Supercuts 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REGIS CORP

FORM 10-K

(Annual Report)

Filed 09/11/06 for the Period Ending 06/30/06

Address 7201 METRO BLVD

MINNEAPOLIS, MN 55439

Telephone 9529477777

CIK 0000716643

Symbol RGS

SIC Code 7200 - Services-Personal Services

Industry Personal Services

Sector Services

Fiscal Year 06/30

http://www.edgar-online.com

© Copyright 2013, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

REGIS CORP FORM 10-K (Annual Report) Filed 09/11/06 for the Period Ending 06/30/06 Address Telephone CIK Symbol SIC Code Industry Sector Fiscal Year 7201 METRO BLVD MINNEAPOLIS, MN 55439 9529477777 0000716643 RGS 7200 - Services-Personal Services Personal Services Services 06/30 http://www.edgar-... -

Page 2

... (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, par value $0.05 per share Preferred Share Purchase Rights New York Stock Exchange New York Stock Exchange... -

Page 3

... Indicate by check mark whether the Registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes 32 No 2 The aggregate market value of the voting common stock held by non-affiliates computed by reference to the price at which common stock was last sold as of the last business day of... -

Page 4

... Salon Markets and Marketing Salon Education and Training Programs Salon Staff Recruiting and Retention Salon Design Salon Management Information Systems Salon Competition Beauty School Business Strategy Hair Restoration Business Strategy Corporate Trademarks Corporate Employees Executive Officers... -

Page 5

... and franchising hair and retail product salons. Over the last four fiscal years, the Company began acquiring and operating beauty schools in North America and internationally. Additionally, in December 2004, the Company acquired Hair Club for Men and Women, a provider of hair restoration services... -

Page 6

... two percent world wide market share, management believes opportunities to acquire additional salons remain. Over the past nearly thirteen years, the Company has added 7,344 locations through acquisitions, expanding in both North America and internationally. When contemplating an acquisition... -

Page 7

... single location salons or small chains. The Company has developed a comprehensive point of sale system to accumulate and monitor service and product sales trends, as well as assist in payroll and cash management. Economies of scale are realized through the support system offered by the home office... -

Page 8

...'s salons, the Company employs full and part-time artistic directors whose duties are to train salon stylists in current styling trends. The major services supplied by the Company's salons are haircutting and styling, hair coloring and waving, shampooing and conditioning. During fiscal year 2006... -

Page 9

... Company's International salon operations consist of 2,040 hair care salons, including 1,587 franchise salons, located throughout Europe, primarily in the United Kingdom, France, Italy and Spain. Under each concept below, the number of new salons expected to be opened within the upcoming fiscal year... -

Page 10

SALON LOCATION SUMMARY NORTH AMERICAN SALONS: 2006 2005 2004 2003 2002 REGIS SALONS Open at beginning of period Salons constructed Acquired Less relocations Salon openings Conversions Salons closed Total, Regis Salons MASTERCUTS Open at beginning of period Salons constructed Acquired Less ... -

Page 11

... Salons closed Total franchise salons Total, SmartStyle/Cost Cutters in Wal-Mart STRIP CENTERS Company-owned salons: Open at beginning of period Salons constructed Acquired Franchise buybacks Less relocations Salon openings Conversions Salons closed Total company-owned salons Franchise salons: Open... -

Page 12

2006 2005 2004 2003 2002 INTERNATIONAL SALONS(1) Company-owned salons: Open at beginning of period Salons constructed Acquired Franchise buybacks Less relocations Salon openings Conversions Salons closed Total company-owned salons Franchise salons: Open at beginning of period Salons constructed... -

Page 13

... year 2007, the Company plans to open approximately 25 new Regis Salons. MasterCuts. MasterCuts is a full service, mall based salon group which focuses on the walk-in consumer (no appointment necessary) that demands moderately priced hair care services. MasterCuts salons emphasize quality hair care... -

Page 14

... Salons are comprised of company-owned and franchise salons operating in strip centers across North America under the following concepts: Supercuts. The Supercuts concept provides consistent, high quality hair care services and professional products to its customers at convenient times and locations... -

Page 15

..., the average annual revenues are typically in excess of £550,000. Jean Louis David (JLD). These franchise salons offer full service hair care without an appointment. Salons are located in European cities, with populations of more than 20,000 in town centers, high-traffic areas and shopping centers... -

