Salesforce.com 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

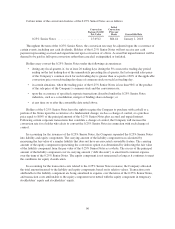

assembled workforce and expanded market opportunities when integrating RelateIQ’s relationship intelligence

technology with the Company’s other offerings. The goodwill balance is not deductible for U.S. income tax

purposes.

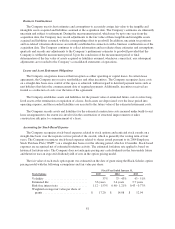

The Company assumed unvested equity awards for shares of RelateIQ’s common stock with a fair value of

$33.9 million. Of the total consideration, $1.1 million was allocated to the purchase consideration and $32.8

million was allocated to future services and will be expensed over the remaining service periods on a straight-line

basis.

Fiscal Year 2014

ExactTarget

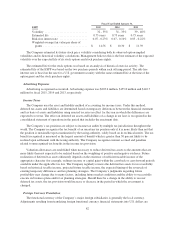

On July 12, 2013, the Company acquired for cash the outstanding stock of ExactTarget, a leading global

provider of cross-channel, digital marketing solutions that empower organizations of all sizes to communicate

with their customers through the digital channels they use most. The Company acquired ExactTarget to, among

other things, create a world-class marketing platform across the channels of email, social, mobile and the web.

The Company has included the financial results of ExactTarget in the consolidated financial statements from the

date of acquisition. The acquisition date fair value of the consideration transferred for ExactTarget was

approximately $2.6 billion, including the proceeds from the Term Loan of $300.0 million (see Note 5 “Debt”),

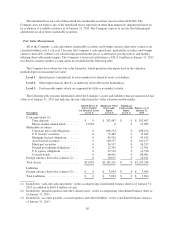

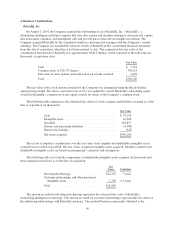

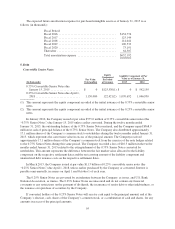

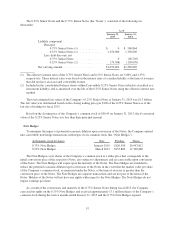

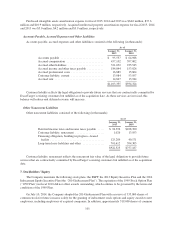

which consisted of the following (in thousands):

Fair value

Cash ........................................... $2,567,098

Fair value of equity awards assumed ................. 17,428

Total .......................................... $2,584,526

The estimated fair value of the stock options assumed by the Company was determined using the Black-

Scholes option pricing model. The share conversion ratio of 0.84 was applied to convert ExactTarget’s

outstanding equity awards for ExactTarget’s common stock into equity awards for shares of the Company’s

common stock.

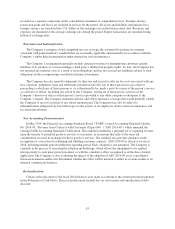

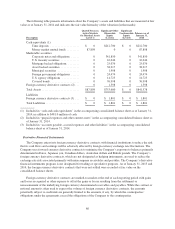

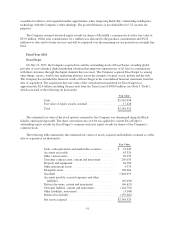

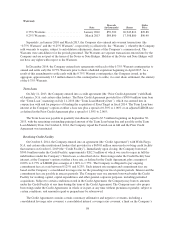

The following table summarizes the estimated fair values of assets acquired and liabilities assumed as of the

date of acquisition (in thousands):

Fair Value

Cash, cash equivalents and marketable securities ........ $ 91,549

Accounts receivable .............................. 63,320

Other current assets ............................... 20,355

Customer contract asset, current and noncurrent ........ 205,033

Property and equipment ........................... 64,782

Other noncurrent assets ............................ 4,379

Intangible assets ................................. 706,064

Goodwill ....................................... 1,848,653

Accounts payable, accrued expenses and other

liabilities ..................................... (65,636)

Deferred revenue, current and noncurrent ............. (46,615)

Customer liability, current and noncurrent ............. (144,792)

Other liabilities, noncurrent ........................ (3,104)

Deferred tax liability .............................. (159,462)

Net assets acquired ............................... $2,584,526

91