Salesforce.com 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

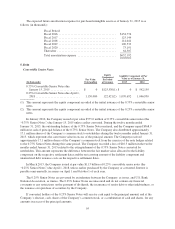

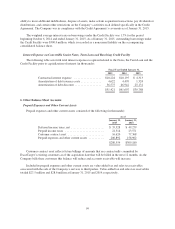

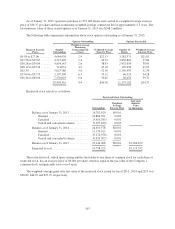

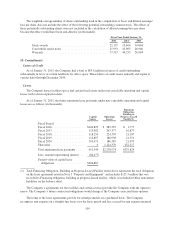

The provision for (benefit from) income taxes consisted of the following (in thousands):

Fiscal Year Ended January 31,

2015 2014 2013

Current:

Federal ................................. $ 893 $ (10,431) $ 12,896

State ................................... 1,388 (245) 3,021

Foreign ................................. 50,493 39,784 30,261

Total ................................... 52,774 29,108 46,178

Deferred:

Federal ................................. 8,771 (128,798) 72,656

State ................................... (10,830) (22,012) 28,538

Foreign ................................. (1,112) (4,058) (4,721)

Total ................................... (3,171) (154,868) 96,473

Provision for (benefit from) for income taxes . . . $ 49,603 $(125,760) $142,651

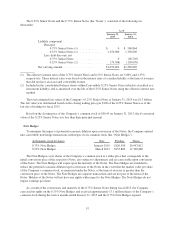

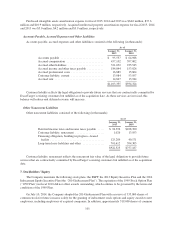

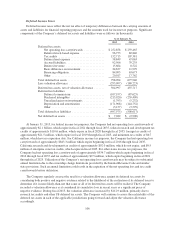

During fiscal 2015, 2014 and 2013, the Company recorded net tax benefits that resulted from allocating

certain tax effects related to exercises of stock options and vesting of restricted stock directly to stockholders’

equity in the amount of $7.7 million, $8.0 million and $7.2 million, respectively.

During fiscal 2013, the Company established a valuation allowance for a significant portion of its deferred

tax assets and recognized a tax expense of $186.8 million. During fiscal 2014, the Company recorded a partial

release of its valuation allowance primarily in connection with the acquisition of ExactTarget. Due to the

ExactTarget acquisition, a deferred tax liability was recorded for the book-tax basis difference related to

purchased intangibles. The net deferred tax liability from acquisitions provided an additional source of income to

support the realizability of the Company’s pre-existing deferred tax assets and as a result, the Company released

a portion of its valuation allowance and recorded a tax benefit of $143.1 million for fiscal 2014. In fiscal 2015,

the Company recorded income taxes in profitable jurisdictions outside the U.S., which was partially offset by tax

benefits from current year losses incurred by ExactTarget in certain state jurisdictions.

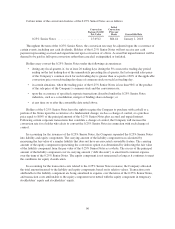

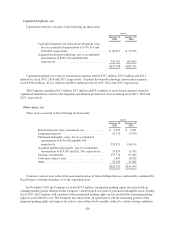

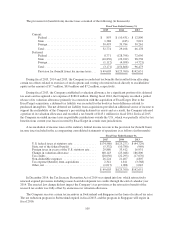

A reconciliation of income taxes at the statutory federal income tax rate to the provision for (benefit from)

income taxes included in the accompanying consolidated statements of operations is as follows (in thousands):

Fiscal Year Ended January 31,

2015 2014 2013

U.S. federal taxes at statutory rate ............... $(74,580) $(125,277) $ (44,729)

State, net of the federal benefit .................. (5,332) (10,780) (969)

Foreign taxes in excess of the U.S. statutory rate .... 29,880 33,412 16,931

Change in valuation allowance .................. 100,143 (25,048) 186,806

Tax credits .................................. (28,056) (22,293) (17,670)

Non-deductible expenses ...................... 26,224 21,407 4,807

Tax expense/(benefit) from acquisitions ........... 2,341 1,811 (3,568)

Other, net ................................... (1,017) 1,008 1,043

$ 49,603 $(125,760) $142,651

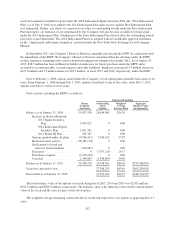

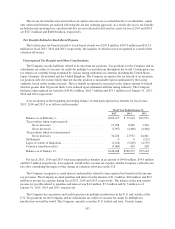

In December 2014, the Tax Increase Prevention Act of 2014 was signed into law, which retroactively

renewed expired provisions including research and development tax credits through the end of calendar year

2014. The enacted law change did not impact the Company’s tax provision as the retroactive benefit of the

research tax credits was fully offset by an increase in valuation allowance.

The Company receives certain tax incentives in Switzerland and Singapore in the form of reduced tax rates.

The tax reduction program in Switzerland expired in fiscal 2015, and the program in Singapore will expire in

fiscal 2016.

105