Supercuts 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

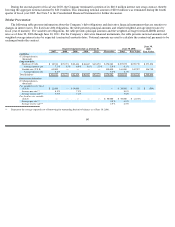

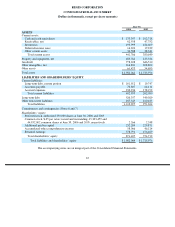

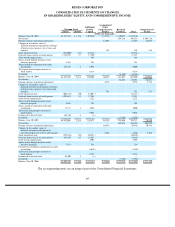

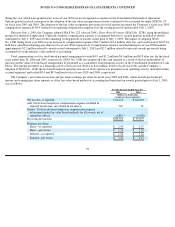

REGIS CORPORATION

CONSOLIDATED STATEMENTS OF CHANGES

IN SHAREHOLDERS’ EQUITY AND COMPREHENSIVE INCOME

The accompanying notes are an integral part of the Consolidated Financial Statements.

69

Accumulated

Additional

Other

Common Stock

Paid

-

In

Comprehensive

Retained

Comprehensive

Shares

Amount

Capital

Income

Earnings

Total

Income

(Dollars in thousands)

Balance, June 30, 2003

43,527,244

$

2,176

$

207,650

$

27,765

$

320,935

$

558,526

Net income

104,218

104,218

$

104,218

Foreign currency translation adjustments

12,695

12,695

12,695

Changes in fair market value of

financial instruments designated as hedges

of interest rate exposure, net of taxes and

transfers

155

155

155

Stock repurchase plan

(544,000

)

(27

)

(22,521

)

(22,548

)

Proceeds from exercise of stock options

1,135,939

57

17,290

17,347

Stock

-

based compensation

198

198

Shares issued through franchise stock

incentive program

9,428

281

281

Shares issued in connection with salon

acquisitions

155,338

8

8,992

9,000

Tax benefit realized upon exercise of

stock options

8,314

8,314

Dividends

(6,166

)

(6,166

)

Balance, June 30, 2004

44,283,949

2,214

220,204

40,615

418,987

682,020

117,068

Net income

64,631

64,631

64,631

Foreign currency translation adjustments

4,758

4,758

4,758

Changes in fair market value of

financial instruments designated as hedges

of interest rate exposure, net of taxes and

transfers

751

751

751

Stock repurchase plan

(608,115

)

(30

)

(23,087

)

(23,117

)

Proceeds from exercise of stock options

1,039,623

52

17,205

17,257

Stock

-

based compensation

1,222

1,222

Shares issued through franchise stock

incentive program

5,618

251

251

Shares issued in connection with salon

acquisitions

75,177

4

4,996

5,000

Tax benefit realized upon exercise of

stock options

9,088

9,088

Issuance of restricted stock

155,750

8

(8

)

—

Dividends

(7,149

)

(7,149

)

Balance, June 30, 2005

44,952,002

2,248

229,871

46,124

476,469

754,712

70,140

Net income

109,578

109,578

109,578

Foreign currency translation adjustments

10,476

10,476

10,476

Changes in fair market value of

financial instruments designated as

cash flow hedges, net of taxes and transfers

1,466

1,466

1,466

Stock repurchase plan

(585,384

)

(29

)

(20,251

)

(20,280

)

Proceeds from exercise of stock options

843,370

43

14,367

14,410

Stock

-

based compensation

4,905

4,905

Shares issued through franchise stock

incentive program

7,971

314

314

Payment for contingent consideration in salon

acquisitions

(3,630

)

(3,630

)

Tax benefit realized upon exercise of

stock options

6,712

6,712

Issuance of restricted stock

85,500

4

(4

)

—

Dividends

(7,256

)

(7,256

)

Balance, June 30, 2006

45,303,459

$

2,266

$

232,284

$

58,066

$

578,791

$

871,407

$

121,520