Page 16

... rights to the Company, such as the right to approve location, suppliers and the sale of a franchise. Additionally, franchisees are required to conform to company established operational policies and procedures relating to quality of service, training, design and decor of stores, and trademark usage... -

Page 17

... training programs is to ensure that customers receive a professional and quality service, which the Company believes will result in more repeat customers, referrals and product sales. The Company has full- and part-time artistic directors who train the stylists in techniques for providing the salon... -

Page 18

... stylists. The Company believes that its compensation structure for salon managers and stylists is competitive within the industry. Stylists benefit from the Company's high-traffic locations and receive a steady source of new business from walk-in customers. In addition, the Company offers a career... -

Page 19

...shopping malls, the Company must be competitive as to rentals and other customary tenant obligations. Beauty School Business Strategy: Operating beauty schools is complementary to the salon business as it allows the Company to attract, train and retain valuable employees. The Company expects to open... -

Page 20

...to Regis Corporation. Given its long history of educating stylists, the Company seeks to improve curriculum and training techniques in its schools. Also, as the largest employer in the beauty industry, the Company believes these schools may provide a continuous pipeline of strong job applicants upon... -

Page 21

...by the schools. Hair Restoration Business Strategy: In December 2004, the Company acquired Hair Club for Men and Women (Hair Club), the largest U.S. provider of hair loss solutions and the only company offering a comprehensive menu of proven hair loss products and services. The Company leverages its... -

Page 22

... market. Women now represent approximately 50 percent of new customers. Currently, all locations offer hair systems, hair therapy and hair care products. Among the hair restoration centers' product offerings are hair transplants. The hair restoration centers employ a hub and spoke strategy for hair... -

Page 23

... any unauthorized use, the Company's success and continuing growth are the result of the quality of its salon location selections and real estate strategies. Corporate Employees: During fiscal year 2006, the Company had approximately 59,000 full- and part-time employees worldwide, of which an... -

Page 24

... Senior Vice President, Real Estate Senior Vice President, Design and Construction Senior Vice President, Regis Corporation and President, Franchise Division Executive Vice President, Fashion, Education and Marketing Executive Vice President and Chief Operating Officer, Regis Salons, Promenade Salon... -

Page 25

... since December 2002, and has been in the shopping center industry for over 20 years. Prior to joining the Company, she served as Vice President of Real Estate at Best Buy, Inc. Bruce Johnson was elected a Senior Vice President of Design and Construction in 1997 and has served as Vice President... -

Page 26

.... Financial and other information can be accessed in the Investor Information section of the Company's website at www.regiscorp.com . The Company makes available, free of charge, copies of its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to... -

Page 27

... of Acquisition and Real Estate Availability The key driver of our revenue and earnings growth is the number of salons we acquire or construct. While we believe that substantial future acquisition and organic growth opportunities exist, any inability to identify and successfully complete future... -

Page 28

...Historically, our revenue and net earnings have generally been realized evenly throughout the fiscal year. The service and retail product revenues associated with our company-owned salons, as well as our franchise revenues, are of a replenishment nature. We estimate that customer visitation patterns... -

Page 29

... with original terms of at least five years, generally with the ability to renew, at the Company's option, for one or more additional five year periods. Salons operating within department stores in Canada and Europe operate under license agreements, while freestanding or shopping center locations in... -

Page 30

...fiscal year 2006 stock repurchase activity: Total Number of Shares Purchased As Part of Publicly Announced Plans or Programs Approximate Dollar Value of Shares that May Yet Be Purchased under the Plans or Programs (in thousands) Period Total Number of Shares Purchased Average Price Paid per Share... -

Page 31

... Company adopted SFAS No. 123 (revised 2004), "Share-Based Payment" (SFAS No. 123R), using the modified prospective method of application. Total compensation cost for stock-based payment arrangements totaled $4.9, $1.2 and $0.2 million ($4.1, $0.8 and $0.1 million after tax) during fiscal years 2006... -

Page 32

... MANAGEMENT'S OVERVIEW Regis Corporation (RGS) owns or franchises beauty salons, hair restoration centers and educational establishments. As of June 30, 2006, our worldwide operations included 11,333 system wide North American and international salons, 90 hair restoration centers and 54 beauty... -

