Salesforce.com 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

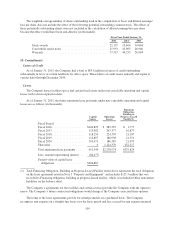

stock that remained available for grant under the 2006 Inducement Equity Incentive Plan (the “Prior Inducement

Plan”) as of July 9, 2014 were added to the 2014 Inducement Plan share reserve and the Prior Inducement Plan

was terminated. Further, any shares of common stock subject to outstanding awards under the Prior Inducement

Plan that expire, are forfeited, or are repurchased by the Company will also become available for future grant

under the 2014 Inducement Plan. Termination of the Prior Inducement Plan did not affect the outstanding awards

previously issued thereunder. The 2014 Inducement Plan was adopted without stockholder approval in reliance

on the “employment inducement exemption” provided under the New York Stock Exchange Listed Company

Manual.

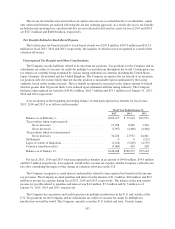

In September 2011, the Company’s Board of Directors amended and restated the ESPP. In conjunction with

the amendment of the ESPP, the Company’s Board of Directors determined that the offerings under the ESPP

would commence, beginning with a twelve month offering period starting in December 2011. As of January 31,

2015, $28.7 million has been withheld on behalf of employees for future purchases under the ESPP and is

recorded in accounts payable, accrued expenses and other liabilities. Employees purchased 3.3 million shares for

$127.8 million and 2.9 million shares for $92.5 million, in fiscal 2015 and 2014, respectively, under the ESPP.

Prior to February 1, 2006, options issued under the Company’s stock option plans generally had a term of 10

years. From February 1, 2006 through July 3, 2013, options issued had a term of five years. After July 3, 2013,

options issued have a term of seven years.

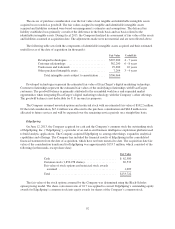

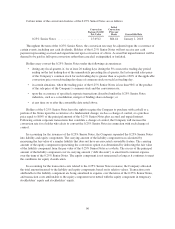

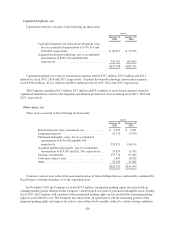

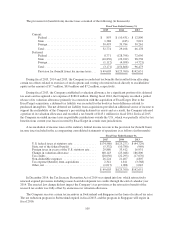

Stock activity excluding the ESPP is as follows:

Options Outstanding

Shares

Available

for Grant

Outstanding

Stock

Options

Weighted-

Average

Exercise Price

Aggregate

Intrinsic Value

(in thousands)

Balance as of January 31, 2014 ...... 55,852,536 28,604,045 $34.26

Increase in shares authorized:

2013 Equity Incentive

Plan .................. 3,943,052 0 0.00

2014 Inducement Equity

Incentive Plan .......... 1,007,381 0 0.00

2011 Relate IQ Plan ....... 291,361 0 0.00

Options granted under all plans . . (9,506,412) 9,506,412 57.87

Restricted stock activity ........ (18,781,110) 0 0.00

Stock grants to board and

advisory board members ...... (226,883) 0 0.00

Exercised ................... 0 (7,307,213) 24.17

Plan shares expired ............ (3,135,270) 0 0.00

Canceled .................... 1,344,883 (1,344,883) 34.80

Balance as of January 31, 2015 ...... 30,789,538 29,458,361 $44.36 $379,380,854

Vested or expected to vest .......... 27,308,293 $43.65 $369,299,016

Exercisable as of January 31, 2015 . . . 11,253,182 $34.37 $248,524,393

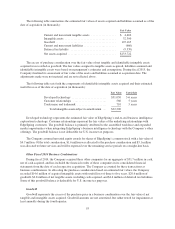

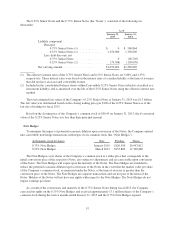

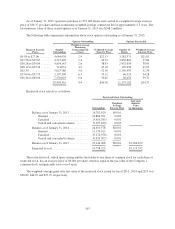

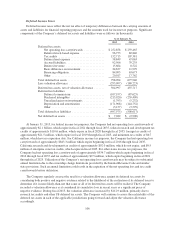

The total intrinsic value of the options exercised during fiscal 2015, 2014 and 2013 was $250.3 million,

$292.3 million and $506.9 million, respectively. The intrinsic value is the difference between the current market

value of the stock and the exercise price of the stock option.

The weighted-average remaining contractual life of vested and expected to vest options is approximately 4.3

years.

102