Salesforce.com 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.invest for future growth include the continuation of the expansion of our data center capacity, the hiring of

additional personnel, particularly in direct sales, other customer-related areas and research and development, the

expansion of domestic and international selling and marketing activities, specifically in our top markets,

continuing to develop our brands, the addition of distribution channels, the upgrade of our service offerings, the

development of new services such as the announcement of our Analytics Cloud and Community Cloud, the

integration of acquired technologies, the expansion of our Marketing Cloud and Salesforce1 Platform core

service offerings, and the additions to our global infrastructure to support our growth.

We also regularly evaluate acquisitions or investment opportunities in complementary businesses, joint

ventures, services and technologies and intellectual property rights in an effort to expand our service offerings.

We expect to continue to make such investments and acquisitions in the future and we plan to reinvest a

significant portion of our incremental revenue in future periods to grow our business and continue our leadership

role in the cloud computing industry. As a result of our aggressive growth plans, specifically our hiring plan and

acquisition activities, we have incurred significant expenses from equity awards and amortization of purchased

intangibles which have resulted in net losses on a U.S. generally accepted accounting principles (“GAAP”) basis.

As we continue with our growth plan, we may continue to have net losses on a GAAP basis. We remained

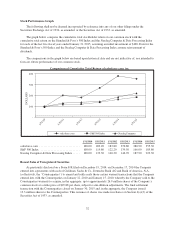

focused on improving operating margins in fiscal 2015 and expect to remain similarly focused in fiscal 2016. Our

operating loss for fiscal 2015 was $145.6 million compared to $286.1 million during the same period a year ago.

Our typical subscription contract term is 12 to 36 months, although terms range from one to 60 months, so

during any fiscal reporting period only a subset of active subscription contracts is eligible for renewal. We

calculate our attrition rate as of the end of each month. Our current attrition rate calculation does not include the

Marketing Cloud service offerings. Our attrition rate was between nine and ten percent during the fiscal year

ended January 31, 2015, which is consistent with the attrition rate as of January 31, 2014. We expect our attrition

rate to remain in this range as we continue to expand our enterprise business and invest in customer success and

related programs.

We expect marketing and sales costs, which were 51 percent of our total revenues for the fiscal year ended

January 31, 2015 and 53 percent for the same period a year ago, to continue to represent a substantial portion of

total revenues in the future as we seek to grow our customer base, sell more products to existing customers, and

build greater brand awareness.

Fiscal Year

Our fiscal year ends on January 31. References to fiscal 2015, for example, refer to the fiscal year ending

January 31, 2015.

Operating Segments

We operate as one operating segment. Operating segments are defined as components of an enterprise for

which separate financial information is evaluated regularly by the chief operating decision maker, who in our

case is the chief executive officer, in deciding how to allocate resources and assess performance. Over the past

few years, we have completed several acquisitions. These acquisitions have allowed us to expand our offerings,

presence and reach in various market segments of the enterprise cloud computing market. While we have

offerings in multiple enterprise cloud computing market segments, our business operates in one operating

segment because all of our offerings operate on a single platform and are deployed in an identical way, and our

chief operating decision maker evaluates our financial information and resources and assesses the performance of

these resources on a consolidated basis. Since we operate as one operating segment, all required financial

segment information can be found in the consolidated financial statements.

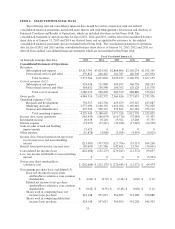

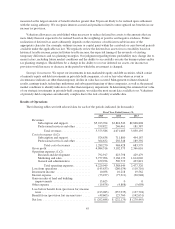

Sources of Revenues

We derive our revenues from two sources: (1) subscription revenues, which are comprised of subscription

fees from customers accessing our enterprise cloud computing services and from customers paying for additional

36