Page 33

... number of new locations in untapped markets domestically and internationally. However, the success of our hair restoration business is not dependent on the same real estate criteria used for salon expansion. In an effort to provide confidentiality for our customers, hair restoration centers operate... -

Page 34

... during fiscal year 2005, as described below. In addition, the net book value of our beauty schools approximates fair value since a significant number of those schools were acquired during the past 24 months. The fair value of the North American salons and hair restoration centers exceeded their... -

Page 35

... Company-owned salon revenues, certain beauty school revenues and certain hair restoration center revenues that do not require us to perform any future services or deliver any future products are recorded at the time of sale. This accounting treatment results in revenue recognition at the time... -

Page 36

... using the lattice (binomial) option-pricing model. During fiscal years 2006, 2005 and 2004, stock-based compensation expense totaled $4.9, $1.2 and $0.2 million, respectively. Our specific weighted average assumptions for the risk free interest rate, expected term, expected volatility and expected... -

Page 37

... key aspects of our fiscal year 2006 results: • Revenues increased 10.8 percent to $2.4 billion and consolidated same-store sales increased 0.4 percent during fiscal year 2006. Samestore sales were negatively impacted by the long hair cycle, as customers tend to cut their hair less often than when... -

Page 38

... 30, 2006 2005 2004 Service revenues Product revenues Franchise royalties and fees Operating expenses: Cost of service(1) Cost of product(2) Site operating expenses General and administrative Rent Depreciation and amortization Goodwill impairment Terminated acquisition income, net Operating income... -

Page 39

... 30, 2006 2005 2004 (Dollars in thousands) North American salons: Regis MasterCuts Trade Secret(1) SmartStyle Strip Center(1) Total North American Salons International salons(1) Beauty schools Hair restoration centers(1) Consolidated revenues Percent change from prior year Salon same-store sales... -

Page 40

... company-owned salons, tuition and service revenues generated within our beauty schools, and service revenues generated by hair restoration centers. Total service revenues were as follows: Increase Over Prior Fiscal Year Revenues Dollar Percentage (Dollars in thousands) Years Ended June 30, 2006... -

Page 41

... revenues are primarily sales at company-owned salons, beauty schools, hair restoration centers, and sales of product and equipment to franchisees. Total product revenues were as follows: Increase Over Prior Fiscal Year Revenues Dollar Percentage (Dollars in thousands) Years Ended June 30, 2006... -

Page 42

... Depreciation) Our cost of revenues primarily includes labor costs related to salon employees, beauty school instructors and hair restoration center employees, the cost of product used in providing services and the cost of products sold to customers and franchisees. The resulting gross margin was as... -

Page 43

... supervision, salon training and promotions, product distribution centers and corporate offices (such as salaries and professional fees), including costs incurred to support franchise, beauty school and hair restoration center operations. G&A expenses were as follows: Expense as % Increase (Decrease... -

Page 44

...64 company-owned salon locations and refocus efforts on improving the sales and operations of nearby salons. Additionally, the increase in this fixed-cost expense as a percent of total revenues was due to salon rent increasing at a faster rate than salon same-store sales during both fiscal year 2006... -

Page 45

..., including additional beauty schools and the fiscal year 2005 acquisition of the hair restoration centers. Additionally, increased borrowing rates contributed to the fiscal year 2006 increase in interest expense as a percent of total revenues. Income Taxes Our reported effective tax rate was as... -

Page 46

... 1,060 (341 ) (292 ) $ 427 $ 785 892 (1,787 ) $ (110 ) Based on our internal management structure, we report four segments: North American salons, International salons, beauty schools and hair restoration centers. Significant results of operations are discussed below with respect to each of these... -

Page 47

..., an adjustment to the weighted average cost associated with our private label product line negatively impacted our product margins in the North American salons. Additionally, rent increased at a faster rate than North American salon same-store sales during the year ended June 30, 2005 and... -

Page 48

...to closing 116 franchise salons during fiscal year 2006. International Salon Operating Income (Loss). Years Ended June 30, Operating income (loss) for the international salons was as follows: Operating Income Increase (Decrease) Over Prior Fiscal Year (Loss) as % of Total Revenues Dollar Percentage... -

