Supercuts 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

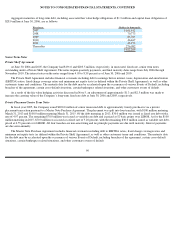

Common shares available for grant under the Company’s 2000 Plan were 250,066, 337,300 and 453,100 shares as of June 30, 2006, 2005

and 2004, respectively, and common shares available for grant under the Company’

s 2004 Plan were 1,971,350 and 2,147,500 at June 30, 2006

and 2005, respectively.

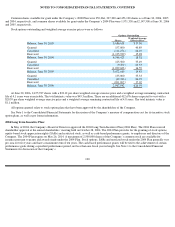

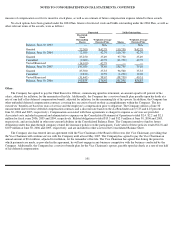

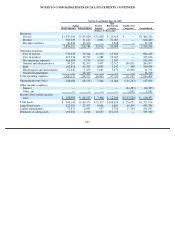

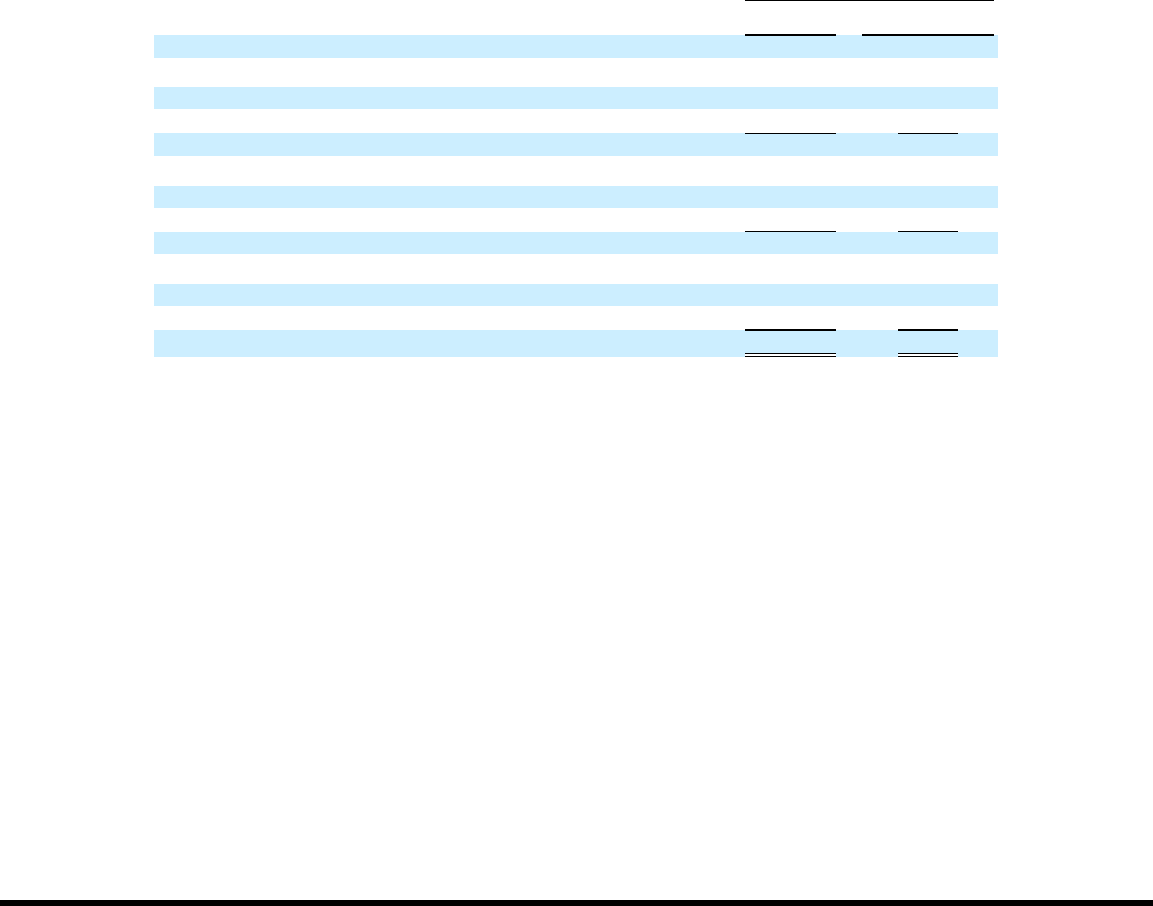

Stock options outstanding and weighted average exercise prices were as follows:

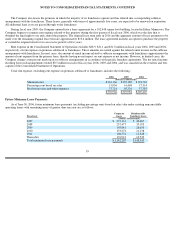

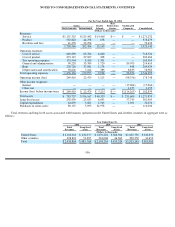

At June 30, 2006, 2,455,787 shares with a $18.12 per share weighted average exercise price and a weighted average remaining contractual

life of 4.1 years were exercisable. The total intrinsic value was $43.3 million. There are an additional 412,676 shares expected to vest with a

$20.59 per share weighted average exercise price and a weighted average remaining contractual life of 4.8 years. The total intrinsic value is

$1.1 million.

All options granted relate to stock option plans that have been approved by the shareholders of the Company.

See Note 1 to the Consolidated Financial Statements for discussion of the Company’

s measure of compensation cost for its incentive stock

option plans, as well as pro forma information.

2004 Long Term Incentive Plan:

In May of 2004, the Company’s Board of Directors approved the 2004 Long Term Incentive Plan (2004 Plan). The 2004 Plan received

shareholder approval at the annual shareholders’ meeting held on October 28, 2004. The 2004 Plan provides for the granting of stock options,

equity-based stock appreciation rights (SARs) and restricted stock, as well as cash-based performance grants, to employees and directors of the

Company. The 2004 Plan expires on May 26, 2014. A maximum of 2,500,000 shares of the Company’s common stock are available for

issuance pursuant to grants and awards made under the 2004 Plan. Stock options, SARs and restricted stock under the 2004 Plan generally vest

pro rata over five years and have a maximum term of ten years. The cash-based performance grants will be tied to the achievement of certain

performance goals during a specified performance period, not less than one fiscal year in length. See Note 1 to the Consolidated Financial

Statements for discussion of the Company’s

100

Options Outstanding

Weighted Average

Shares

Exercise Price

Balance, June 30, 2003

5,686,638

$

17.30

Granted

157,000

40.89

Cancelled

(111,276

)

24.49

Exercised

(1,135,939

)

15.28

Balance, June 30, 2004

4,596,423

18.32

Granted

125,500

35.49

Cancelled

(9,700

)

23.53

Exercised

(1,039,623

)

16.59

Balance, June 30, 2005

3,672,600

19.43

Granted

135,000

35.33

Cancelled

(47,766

)

26.95

Exercised

(851,892

)

17.02

Balance, June 30, 2006

2,907,942

$

20.59