Salesforce.com 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

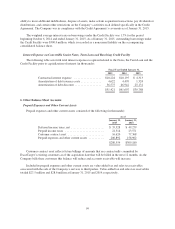

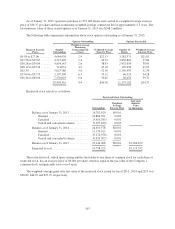

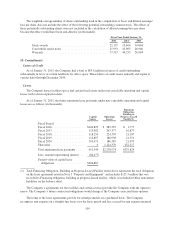

The weighted-average number of shares outstanding used in the computation of basic and diluted earnings/

loss per share does not include the effect of the following potential outstanding common stock. The effects of

these potentially outstanding shares were not included in the calculation of diluted earnings/loss per share

because the effect would have been anti-dilutive (in thousands):

Fiscal Year Ended January 31,

2015 2014 2013

Stock awards ...................................... 22,157 19,664 30,068

Convertible senior notes .............................. 25,953 43,965 26,940

Warrants .......................................... 37,517 44,253 26,944

10. Commitments

Letters of Credit

As of January 31, 2015, the Company had a total of $63.8 million in letters of credit outstanding

substantially in favor of certain landlords for office space. These letters of credit renew annually and expire at

various dates through December 2030.

Leases

The Company leases facilities space and certain fixed assets under non-cancelable operating and capital

leases with various expiration dates.

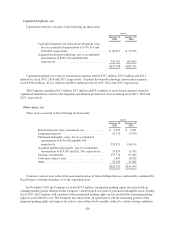

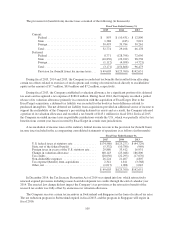

As of January 31, 2015, the future minimum lease payments under non-cancelable operating and capital

leases are as follows (in thousands):

Capital

Leases

Operating

Leases

Financing

Obligation,

Building in

Progress-Leased

Facility(1)

Fiscal Period:

Fiscal 2016 ..................... $104,825 $ 289,547 $ 1,777

Fiscal 2017 ..................... 113,982 267,377 16,877

Fiscal 2018 ..................... 118,259 224,359 21,107

Fiscal 2019 ..................... 112,807 186,936 21,551

Fiscal 2020 ..................... 201,471 186,385 21,995

Thereafter ...................... 0 1,124,370 252,517

Total minimum lease payments ..... 651,344 $2,278,974 $335,824

Less: amount representing interest . . (84,477)

Present value of capital lease

obligations ................... $566,867

(1) Total Financing Obligation, Building in Progress-Leased Facility noted above represents the total obligation

on the lease agreement noted in Note 3 “Property and Equipment” and includes $125.3 million that was

recorded to Financing obligation, building in progress-leased facility, which is included in Other noncurrent

liabilities on the balance sheet.

The Company’s agreements for the facilities and certain services provide the Company with the option to

renew. The Company’s future contractual obligations would change if the Company exercised these options.

The terms of the lease agreements provide for rental payments on a graduated basis. The Company

recognizes rent expense on a straight-line basis over the lease period and has accrued for rent expense incurred

109