Supercuts 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

assured if failure to exercise a renewal option imposes an economic penalty to the Company. In such cases, the Company will include the

renewal option period along with the original lease term in the determination of appropriate estimated useful lives.

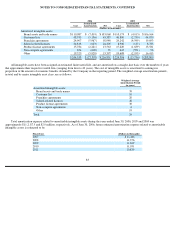

The Company capitalizes both internal and external costs of developing or obtaining computer software for internal use. Costs incurred to

develop internal-use software during the application development stage are capitalized, while data conversion, training and maintenance costs

associated with internal-

use software are expensed as incurred. At June 30, 2006 and 2005, the net book value of capitalized software costs was

$31.5 and $24.9 million, respectively. Amortization expense related to capitalized software was $8.1, $6.6 and $5.8 million in fiscal years

2006, 2005 and 2004, respectively, which has been determined based on an estimated useful life of five or seven years.

Expenditures for maintenance and repairs and minor renewals and betterments which do not improve or extend the life of the respective

assets are expensed. All other expenditures for renewals and betterments are capitalized. The assets and related depreciation and amortization

accounts are adjusted for property retirements and disposals with the resulting gain or loss included in operating income. Fully depreciated or

amortized assets remain in the accounts until retired from service.

Goodwill:

Goodwill is tested for impairment annually or at the time of a triggering event in accordance with the provisions of Statement of Financial

Accounting Standards (SFAS) No. 142, Goodwill and Other Intangible Assets . The Company considers its various concepts to be reporting

units when it tests for goodwill impairment because that is where the Company believes goodwill resides. During the third quarter of each of

the three fiscal years in the period ending June 30, 2006, goodwill was tested for impairment in this manner. In fiscal year 2006, the net book

value of our European and Beauty School businesses approximated their fair values and the estimated fair value of the remaining reporting

units exceeded their carrying amounts, indicating no impairment of goodwill. Fair values are estimated based on the Company’s best estimate

of the expected present value of future cash flows and compared with the corresponding carrying value of the reporting unit, including

goodwill.

In fiscal year 2005, the Company recorded a pre-tax, non-cash impairment charge of $38.3 million to write down the carrying value of the

goodwill associated with the Company’s European business. During the quarter ending March 31, 2005, the Company reduced its expectations

for the European business based on recent growth trends. Based on the results of its third quarter fiscal year 2005 goodwill impairment testing,

which factored in these revised growth trend expectations, the Company wrote down the carrying value of the European business to reflect its

estimated fair value.

Long-Lived Asset Impairment Assessments, Excluding Goodwill:

The Company reviews long-lived assets for impairment at the salon level annually or if events or circumstances indicate that the carrying

value of such assets may not be fully recoverable. Impairment is evaluated based on the sum of undiscounted estimated future cash flows

expected to result from use of the assets compared to its carrying value. If an impairment is recognized, the carrying value of the impaired asset

is reduced to its fair value, based on discounted estimated future cash flows.

During fiscal year 2006, the Company tested its long-lived assets for impairment and recognized impairment charges related primarily to

the carrying value of certain salons’ property and equipment of $8.4 million, including $7.4 million located in North America and $1.0 million

located in the United Kingdom. During fiscal years 2005 and 2004, the Company recognized similar impairment charges for

73