Supercuts 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

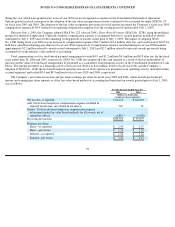

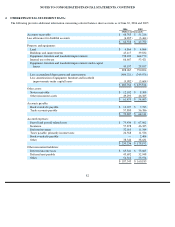

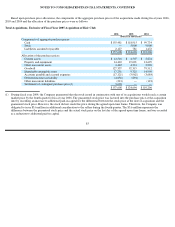

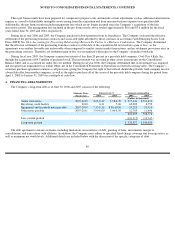

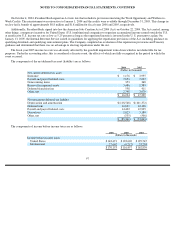

Based upon the actual and preliminary purchase price allocations, the change in the carrying amount of the goodwill for the years ended

June 30, 2006 and 2005 is as follows:

(1)

Relates to the resolution of an income tax contingency related to prior acquisitions.

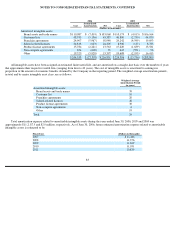

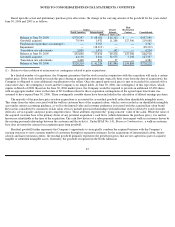

In a limited number of acquisitions, the Company guarantees that the stock issued in conjunction with the acquisition will reach a certain

market price. If the stock should not reach this price during an agreed upon time frame (typically three years from the date of acquisition), the

Company is obligated to issue additional consideration to the sellers. Once the agreed upon stock price is met or exceeded for a period of five

consecutive days, the contingency is met and the Company is no longer liable. At June 30, 2006, one contingency of this type exists, which

expires in March of 2008. Based on the June 30, 2006 market price, the Company would be required to provide an additional 65,430 shares

with an aggregate market value on that date of $2.3 million related to these acquisition contingencies if the agreed upon time frame was

assumed to have expired June 30, 2006. These contingently issuable shares have been included in the calculation of diluted earnings per share.

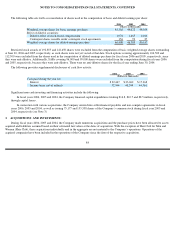

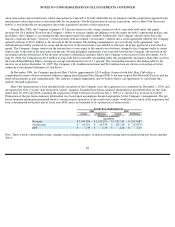

The majority of the purchase price in salon acquisitions is accounted for as residual goodwill rather than identifiable intangible assets.

This stems from the value associated with the walk-in customer base of the acquired salons, which is not recorded as an identifiable intangible

asset under current accounting guidance, as well as the limited value and customer preference associated with the acquired hair salon brand.

Key factors considered by consumers of hair salon services include personal relationships with individual stylists (driven by word of mouth

referrals), service quality and price point competitiveness. These attributes represent the “going concern” value of the salon. While the value of

the acquired customer base is the primary driver of any potential acquisition’s cash flows (which determines the purchase price), it is neither

known nor identifiable at the time of the acquisition. The cash flow history of a salon primarily results from repeat walk-

in customers driven by

the existing personal relationship between the customer and the stylist(s). Under SFAS No. 141, Business Combinations , a walk-in customer

base does not meet the criteria for recognition apart from goodwill.

Residual goodwill further represents the Company’s opportunity to strategically combine the acquired business with the Company’s

existing structure to serve a greater number of customers through its expansion strategies. In the acquisitions of international salons, beauty

schools and hair restoration centers, the residual goodwill primarily represents the growth prospects that are not captured as part of acquired

tangible or identified intangible assets. Generally, the goodwill recognized in the North American

87

Salons

Beauty

Hair

Restoration

North America

International

Schools

Centers

Consolidated

(Dollars in thousands)

Balance at June 30, 2004

$

370,347

$

68,681

$

18,112

$

—

$

457,140

Goodwill acquired

79,544

1,432

11,206

127,506

219,688

Finalization of purchase accounting(1)

—

3,767

—

—

3,767

Impairment

—

(

38,319

)

—

—

(

38,319

)

Translation rate adjustments

2,805

1,471

(42

)

—

4,234

Balance at June 30, 2005

452,696

37,032

29,276

127,506

646,510

Goodwill acquired

64,150

3,316

52,573

7,298

127,337

Translation rate adjustments

3,468

876

37

—

4,381

Balance at June 30, 2006

$

520,314

$

41,224

$

81,886

$

134,804

$

778,228