Page 49

...to the franchise operations in France), as well as the fixed cost components of G&A increasing at a faster rate than the same-store sales in the international salons. Beauty Schools Beauty School Revenues. Total beauty schools revenues were as follows: Increase Over Prior Fiscal Year Revenues Dollar... -

Page 50

...students and an increase in marketing expenses incurred to help bolster late summer and early fall enrollment impacted fiscal year 2006 operating income. Hair Restoration Centers As discussed in Note 3 to the Consolidated Financial Statements, we acquired Hair Club for Men and Women in December 2004... -

Page 51

... to finance construction of new stores, remodel certain existing stores, acquire salons and beauty schools and purchase inventory. Customers pay for salon services and merchandise in cash at the time of sale, which reduces our working capital requirements. Total assets at June 30, 2006 and 2005 were... -

Page 52

...: Operating Cash Flows For the Years Ended June 30, 2006 2005 2004 (Dollars in thousands) Net income Depreciation and amortization Accounts payable and accrued expenses Asset and goodwill impairments Deferred income taxes Inventories Stock-based compensation Excess tax benefits from stock-based... -

Page 53

... fiscal year 2005, accounts payable and accrued expenses increased primarily due to an increase in inventory, as well as the timing of advertising expenses and income tax payments. Inventories increased due to growth in the number of salons, as well as lower than expected same-store product sales... -

Page 54

... 30, 2006 2005 2004 (Dollars in thousands) Net borrowings (payments) on revolving credit facilities Repurchase of common stock Net (payments) borrowings of long-term debt Proceeds from the issuance of common stock Dividend payments Excess tax benefit from stock-based compensation plans Other $ 56... -

Page 55

...of the credit agreement, certain cross-default situations, certain bankruptcy related situations, and other customary events of default for a facility of this type. The interest rates under the facility vary and are based on a bank's reference rate, the federal funds rate and/or LIBOR, as applicable... -

Page 56

... to a salary deferral program, $11.3 million (including $2.6 million in interest) related to established contractual payment obligations under retirement and severance payment agreements for a small number of retired employees and $5.5 million related to the Executive Profit Sharing Plan (see Note... -

Page 57

..., in the ordinary course of business. These contracts primarily relate to our commercial contracts, operating leases and other real estate contracts, financial agreements, agreements to provide services, and agreements to indemnify officers, directors and employees in the performance of their... -

Page 58

... our self-insurance program and Department of Education requirements surrounding Title IV funding. Dividends We paid dividends of $0.16 per share during fiscal years 2006 and 2005, and $0.14 per share during fiscal year 2004. On August 23, 2006, the Board of Directors of the Company declared a $0.04... -

Page 59

... to obtain suitable locations and financing for new salon development; governmental initiatives such as minimum wage rates, taxes and possible franchise legislation; the ability of the Company to successfully identify, acquire and integrate salons and beauty schools that support its growth... -

Page 60

... rate debt. Generally, the terms of the interest rate swap agreements contain quarterly settlement dates based on the notional amounts of the swap contracts. Pay fixed rates, receive variable rates On October 21, 2005, the Company entered into interest rate swap contracts that pay fixed rates... -

Page 61

... 30, 2006 through June 30, 2011. For the Company's derivative financial instruments, the table presents notional amounts and weighted-average interest rates by expected (contractual) maturity dates. Notional amounts are used to calculate the contractual payments to be exchanged under the contract... -

Page 62

... operations at June 30, 2006 and 2005, respectively. Net Investments: (U.S.$Equivalent in thousands) Net investment (CND) Net investment (EURO) Net investment (GBP) Foreign Currency Derivative: Fixed-for-fixed cross currency swap (Euro/U.S.) Euro amount Average pay Euro rate U.S.$amount Average... -

Page 63

.... The exposure to Canadian dollar exchange rates on the Company's fiscal year 2006 cash flows primarily includes payments in Canadian dollars from the Company's Canadian salon operations for retail inventory exported from the United States. The Company seeks to manage exposure to changes in the... -

Page 64

... Management's Statement of Responsibility for Financial Statements and Report on Internal Control over Financial Reporting Reports of Independent Registered Public Accounting Firm Consolidated Balance Sheet as of June 30, 2006 and 2005 Consolidated Statement of Operations for each of the three years... -

