Salesforce.com 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

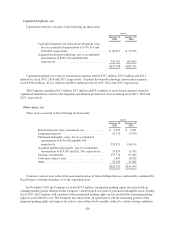

The excess tax benefits associated with stock option exercises are recorded directly to stockholders’ equity

only when such benefits are realized following the tax law ordering approach. As a result, the excess tax benefits

included in net operating loss carryforwards but are not reflected in deferred tax assets for fiscal 2015 and 2014

are $527.2 million and $408.8 million, respectively.

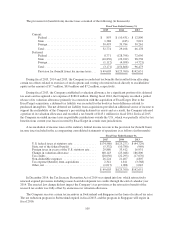

Tax Benefits Related to Stock-Based Expense

The total income tax benefit related to stock-based awards was $170.8 million, $147.8 million and $113.9

million for fiscal 2015, 2014 and 2013, respectively, the majority of which was not recognized as a result of the

valuation allowance.

Unrecognized Tax Benefits and Other Considerations

The Company records liabilities related to its uncertain tax positions. Tax positions for the Company and its

subsidiaries are subject to income tax audits by multiple tax jurisdictions throughout the world. Certain prior year

tax returns are currently being examined by various taxing authorities in countries including the United States,

Japan, Germany, Swtizerland and the United Kingdom. The Company recognizes the tax benefit of an uncertain

tax position only if it is more likely than not that the position is sustainable upon examination by the taxing

authority, based on the technical merits. The tax benefit recognized is measured as the largest amount of benefit

which is greater than 50 percent likely to be realized upon settlement with the taxing authority. The Company

had gross unrecognized tax benefits of $146.2 million, $102.3 million and $75.1 million as of January 31, 2015,

2014 and 2013 respectively.

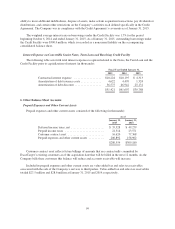

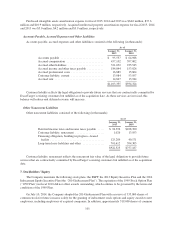

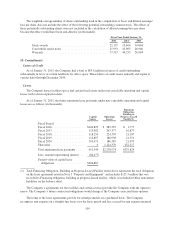

A reconciliation of the beginning and ending balance of total unrecognized tax benefits for fiscal years

2015, 2014 and 2013 is as follows (in thousands):

Fiscal Year Ended January 31,

2015 2014 2013

Balance as of February 1, ................................ $102,275 $ 75,144 $51,971

Tax positions taken in prior period:

Gross increases .................................... 17,938 8,420 7,304

Gross decreases ................................... (1,967) (4,466) (4,460)

Tax positions taken in current period:

Gross increases .................................... 34,226 27,952 24,401

Settlements ........................................... 0 0 (121)

Lapse of statute of limitations ............................ (1,224) (5,205) (4,159)

Currency translation effect ............................... (5,060) 430 208

Balance as of January 31, ................................ $146,188 $102,275 $75,144

For fiscal 2015, 2014 and 2013 total unrecognized tax benefits in an amount of $44.6 million, $34.9 million

and $32.3 million respectively, if recognized, would reduce income tax expense and the Company’s effective tax

rate after considering the impact of the change in valuation allowance in the U.S.

The Company recognizes accrued interest and penalties related to unrecognized tax benefits in the income

tax provision. The Company accrued penalties and interest in the amount of $1.3 million, $0.6 million and $0.3

million in income tax expense during fiscal 2015, 2014 and 2013, respectively. The balance in the non-current

income tax payable related to penalties and interest was $4.6 million, $3.3 million and $1.7 million as of

January 31, 2015, 2014 and 2013, respectively.

The Company has operations and taxable presence in multiple jurisdictions in the U.S. and outside of the

U.S. Tax positions for the Company and its subsidiaries are subject to income tax audits by multiple tax

jurisdictions around the world. The Company currently considers U.S. federal and state, Canada, Japan,

107