Salesforce.com 2015 Annual Report Download - page 65

Download and view the complete annual report

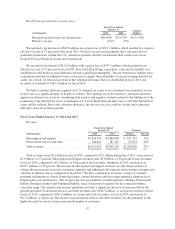

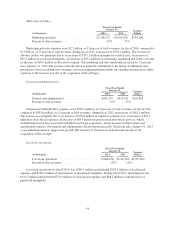

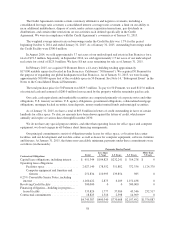

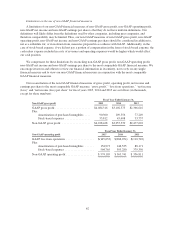

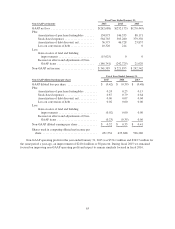

Please find page 65 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The majority of our operating lease agreements provide us with the option to renew. Our future operating

lease obligations would change if we exercised these options and if we entered into additional operating lease

agreements as we expand our operations. The financing obligation above represents the total obligation for our

lease of approximately 445,000 rentable square feet of office space in San Francisco, California. As of

January 31, 2015, $125.3 million of the total obligation noted above was recorded to Financing obligation,

building in progress—leased facility, which is included in “Other noncurrent liabilities” on the consolidated

balance sheets.

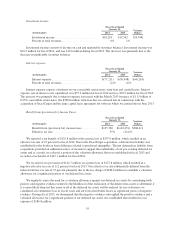

In April 2014, we entered into an office lease agreement to lease approximately 714,000 rentable square feet

of an office building located in San Francisco, California that is under construction. The lease payments

associated with the lease will be approximately $560.0 million over the 15.5 year term of the lease, beginning in

our first quarter of fiscal 2018, which is reflected above under Operating Leases.

Subsequent to January 31, 2015, we acquired 50 Fremont. As of January 31, 2015, we had been leasing

approximately 500,000 square feet of 50 Fremont (see Note 14 “Subsequent Event” in the Notes to the

Consolidated Financial Statements). The lease, which was signed in January 2012, is reflected above under

Operating lease obligations, and the commitment totals $238.5 million. The operating lease commitment is as

follows: $16.1 million during fiscal 2016; $16.6 million during fiscal 2017; $17.1 million during fiscal 2018;

$17.6 million during fiscal 2019; $18.1 million during fiscal 2020; and $153.0 thereafter. Beginning in the

quarter ending April 30, 2015, this commitment will be removed from operating lease obligations.

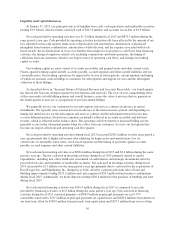

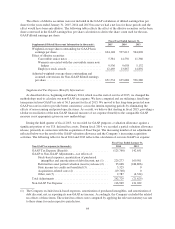

During fiscal 2015 and in future fiscal years, we have made and expect to continue to make additional

investments in our infrastructure to scale our operations and increase productivity. We plan to upgrade or replace

various internal systems to scale with the overall growth of the Company. Additionally, we expect capital

expenditures to be higher in absolute dollars and remain consistent as a percentage of total revenues in future

periods as a result of continued office build-outs, other leasehold improvements and data center investments.

In the future, we may enter into arrangements to acquire or invest in complementary businesses or joint

ventures, services and technologies, and intellectual property rights. We may be required to seek additional

equity or debt financing. Additional funds may not be available on terms favorable to us or at all.

We believe our existing cash, cash equivalents and short-term marketable securities and cash provided by

operating activities will be sufficient to meet our working capital, capital expenditure and debt repayment needs

over the next 12 months.

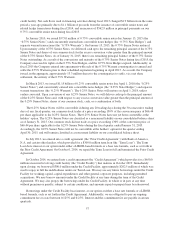

New Accounting Pronouncement

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

No. 2014-09, “Revenue from Contracts with Customers (Topic 606)” (“ASU 2014-09”) which amended the

existing FASB Accounting Standards Codification. This standard establishes a principle for recognizing revenue

upon the transfer of promised goods or services to customers, in an amount that reflects the expected

consideration received in exchange for those goods or services. The standard also provides guidance on the

recognition of costs related to obtaining and fulfilling customer contracts. ASU 2014-09 is effective for fiscal

2018, including interim periods within that reporting period. Early adoption is not permitted. We are currently in

the process of assessing the adoption methodology, which allows the amendment to be applied retrospectively to

each prior period presented, or with the cumulative effect recognized as of the date of initial application. We are

also evaluating the impact of the adoption of ASU 2014-09 on our consolidated financial statements and have not

determined whether the effect will be material to either our revenue results or our deferred commissions

balances.

59