Page 65

... its assessment of internal control over financial reporting as of June 30, 2006 because the 2006 Acquired Beauty Schools were acquired by the Company in purchase business combinations during fiscal year 2006. The 2006 Acquired Beauty Schools are wholly owned subsidiaries of Regis Corporation whose... -

Page 66

... statements, Regis Corporation changed its method of accounting for share-based payments as of July 1, 2005. Internal control over financial reporting Also, in our opinion, management's assessment, included in Management's Annual Report on Internal Control over Financial Reporting appearing under... -

Page 67

... of Hair Design, Warwick Academy of Beauty, and Wheatridge Beauty College (collectively "2006 Acquired Beauty Schools") from its assessment of internal control over financial reporting as of June 30, 2006 because the 2006 Acquired Beauty Schools were acquired by the Company in purchase business... -

Page 68

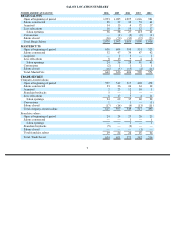

REGIS CORPORATION CONSOLIDATED BALANCE SHEET (Dollars in thousands, except per share amounts) June 30, 2006 2005 ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Deferred income taxes Other current assets Total current assets Property and equipment, net Goodwill Other ... -

Page 69

... CORPORATION CONSOLIDATED STATEMENT OF OPERATIONS (Dollars and shares in thousands, except per share amounts) 2006 Years Ended June 30, 2005 2004 Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and administrative... -

Page 70

... Changes in fair market value of financial instruments designated as hedges of interest rate exposure, net of taxes and transfers Stock repurchase plan Proceeds from exercise of stock options Stock-based compensation Shares issued through franchise stock incentive program Shares issued in connection... -

Page 71

...-term debt Excess tax benefits from stock-based compensation plans Other, primarily increase (decrease) in negative book cash balances Dividends paid Repurchase of common stock Proceeds from issuance of common stock Net cash provided by (used in) financing activities Effect of exchange rate changes... -

Page 72

...primarily located in strip shopping centers. The company-owned and franchise salons in the U.K., France and several other countries are owned and operated in malls, leading department stores, mass merchants and high-street locations. Beauty schools are typically located within leased space. The hair... -

Page 73

... of cost or market with cost determined on a weighted average basis. Cost of product used and sold associated with the Company's salon business are determined by applying estimated gross profit margins to service and product revenues, which are based on historical factors including product pricing... -

Page 74

... fiscal year 2006, the net book value of our European and Beauty School businesses approximated their fair values and the estimated fair value of the remaining reporting units exceeded their carrying amounts, indicating no impairment of goodwill. Fair values are estimated based on the Company's best... -

Page 75

... customer return data that management believes to be reasonable, and is less than one percent of sales. Product sales by the Company to its franchisees are included within product revenues on the Consolidated Statement of Operations and recorded at the time product is shipped to franchise locations... -

Page 76

...net rental income (see Note 6). Royalties are recognized as revenue in the month in which franchisee services are rendered or products are sold to franchisees. The Company recognizes revenue from initial franchise fees at the time franchise locations are opened, as this is generally when the Company... -

Page 77

... such as payroll, training costs and promotion incurred prior to the opening of a new location are expensed as incurred. Sales Taxes: Sales taxes are recorded on a net basis (rather than as both revenue and an expense) within the Company's Consolidated Statement of Operations. Income Taxes: Deferred... -

Page 78

... of APB No. 25, no stock-based employee compensation cost was reflected in net income, as all options granted under those plans had an exercise price equal to the market value of the underlying stock on the date of grant. Effective July 1, 2003, the Company adopted the fair value recognition... -

Page 79

...30, 2005 2004 (Dollars in thousands, except per share amounts) Net income, as reported Add: Stock-based employee compensation expense included in reported net income, net of related tax effects Deduct: Total stock-based employee compensation expense determined under fair value based methods for all... -

Page 80

... rates. The expense associated with the restricted stock grant is based on the market price of the Company's stock at the date of grant and is amortized on a straight-line basis over the five-year vesting period. Stock awards are not performance based and vest with continued employment. Stock... -

Page 81

...FSP 123R-4 becomes effective upon initial adoption of SFAS No. 123R. Regis' stock-based compensation awards do not contain contingent cash settlement features; therefore, the adoption of FSP 123R-4 did not impact the Company's Consolidated Financial Statements. In April 2006, the FASB issued FSP FIN... -

