Supercuts 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

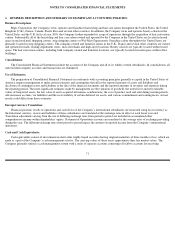

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

during the year which were granted prior to fiscal year 2004 are not recognized as expense in the Consolidated Statement of Operations.

Options granted in fiscal years prior to the adoption of the fair value recognition provisions continued to be accounted for under APB No. 25

for fiscal year 2005 and 2004. The adoption of the fair value recognition provisions for stock options increased the Company’s fiscal year 2005

compensation expense by $0.4 (related to recognizing compensation expense over the vesting period of options after July 1, 2003).

Effective July 1, 2005, the Company adopted SFAS No. 123 (revised 2004), Share-Based Payment (SFAS No. 123R), using the modified

prospective method of application. Under this method, compensation expense is recognized both for (i) awards granted, modified or settled

subsequent to July 1, 2003 and (ii) the remaining vesting periods of awards issued prior to July 1, 2003. The impact of adopting SFAS

No. 123R during fiscal year 2006 was an increase in compensation expense of $2.7 million ($2.4 million after tax), and a reduction of $0.05 for

both basic and diluted earnings per share for fiscal year 2006, respectively. Compensation expense recorded during fiscal year 2006 includes

approximately $2.3 million related to awards issued subsequent to July 1, 2003 and $2.7 million related to unvested awards previously being

accounted for on the intrinsic value method of accounting.

Total compensation cost for stock-

based payment arrangements totaled $4.9 and $1.2 million ($4.1million and $0.8 after tax) for the fiscal

years ended June 30, 2006 and 2005, respectively. SFAS No. 123R also requires that the cash retained as a result of the tax deductibility of

increases in the value of stock-based arrangements be presented as a cash inflow from financing activity in the Consolidated Statement of Cash

Flows. The amount presented as a financing activity for fiscal year 2006 was $4.6 million. Prior to fiscal year 2006, and the Company’s

adoption of SFAS No. 123R, the tax benefit realized upon the exercise of stock options was presented as an operating activity (included within

accrued expenses) and totaled $9.0 and $8.3 million for fiscal years 2005 and 2004, respectively.

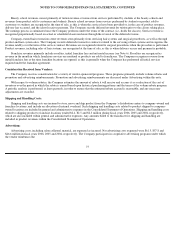

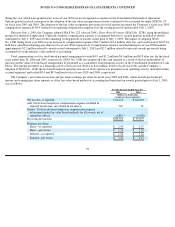

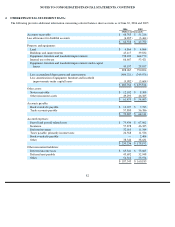

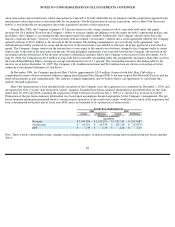

The Company’s pro forma net income and pro forma earnings per share for fiscal years 2005 and 2004, which include pro forma net

income and earnings per share amounts as if the fair value-based method of accounting had been used on awards granted prior to July 1, 2003,

was as follows:

78

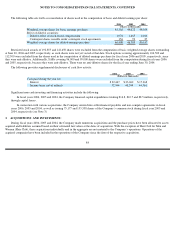

For the Periods Ended June 30,

2005

2004

(Dollars in thousands,

except per share amounts)

Net income, as reported

$

64,631

$

104,218

Add: Stock-based employee compensation expense included in

reported net income, net of related tax effects

765

61

Deduct: Total stock-based employee compensation expense

determined under fair value based methods for all awards, net of

related tax effects

(4,885

)

(6,600

)

Pro forma net income

$

60,511

$

97,679

Earnings per share:

Basic—as reported

$

1.45

$

2.37

Basic—pro forma

$

1.36

$

2.22

Diluted—as reported

$

1.39

$

2.26

Diluted—pro forma

$

1.31

$

2.13