

1.1

7,321

42.9

20

2004

17,064

0.9

(4,330

)

(20.2

)

(40

)

Effective

Basis Point (Increase)

Years Ended June 30,

Rate

Improvement

2006

35.6

%

890

2005

44.5

(850

)

2004

36.0

140