Salesforce.com 2015 Annual Report Download - page 50

Download and view the complete annual report

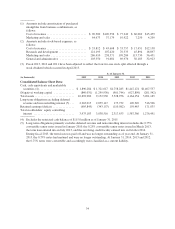

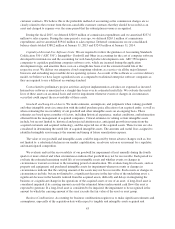

Please find page 50 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.liabilities assumed and pre-acquisition contingencies. We use our best estimates and assumptions to accurately

assign fair value to the tangible and intangible assets acquired and liabilities assumed at the acquisition date.

Examples of critical estimates in valuing certain of the intangible assets and goodwill we have acquired

include but are not limited to:

• future expected cash flows from subscription and support contracts, professional services contracts,

other customer contracts and acquired developed technologies and patents;

• the acquired company’s trade name, trademark and existing customer relationship, as well as

assumptions about the period of time the acquired trade name and trademark will continue to be used in

our offerings;

• uncertain tax positions and tax related valuation allowances assumed; and

• discount rates.

Unanticipated events and circumstances may occur that may affect the accuracy or validity of such

assumptions, estimates or actual results.

Stock-Based Options and Awards. We recognize the fair value of our stock options and awards on a straight-

line basis over the requisite service period of the option or award which is the vesting term of generally four

years for stock options and restricted stock awards and one year for shares issued pursuant to our Employee

Stock Purchase Plan (“ESPP”). The fair value of each option or ESPP share or stock purchase right is estimated

on the date of grant using the Black-Scholes option pricing model. The estimated forfeiture rate applied is based

on historical forfeiture rates. We evaluate the forfeiture rates at least annually, or when events or circumstances

indicate a change may be needed. This may cause a fluctuation in our stock-based expense in the period of

change. Inputs into the Black-Scholes option pricing model include:

• The estimated life for the stock options which is estimated based on an actual analysis of expected life.

The estimated life for shares issued pursuant to our ESPP is based on the two purchase periods within

the 12 month offering period;

• The risk free interest rate which is based on the rate for a U.S. government security with the same

estimated life at the time of the option grant and the stock purchase rights;

• The future stock price volatility which is estimated considering both our observed option-implied

volatilities and our historical volatility calculations. We believe this is the best estimate of the expected

volatility over the expected life of our stock options and stock purchase rights; and

• The probability of performance conditions, if any, that affect the vesting of certain awards being

achieved. Expense is only recognized for those shares expected to vest.

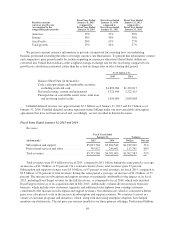

Income Taxes. We use the asset and liability method of accounting for income taxes. Under this method,

deferred tax assets and liabilities are determined based on temporary differences between the financial statement

and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are

expected to reverse. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the

consolidated statements of operations in the period that includes the enactment date. At each of the interim

financial reporting periods, we compute our tax provision by applying an estimated annual effective tax rate to

year to date ordinary income and adjust the provision for discrete tax items recorded in the same period. The

estimated annual effective tax rate at each interim period represents the best estimate based on evaluations of

possible future transactions and may be subject to subsequent refinement or revision.

Our tax positions are subject to income tax audits by multiple tax jurisdictions throughout the world. We

recognize the tax benefit of an uncertain tax position only if it is more likely than not that the position is

sustainable upon examination by the taxing authority, based on the technical merits. The tax benefit recognized is

44