Salesforce.com 2015 Annual Report Download - page 67

Download and view the complete annual report

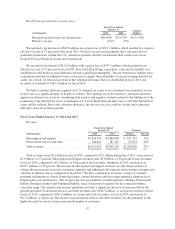

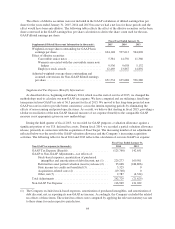

Please find page 67 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•Non-Cash Gains/Losses on Conversions of Debt. Upon settlement of the Company’s convertible senior

notes, we attribute the fair value of the consideration transferred to the liability and equity components

of the convertible senior notes. The difference between the fair value of consideration attributed to the

liability component and the carrying value of the liability as of settlement date is recorded as a non-

cash gain or loss on the statement of operations. Management believes that the exclusion of the non-

cash gain/loss provides investors an enhanced view of the company’s operational performance.

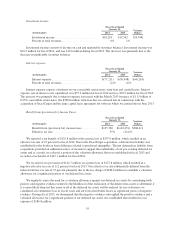

•Gain on sales of land and building improvements. The Company views the non-operating gains

associated with the sales of the land and building improvements to be a discrete item. Management

believes that the exclusion of the gains provides investors an enhanced view of the Company’s

operational performance.

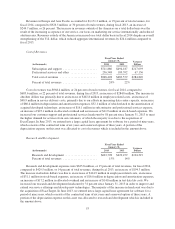

•Income Tax Effects and Adjustments. During fiscal 2014, the Company’s non-GAAP tax provision

excluded the tax effects of expense items described above and certain tax items not directly related to

the current fiscal year’s ordinary operating results. Examples of such tax items included, but are not

limited to, changes in the valuation allowance related to deferred tax assets, certain acquisition-related

costs and unusual or infrequently occurring items. Management believes the exclusion of these income

tax adjustments provides investors with useful supplemental information about the Company’s

operational performance. During fiscal 2015, the Company began to compute and utilize a fixed long-

term projected non-GAAP tax rate in order to provide better consistency across the interim reporting

periods by eliminating the effects of non-recurring and period-specific items such as changes in the tax

valuation allowance and tax effects of acquisitions-related costs, since each of these items can vary in

size and frequency. When projecting this long-term rate, the Company evaluated a three-year financial

projection that excludes the impact of the following items: Stock-Based Expenses, Amortization of

Purchased Intangibles, Amortization of Debt Discount, Gains/Losses on Conversions of Debt, and

Gains/Losses on sales of land and building improvements. The projected rate also assumes no new

acquisitions in the three-year period, and takes into account other factors including the Company’s

current tax structure, its existing tax positions in various jurisdictions and key legislation in major

jurisdictions where the Company operates. The non-GAAP tax rate for fiscal 2015 is 36.5%. The

Company intends to re-evaluate this long-term rate on an annual basis or if any significant events that

may materially affect this long-term rate occur. This long-term rate could be subject to change for a

variety of reasons, for example, significant changes in the geographic earnings mix including

acquisition activity, or fundamental tax law changes in major jurisdictions where the Company

operates.

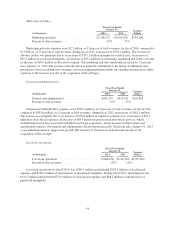

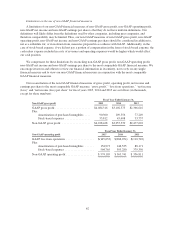

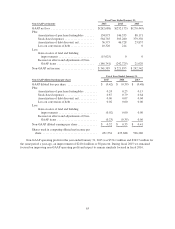

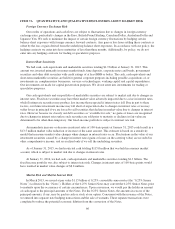

We define non-GAAP gross profit as our total revenues less cost of revenues, as reported on our

consolidated statement of operations, excluding the portions of stock-based expenses and amortization of

purchased intangibles that are included in cost of revenues.

We define non-GAAP operating profit as our non-GAAP gross profit less operating expenses, as reported

on our consolidated statement of operations, excluding the portions of stock-based expenses and amortization of

purchased intangibles that are included in operating expenses.

Non-GAAP earnings per share

Management uses the non-GAAP earnings per share to provide an additional view of performance by

excluding items that are not directly related to performance in any particular period in the earnings per share

calculation.

We define non-GAAP earnings per share as our non-GAAP net income, which excludes the above

components, which we believe are not reflective of our ongoing operational expenses, divided by basic or diluted

shares outstanding.

61