Page 82

... for interim and annual periods beginning after December 15, 2006 (i.e., the third quarter of the Company's fiscal year 2007). The Company currently presents taxes within the scope of EITF No. 06-3 on a net basis, and has disclosed this policy within its accounting policy footnote. Other than... -

Page 83

... Other assets: Notes receivable Other noncurrent assets Accounts payable: Book overdrafts payable Trade accounts payable Accrued expenses: Payroll and payroll related costs Insurance Deferred revenues Taxes payable, primarily income taxes Book overdrafts payable Other Other noncurrent liabilities... -

Page 84

... the Company in that reporting period. The weighted average amortization periods, in total and by major intangible asset class, are as follows: Weighted Average Amortization Period (in years) Amortized intangible assets: Brand assets and trade names Customer list Franchise agreements School-related... -

Page 85

... 155,338 shares of the Company's common stock during fiscal year 2005 and 2004, respectively (see Note 3). 3. ACQUISITIONS AND INVESTMENTS: During fiscal years 2006, 2005 and 2004, the Company made numerous acquisitions and the purchase prices have been allocated to assets acquired and liabilities... -

Page 86

... 2006 2005 (Dollars in thousands) 2004 Components of aggregate purchase prices: Cash Stock Liabilities assumed or payable Allocation of the purchase prices: Current assets Property and equipment Other noncurrent assets Goodwill Identifiable intangible assets Accounts payable and accrued expenses... -

Page 87

... the acquisition of Hair Club below. The value and related weighted average amortization periods for the intangibles acquired during fiscal year 2006 business acquisitions, in total and by major intangible asset class, are as follows Purchase Price Allocation Weighted Average Amortization Period (in... -

Page 88

... represents the Company's opportunity to strategically combine the acquired business with the Company's existing structure to serve a greater number of customers through its expansion strategies. In the acquisitions of international salons, beauty schools and hair restoration centers, the residual... -

Page 89

...'s operational policies and procedures, the Company is accounting for this investment under the equity method. Additionally, the Company and the entity that is the majority corporate investor ("investor") of this privately held investment ("investment") entered into a credit agreement whereby... -

Page 90

...the following: Maturity Dates (fiscal year) Interest rate % 2006 2005 Amounts outstanding 2006 2005 (Dollars in thousands) Senior term notes Revolving credit facility Equipment and leasehold notes payable Other notes payable Less current portion Long-term portion 2007-2015 2010 2007-2010 2007-2011... -

Page 91

... Fiscal year (Dollars in thousands) 2007 2008 2009 2010 2011 Thereafter $ 101,912 70,773 83,765 46,467 43,270 276,082 $ 622,269 Senior Term Notes Private Shelf Agreement At June 30, 2006 and 2005, the Company had $191.0 and $203.5 million, respectively, in unsecured, fixed rate, senior term notes... -

Page 92

.... Because the credit agreement provides for possible acceleration of the maturity date of the facility based on provisions that are not objectively determinable, the outstanding borrowings as of June 30, 2006 and 2005 are classified as part of the current portion of the Company's long-term debt... -

Page 93

... of Operations and, therefore, amounts are transferred out of accumulated other comprehensive income to earnings at each interest payment date. Forward Foreign Currency Contracts On February 1, 2006, the Company entered into several forward foreign currency contracts to sell Canadian dollars and buy... -

Page 94

... dates between July 2006 and July 2008. These swaps were designated as hedges of a portion of the Company's senior term notes and are being accounted for as fair value hedges. During fiscal year 2003, the Company terminated a portion of a $40.0 million interest rate swap contract. The remainder of... -

Page 95

.... For certain leases, the Company is required to pay additional rent based on a percent of sales in excess of a predetermined amount and, in most cases, real estate taxes and other expenses. Rent expense for the Company's international department store salons is based primarily on a percent of... -

Page 96

... classified in the royalties and fees caption of the Consolidated Statement of Operations. Total rent expense, excluding rent expense on premises subleased to franchisees, includes the following: 2006 2005 (Dollars in thousands) 2004 Minimum rent Percentage rent based on sales Real estate taxes and... -

