Supercuts 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

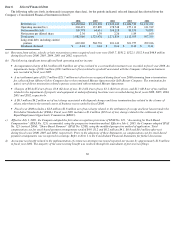

receipt of a $50.0 million termination fee, net of acquisition related expenses incurred prior to the acquisition.

•

We recognized $8.4 million ($5.4 million net of tax) of impairment charges, primarily related to impaired long-lived salon assets

associated with underperforming salons.

•

We recorded a $4.3 million ($2.8 million net of tax) impairment loss related to an investment that we had recorded under the cost

method.

•

An aggregate $6.5 million ($4.2 million net of tax) of expense was recognized during the fourth quarter stemming from our decision to

close 64 underperforming company-owned salon locations and refocus efforts on improving the sales and operations of nearby salons.

The salon closures resulted in $4.1 million, or $2.7 million tax-effected, in lease termination fees (recorded within rent expense in the

Consolidated Statement of Operations), as well as $2.4 million, or $1.5 million tax-effected, in losses on the disposal of the salons’

property and equipment (recorded within depreciation and amortization in the Consolidated Statement of Operations).

•

Included in the fourth quarter general and administrative expenses within the Consolidated Statement of Operations is $2.8 million

($1.8 million net of tax) related to the settlement of a Fair Labor Standards Act (FLSA) lawsuit over wage and hour disputes.

•

Total debt at the end of the fiscal year 2006 was $622.3 million and our debt-to-capitalization ratio, calculated as total debt as a

percentage of total debt and shareholder’s equity, improved 130 basis points to 41.7 percent as compared to the prior fiscal year.

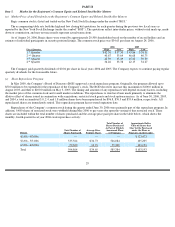

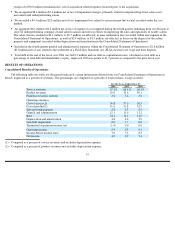

RESULTS OF OPERATIONS

Consolidated Results of Operations

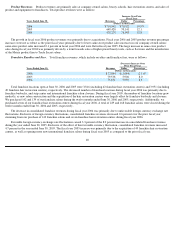

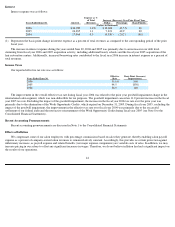

The following table sets forth, for the periods indicated, certain information derived from our Consolidated Statement of Operations in

Item 8, expressed as a percent of revenues. The percentages are computed as a percent of total revenues, except as noted.

(1)

Computed as a percent of service revenues and excludes depreciation expense.

(2)

Computed as a percent of product revenues and excludes depreciation expense.

37

For the Years Ended June 30,

2006

2005

2004

Service revenues

67.2

%

66.8

%

66.1

%

Product revenues

29.6

29.6

30.1

Franchise royalties and fees

3.2

3.6

3.8

Operating expenses:

Cost of service(1)

56.8

57.0

56.5

Cost of product(2)

51.6

51.8

52.5

Site operating expenses

8.2

8.3

8.5

General and administrative

12.1

11.9

11.2

Rent

14.4

14.2

14.0

Depreciation and amortization

4.8

4.2

3.9

Goodwill impairment

0.0

1.7

0.0

Terminated acquisition income, net

(1.4

)

0.0

0.0

Operating income

8.4

6.3

9.3

Income before income taxes

7.0

5.3

8.5

Net income

4.5

2.9

5.4