Salesforce.com 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

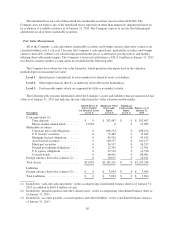

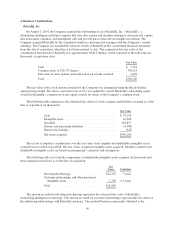

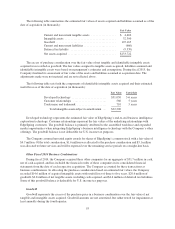

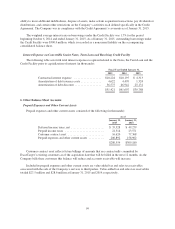

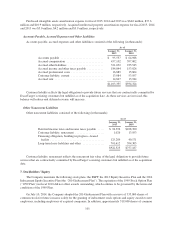

The expected future amortization expense for purchased intangible assets as of January 31, 2015 is as

follows (in thousands):

Fiscal Period:

Fiscal 2016 ....................................... $154,776

Fiscal 2017 ....................................... 125,144

Fiscal 2018 ....................................... 114,041

Fiscal 2019 ....................................... 100,533

Fiscal 2020 ....................................... 73,191

Thereafter ........................................ 64,507

Total amortization expense .......................... $632,192

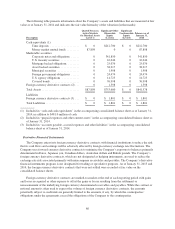

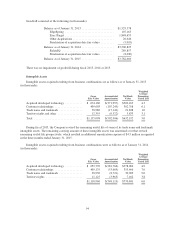

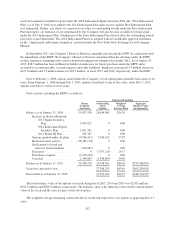

5. Debt

Convertible Senior Notes

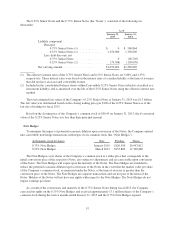

(In thousands)

Par Value

Outstanding

Equity

Component

Recorded

at Issuance

Liability Component of Par

Value as of January 31,

2015 2014

0.75% Convertible Senior Notes due

January 15, 2015 .................... $ 0 $125,530(1) $ 0 $ 542,159

0.25% Convertible Senior Notes due April 1,

2018 .............................. 1,150,000 122,421(2) 1,070,692 1,046,930

(1) This amount represents the equity component recorded at the initial issuance of the 0.75% convertible senior

notes.

(2) This amount represents the equity component recorded at the initial issuance of the 0.25% convertible senior

notes.

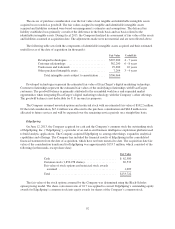

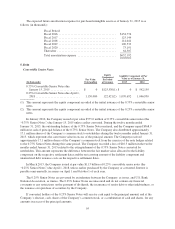

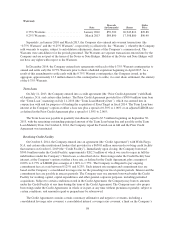

In January 2010, the Company issued at par value $575.0 million of 0.75% convertible senior notes (the

“0.75% Senior Notes”) due January 15, 2015 unless earlier converted. During the twelve months ended

January 31, 2015, the outstanding balance of the 0.75% Senior Notes matured, and the Company repaid $568.9

million in cash of principal balance of the 0.75% Senior Notes. The Company also distributed approximately

17.1 million shares of the Company’s common stock to noteholders during the twelve months ended January 31,

2015, which represents the conversion value in excess of the principal amount. The Company received

approximately 17.1 million shares of the Company’s common stock from the exercise of the note hedges related

to the 0.75% Senior Notes during this same period. The Company recorded a loss of $10.3 million in the twelve

months ended January 31, 2015 related to the extinguishment of the 0.75% Senior Notes converted by

noteholders. This amount represents the difference between the fair market value allocated to the liability

component on the respective settlement dates and the net carrying amount of the liability component and

unamortized debt issuance costs on the respective settlement dates.

In March 2013, the Company issued at par value $1.15 billion of 0.25% convertible senior notes (the

“0.25% Senior Notes”) due April 1, 2018, unless earlier purchased by the Company or converted. Interest is

payable semi-annually, in arrears on April 1 and October 1 of each year.

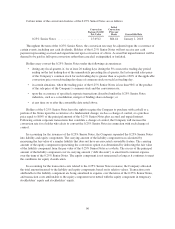

The 0.25% Senior Notes are governed by an indenture between the Company, as issuer, and U.S. Bank

National Association, as trustee. The 0.25% Senior Notes are unsecured and do not contain any financial

covenants or any restrictions on the payment of dividends, the incurrence of senior debt or other indebtedness, or

the issuance or repurchase of securities by the Company.

If converted, holders of the 0.25% Senior Notes will receive cash equal to the principal amount, and at the

Company’s election, cash, shares of the Company’s common stock, or a combination of cash and shares, for any

amounts in excess of the principal amounts.

95