Page 97

...enter into transactions to acquire established hair care salons and beauty schools. Contingencies: The Company is self-insured for most workers' compensation and general liability losses subject to per occurrence and aggregate annual liability limitations. The Company is insured for losses in excess... -

Page 98

... tax asset (liability) are as follows: 2006 2005 (Dollars in thousands) Net current deferred tax asset: Insurance Payroll and payroll related costs Nonrecurring items Reserve for impaired assets Deferred franchise fees Other, net Net noncurrent deferred tax liability: Depreciation and amortization... -

Page 99

... BENEFIT PLANS: Profit Sharing Plan: Effective July 1, 2003, the Company's qualified employee stock ownership plan (ESOP) was converted to a profit sharing plan. The profit sharing plan covers substantially all field supervisors, warehouse and corporate office employees. The profit sharing plan is... -

Page 100

... also be granted to the Company's outside directors for a term not to exceed ten years from the grant date. The 2000 Plan contains restrictions on transferability, time of exercise, exercise price and on disposition of any shares acquired through exercise of the options. Stock options are granted at... -

Page 101

... of compensation cost for its incentive stock option plans, as well as pro forma information. 2004 Long Term Incentive Plan: In May of 2004, the Company's Board of Directors approved the 2004 Long Term Incentive Plan (2004 Plan). The 2004 Plan received shareholder approval at the annual shareholders... -

Page 102

... based on the Aa Bond index rate (5.25 and 6.25 percent at June 30, 2006 and 2005, respectively). Compensation associated with these agreements is charged to expense as services are provided. Associated costs included in general and administrative expenses on the Consolidated Statement of Operations... -

Page 103

..., CONTINUED benefit, adjusted for inflation, for the remaining life of his spouse. Estimated associated costs included in general and administrative expenses on the Consolidated Statement of Operations totaled $0.3 million for each of fiscal years 2006, 2005 and 2004. All service costs will be... -

Page 104

.... The Company's newly acquired hair restoration centers are located in the United States and Canada. Based on the way the Company manages its business, it has reported its North American salons, international salons, beauty schools and hair restoration centers as four separate reportable operating... -

Page 105

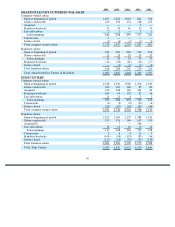

...For the Year Ended June 30, 2006 Hair Salons Beauty Restoration Unallocated North America International Schools Centers Corporate (Dollars in thousands) Consolidated Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and... -

Page 106

...For the Year Ended June 30, 2005 Hair Salons Beauty Restoration Unallocated North America International Schools Centers Corporate (Dollars in thousands) Consolidated Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and... -

Page 107

...For the Year Ended June 30, 2004 Hair Salons Beauty Restoration Unallocated North America International Schools Centers Corporate (Dollars in thousands) Consolidated Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and... -

Page 108

... Agreement for Sally Beauty Company. The termination fee gain is net of direct transaction related expenses associated with terminated Merger Agreement. An additional $5.7 million of direct transaction related expenses were expensed in the third quarter of fiscal year 2006. • An impairment charge... -

Page 109

.... Management necessarily applied its judgment in assessing the costs and benefits of such controls and procedures, which, by their nature, can provide only reasonable assurance regarding management's control objectives. With the participation of management, the Company's chief executive officer and... -

Page 110

...2006 reporting the Company's consolidated revenues and consolidated same-store sales for the quarter and year ended June 30, 2006. The information set forth under this Item 9B. is intended to be furnished under this Item 9B. and also "Item 2.02, Results of Operations and Financial Condition" of Form... -

Page 111

...& Ethics, that applies to all employees, including the Company's chief executive officer, chief financial officer, directors and executive officers. The Code of Business Conduct & Ethics is available on the Company's website at www.regiscorp.com , under the heading "Corporate Governance / Guidelines... -

Page 112

... well as shares granted through stock appreciation rights under the 2004 Long Term Incentive Plan. Information regarding the stock-based compensation plans is included in Notes 1 and 9 to the Consolidated Financial Statements. The Company's 2004 Long Term Incentive Plan (2004 Plan) provides for the... -

Page 113

... 10K date September 24, 1997.) Form of Amendment to Employment and Deferred Compensation Agreement between the Company and six executive officers. (Incorporated by reference to Exhibit 10.6 of the Company's Report on Form 8-K dated January 13, 2006. Northwestern Mutual Life Insurance Company Policy... -

