Supercuts 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

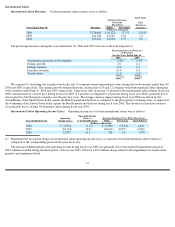

we acquired 42 company-owned and 49 franchise hair restoration centers in conjunction with the initial acquisition of Hair Club for Men and

Women.

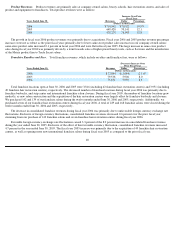

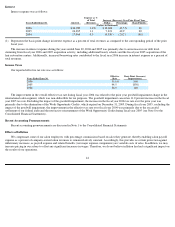

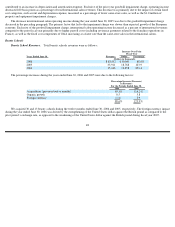

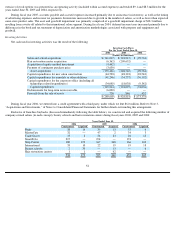

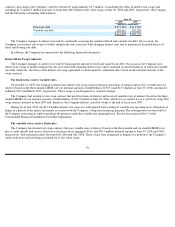

Hair Restoration Center Operating Income. Operating income for our hair restoration centers was as follows:

(1)

Represents the basis point change in hair restoration center operating income as a percent of total hair restoration center revenues as

compared to the corresponding period of the prior fiscal year.

(2)

We did not own or operate any hair restoration centers until December 2004.

During fiscal year 2006, we wrote off approximately $0.5 million of software acquired as part of the original Hair Club acquisition, as it

was determined that the software will no longer be used. The remaining 50 basis point fluctuation in hair restoration center operating income as

a percent of hair restoration center revenues was primarily due to our integration of the recently acquired centers.

LIQUIDITY AND CAPITAL RESOURCES

Overview

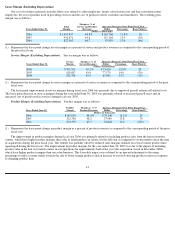

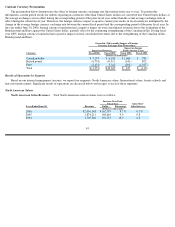

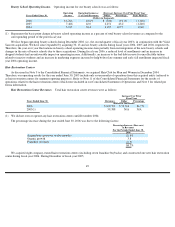

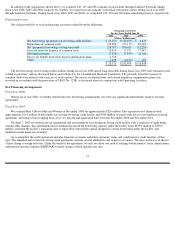

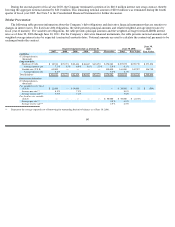

We continue to maintain a strong balance sheet to support system growth and financial flexibility. Our debt to capitalization ratio,

calculated as total debt as a percentage of total debt and shareholders’ equity at fiscal year end, was as follows:

The improvement in the debt to capitalization ratio during fiscal year 2006 was due to increased equity levels stemming primarily from

fiscal year 2006 earnings. The increase in debt during fiscal year 2005 was driven by the $210 million debt-financed acquisition of Hair Club

for Men and Women during the second quarter of fiscal year 2005, as well as over $100 million for the purchase of salons and beauty schools

during fiscal year 2005. Our principal on-going cash requirements are to finance construction of new stores, remodel certain existing stores,

acquire salons and beauty schools and purchase inventory. Customers pay for salon services and merchandise in cash at the time of sale, which

reduces our working capital requirements.

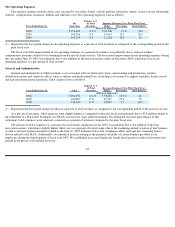

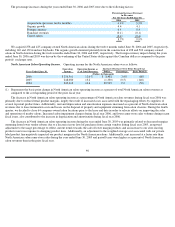

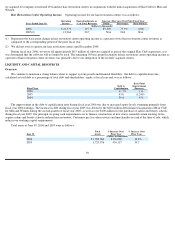

Total assets at June 30, 2006 and 2005 were as follows:

50

Operating

Operating Income as

Increase (Decrease) Over Prior Fiscal Year

Years Ended June 30,

Income

% of Total Revenues

Dollar

Percentage

Basis Point(1)

(Dollars in thousands)

2006

$

21,573

19.7

%

$

9,309

75.9

%

(100

)

2005(2)

12,264

20.7

N/A

N/A

N/A

Debt to

Basis Point

Improvement

Fiscal Year

Capitalization

(Increase)

2006

41.7

%

130

2005

43.0

(1,240

)

2004

30.6

450

Total

$ Increase Over

% Increase Over

June 30,

Assets

Prior Year

Prior Year

(Dollars in thousands)

2006

$

1,982,064

$

256,088

14.8

%

2005

1,725,976

454,117

35.7