Supercuts 2006 Annual Report Download - page 60

Download and view the complete annual report

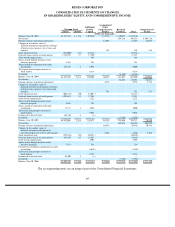

Please find page 60 of the 2006 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

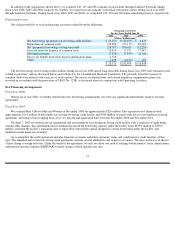

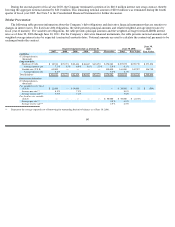

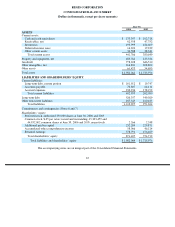

contracts) may impact the Company’s interest expense by approximately $1.5 million. Considering the effect of interest rate swaps and

including $1.3 and $2.5 million increases to long-term debt related to fair value swaps at June 30, 2006 and 2005, respectively, the Company

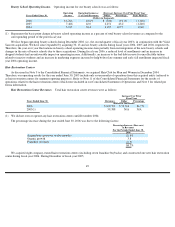

had the following outstanding debt balances:

The Company manages its interest rate risk by continually assessing the amount of fixed and variable rate debt. On occasion, the

Company uses interest rate swaps to further mitigate the risk associated with changing interest rates and to maintain its desired balances of

fixed and floating rate debt.

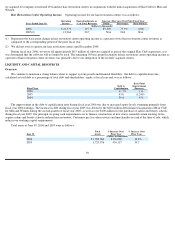

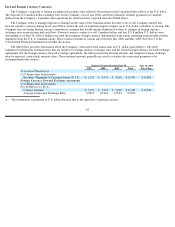

In addition, the Company has entered into the following financial instruments:

Interest Rate Swap Contracts:

The Company manages its interest rate risk by balancing the amount of fixed and variable rate debt. On occasion, the Company uses

interest rate swaps to further mitigate the risk associated with changing interest rates and to maintain its desired balances of fixed and variable

rate debt. Generally, the terms of the interest rate swap agreements contain quarterly settlement dates based on the notional amounts of the

swap contracts.

Pay fixed rates, receive variable rates

On October 21, 2005, the Company entered into interest rate swap contracts that pay fixed rates of interest and receive variable rates of

interest (based on the three-month LIBOR rate) on notional amounts of indebtedness of $35.0 and $15.0 million at June 30, 2006, and mature

in March 2013 and March 2015, respectively. These swaps were designated as cash flow hedges.

The Company had an interest rate swap contract that paid fixed rates of interest and received variable rates of interest (based on the three-

month LIBOR rate) on notional amounts of indebtedness of $11.8 million at June 30, 2004, which was accounted for as a cash flow swap. This

swap contract matured in June 2005 and, therefore, the Company held no cash flow swaps at the end of fiscal year 2005.

During fiscal year 2003, the $11.8 million interest rate swap was redesignated from a hedge of variable rate operating lease obligations to

hedge of a portion of the interest payments associated with the Company’s long-term financing program. The redesignation was the result of

the Company exercising its right to purchase the property under the variable rate operating lease. See the discussion in Note 5 to the

Consolidated Financial Statements for further explanation.

Pay variable rates, receive fixed rates

The Company has interest rate swap contracts that pay variable rates of interest (based on the three-month and six-month LIBOR rates

plus a credit spread) and receive fixed rates of interest on an aggregate $36.0 and $48.5 million notional amount at June 30, 2006 and 2005,

respectively, with maturation dates between July 2006 and July 2008. These swaps were designated as hedges of a portion of the Company’s

senior term notes and are being accounted for as fair value swaps.

59

June 30,

2006

2005

(Dollars in thousands)

Fixed rate debt

$

471,928

$

413,526

Variable rate debt

150,341

155,250

$

622,269

$

568,776