Supercuts 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

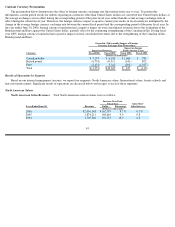

the customer represent less than one percent of total company-owned revenues. The vast majority of returns and refunds occur within a matter

of days of the original sales transaction.

The majority of beauty school tuition payments are originally recorded as deferred revenues. The earnings process is culminated once we

perform under the terms of the contract (i.e., instruct a class). Therefore, revenue is recognized proportionally based on actual or scheduled

class hours. Based on this practice, little judgment is exercised related to recognizing beauty school tuition revenues. However, we must

estimate our expected exposure to refunds and uncollectible accounts, which are recorded as a reduction to tuition revenues or charged to

expense based on estimated amounts at the time of sale and at the time of occurrence of these events. A significant variance between expected

and actual refunds could have a material impact on revenues disclosed in the Consolidated Financial Statements.

Payments for services performed under customer contracts covering a specified time span in the hair restoration centers are originally

recorded as deferred revenues. The earnings process is culminated, and revenue is recognized, once we perform under the terms of the contract.

Our policy is to recognize revenue on a straight-line basis over the course of a customer’s contract period, which could vary slightly from the

actual timing of services performed under the contract.

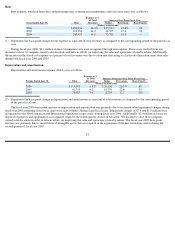

Cost of Product Used and Sold

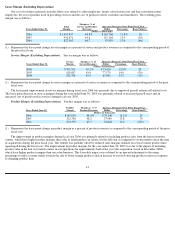

Product costs are determined by applying estimated gross profit margins to service and product revenues, which are based on historical

factors including product pricing trends and estimated shrinkage. In addition, the estimated gross profit margin is adjusted based on the results

of physical inventory counts performed at least twice a year and the monthly monitoring of factors that could impact our usage rates estimates.

These factors include mix of service sales, discounting and special promotions. During fiscal year 2006, we performed physical inventory

counts beginning in September, February and May, and adjusted our estimated gross profit margin to reflect the results of the observations.

Significant changes in product costs, volumes or shrinkage could have a material impact on our gross margin.

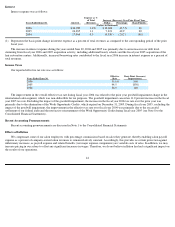

Self-insurance Accruals

We use a combination of third party insurance and self-insurance for a number of risks including workers’

compensation, health insurance

and general liability claims. The liability reflected on our Consolidated Balance Sheet represents an estimate of the undiscounted ultimate cost

of uninsured claims incurred as of the balance sheet date. In estimating this liability, we utilize loss development factors prepared by

independent third party actuaries. These development factors utilize historical data to project the future development of incurred losses. Loss

estimates are adjusted based upon actual claims settlements and reported claims. Although we do not expect the amounts ultimately paid to

differ significantly from the estimates, self-insurance accruals could be affected if future claims experience differs significantly from the

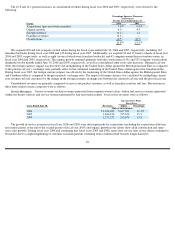

historical trends and actuarial assumptions. During fiscal year 2006, 2005 and 2004, our insurance costs were $37.6, $37.1 and $31.5 million,

respectively.

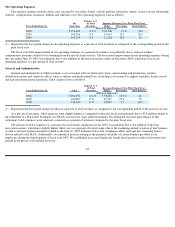

Stock-based Compensation Expense

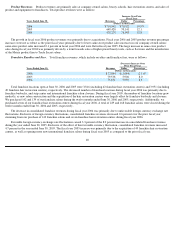

Compensation expense for stock-based compensation is estimated on the grant date using the lattice (binomial) option-pricing model.

During fiscal years 2006, 2005 and 2004, stock-based compensation expense totaled $4.9, $1.2 and $0.2 million, respectively. Our specific

weighted average assumptions for the risk free interest rate, expected term, expected volatility and expected dividend yield are documented in

Note 1 to the Consolidated Financial Statements. Additionally, under SFAS No. 123R, we are required to estimate pre

-vesting forfeitures for

purposes of determining compensation expense to be recognized. Future expense amounts for any particular quarterly or annual period could be

affected by changes in our assumptions or changes in market conditions.

35