Salesforce.com 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

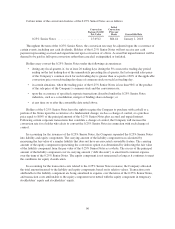

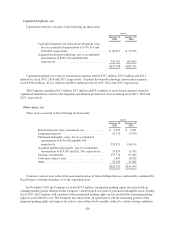

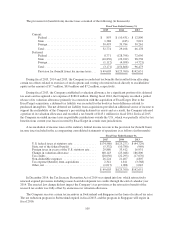

Deferred Income Taxes

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amounts of

assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant

components of the Company’s deferred tax assets and liabilities were as follows (in thousands):

As of January 31,

2015 2014

Deferred tax assets:

Net operating loss carryforwards .............. $252,858 $ 259,465

Deferred stock-based expense ................ 96,753 82,840

Tax credits ............................... 152,715 107,381

Deferred rent expense ....................... 58,849 47,063

Accrued liabilities .......................... 92,506 79,235

Deferred revenue .......................... 15,664 8,522

Basis difference on investment ................ 24,637 11,999

Financing obligation ........................ 84,095 63,673

Other .................................... 20,017 17,762

Total deferred tax assets ......................... 798,094 677,940

Less valuation allowance ........................ (293,097) (180,223)

Deferred tax assets, net of valuation allowance ....... 504,997 497,717

Deferred tax liabilities:

Deferred commissions ...................... (107,197) (87,625)

Purchased intangibles ....................... (213,920) (259,409)

Unrealized gains on investments .............. (1,793) (5,232)

Depreciation and amortization ................ (171,908) (144,752)

Other .................................... (3,157) (3,599)

Total deferred tax liabilities ...................... (497,975) (500,617)

Net deferred tax assets .......................... $ 7,022 $ (2,900)

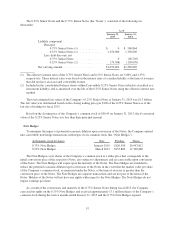

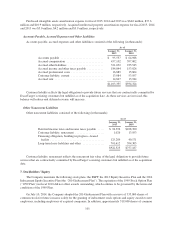

At January 31, 2015, for federal income tax purposes, the Company had net operating loss carryforwards of

approximately $2.1 billion, which expire in fiscal 2021 through fiscal 2035, federal research and development tax

credits of approximately $110.6 million, which expire in fiscal 2020 through fiscal 2035, foreign tax credits of

approximately $21.5 million, which expire in fiscal 2019 through fiscal 2025, and minimum tax credits of $0.7

million, which have no expiration date. For California income tax purposes, the Company had net operating loss

carryforwards of approximately $843.3 million which expire beginning in fiscal 2016 through fiscal 2035,

California research and development tax credits of approximately $92.0 million, which do not expire, and $9.5

million of enterprise zone tax credits, which expire in fiscal 2025. For other states income tax purposes, the

Company had net operating loss carryforwards of approximately $934.7 million which expire beginning in fiscal

2016 through fiscal 2035 and tax credits of approximately $9.5 million, which expire beginning in fiscal 2021

through fiscal 2025. Utilization of the Company’s net operating loss carryforwards may be subject to substantial

annual limitation due to the ownership change limitations provided by the Internal Revenue Code and similar

state provisions. Such an annual limitation could result in the expiration of the net operating loss and tax credit

carryforwards before utilization.

The Company regularly assesses the need for a valuation allowance against its deferred tax assets by

considering both positive and negative evidence related to the likelihood of the realization of its deferred taxes to

determine if it is more-likely-than-not that some or all of its deferred tax assets will be realized. The Company

recorded a valuation allowance as it considered its cumulative loss in recent years as a significant piece of

negative evidence. During fiscal 2015, the valuation allowance increased by $112.9 million, primarily due to

research tax credits and other US deferred tax assets. The Company will continue to assess the realizability of the

deferred tax assets in each of the applicable jurisdictions going forward and adjust the valuation allowance

accordingly.

106