Page 114

...(q) 10(r) Employee Stock Ownership Plan and Trust Agreement dated as of May 15, 1992 between the Registrant and Myron Kunin and Paul D. Finkelstein, Trustees. (Incorporated by reference to Exhibit 10(q) as part of the Company's Report on Form 10-K dated September 27, 1993, for the year ended June... -

Page 115

... 31, 1997.) Series G Senior Note dated as of July 10, 1998 between the Registrant and Prudential Insurance Company of America. (Incorporated by reference to the Company's Report on Form 10-K dated September 17, 1998, for the year ended June 30, 1998.) Term Note C Agreement between the Registrant and... -

Page 116

... June 30, 2004.) 2004 Long Term Incentive Plan (Draft). (Incorporated by reference to Exhibit 10(ff) of the Company's Report on Form 10-K dated September 10, 2004, for the year ended June 30, 2004.) Purchase Agreement between Regis Corporation and Hair Club for Men and Women, Inc. (Incorporated by... -

Page 117

.... REGIS CORPORATION By /s/ PAUL D. FINKELSTEIN Paul D. Finkelstein, Chairman of the Board of Directors, President and Chief Executive Officer By /s/ RANDY L. PEARCE Randy L. Pearce, Senior Executive Vice President, Chief Financial and Administrative Officer (Principal Financial and Accounting... -

Page 118

REGIS CORPORATION SCHEDULE II-VALUATION AND QUALIFYING ACCOUNTS as of June 30, 2006, 2005 and 2004 (dollars in thousands) Balance at beginning of period Charged to costs and expenses Charged to Other Accounts Balance at end of period Description Deductions Valuation Account, Allowance for ... -

Page 119

... 33372200), and Form S-8 (Nos. 333-123737, 333-88938, 33-44867 and 33-89882) of Regis Corporation of our report dated September 8, 2006 relating to the consolidated financial statements and financial statement schedule, management's assessment of the effectiveness of internal control over financial... -

Page 120

... SARBANES-OXLEY ACT OF 2002 I, Paul D. Finkelstein, Chairman of the Board of Directors, President and Chief Executive Officer of Regis Corporation, certify that: 1. 2. I have reviewed this annual report on Form 10-K of Regis Corporation; Based on my knowledge, this report does not contain any untrue... -

Page 121

...-OXLEY ACT OF 2002 I, Randy L. Pearce, Senior Executive Vice President, Chief Financial and Administrative Officer of Regis Corporation, certify that: 1. 2. I have reviewed this annual report on Form 10-K of Regis Corporation; Based on my knowledge, this report does not contain any untrue statement... -

Page 122

... with the Annual Report of Regis Corporation (the Registrant) on Form 10-K for the fiscal year ending June 30, 2006 as filed with the Securities and Exchange Commission on the date hereof, I, Paul D. Finkelstein, Chairman of the Board of Directors, President and Chief Executive Officer of the... -

Page 123

... information contained in the Annual Report on Form 10-K fairly presents, in all material respects, the financial condition and results of operations of the Registrant. September 8, 2006 /s/ RANDY L. PEARCE Randy L. Pearce, Senior Executive Vice President, Chief Financial and Administrative Officer -

Page 124

... a year ago. Fiscal year 2006 same-store sales increased 0.4 percent. Fourth Quarter Revenues: Salons North America For the Three Months Ended June, 2006 Beauty Hair Restoration International Schools Centers Consolidated (Dollars in thousands) Revenues: Service Product Royalties and fees Total... -

Page 125

... the 16-week period ended June 25, 2005. Fiscal Year Revenues: Salons North America For the 12 Months Ended June, 2006 Beauty Hair Restoration International Schools Centers Consolidated (Dollars in thousands) Revenues: Service Product Royalties and fees Total $ $ 1,395,953 601,332 39,263 2,036... -

Page 126

... beauty schools operating under concepts such as Supercuts, Jean Louis David, Vidal Sassoon, Regis Salons, MasterCuts, Trade Secret, SmartStyle, Cost Cutters and Hair Club for Men and Women. These and other concepts are located in the US and in ten other countries throughout North America and Europe...