Salesforce.com 2015 Annual Report Download - page 71

Download and view the complete annual report

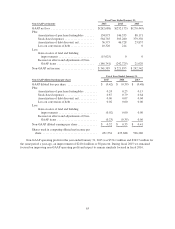

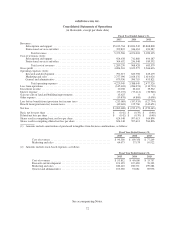

Please find page 71 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) During fiscal 2013, the Company evaluated both positive and negative evidence related to the likelihood of

the realization of the deferred tax assets and determined that the negative evidence outweighed the positive

evidence due to the cumulative GAAP loss in recent years and forecasted future GAAP losses. As a result, a

valuation allowance was established against a significant portion of the deferred tax assets in Q3 fiscal

2013. However, a valuation allowance would not be necessary on a non-GAAP basis given the Company’s

non-GAAP operating income. As a result, the Company excluded its GAAP valuation allowance recorded

during the period when computing its non-GAAP tax expense.

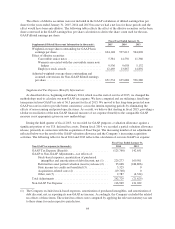

(3) During fiscal 2014, California mandated a change to the way it apportioned income to the state, which

significantly reduced the Company’s California income tax expense. Accordingly, for computing non-

GAAP tax expense, the Company did not recognize tax benefits related to certain California research and

development tax credits as the Company believed these credits may not be realized given the lowered

California income tax expense.

(4) During fiscal 2014, the Company excluded certain tax effects related to acquisitions in computing its non-

GAAP tax expense. The majority of this adjustment was attributable to non-cash tax costs associated with

the transfer of purchased intangibles. This non-cash tax item was excluded because the decisions which

gave rise to these non-cash tax costs were neither made to increase revenue nor directly related to

performance in any particular period, but were made for the Company’s long term benefit over multiple

periods. The remainder of this adjustment included the tax effects of legal and accounting fees incurred to

facilitate transactions, which amount was not material. The related tax effects were computed by applying

the relevant statutory tax rate to these items for each respective jurisdiction.

(5) Other, net included multiple items that were immaterial either on an individual basis or an aggregate basis.

65