Salesforce.com 2015 Annual Report Download - page 116

Download and view the complete annual report

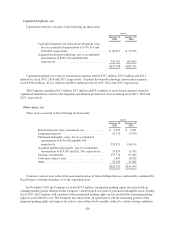

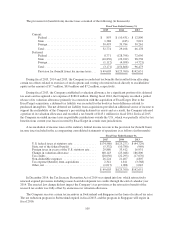

Please find page 116 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.but not paid. Of the total operating lease commitment balance of $2.3 billion, approximately $2.0 billion is

related to facilities space. The remaining commitment amount is related to computer equipment, other leases,

data center capacity and our development and test data center.

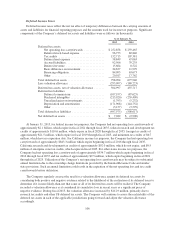

In April 2014, the Company entered into an office lease agreement to lease approximately 714,000 rentable

square feet of an office building located in San Francisco, California that is under construction. The lease

payments associated with the lease will be approximately $560.0 million over the 15.5 year term of the lease,

beginning in the Company’s first quarter of fiscal 2018, which is reflected above under Operating Leases.

In February 2015, the Company acquired an office building totaling approximately 817,000 rentable square

feet. As of January 31, 2015, approximately 500,000 square feet of the building was being leased by the

Company (see Note 14 “Subsequent Event”). The lease, which was signed in January 2012, is reflected above

under Operating Leases, and the commitment totals $238.5 million. The operating lease commitment is as

follows: $16.1 million during fiscal 2016; $16.6 million during fiscal 2017; $17.1 million during fiscal 2018;

$17.6 million during fiscal 2019; $18.1 million during fiscal 2020; and $153.0 million thereafter. Beginning in

the quarter ending April 30, 2015, this commitment will be excluded from future operating lease obligations.

Rent expense for fiscal 2015, 2014 and 2013 was $162.8 million, $123.6 million and $88.3 million,

respectively.

In December 2014, the Company entered into an agreement with a third party provider under which the

Company will purchase certain infrastructure services for three years. The agreement provides that the Company

will pay $33.0 million in fiscal 2016 and $36.0 million in both fiscal 2017 and 2018 for infrastructure services

under the agreement.

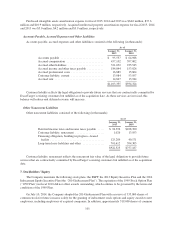

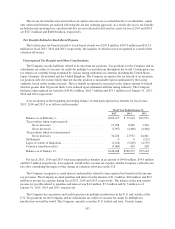

11. Employee Benefit Plan

The Company has a 401(k) plan covering all eligible employees in the United States and Canada. Since

January 1, 2006, the Company has been contributing to the plan. Total Company contributions during fiscal

2015, 2014 and 2013, were $38.1 million, $27.9 million and $22.1 million, respectively.

12. Legal Proceedings and Claims

In the ordinary course of business, the Company is or may be involved in various legal proceedings and

claims related to alleged infringement of third-party patents and other intellectual property rights, commercial,

corporate and securities, labor and employment, class actions, wage and hour, and other claims. The Company

has been, and may in the future be, put on notice and/or sued by third parties for alleged infringement of their

proprietary rights, including patent infringement.

During fiscal 2015, the Company received a communication from a large technology company alleging that

the Company infringed certain of its patents. The Company continues to analyze this claim. No litigation has

been filed to date. There can be no assurance that this claim will not lead to litigation in the future. The resolution

of this claim is not expected to have a material adverse effect on the Company’s financial condition, but it could

be material to the net income or cash flows or both of a particular quarter.

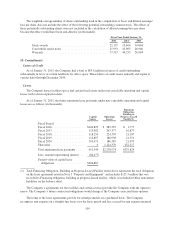

In general, the resolution of a legal matter could prevent the Company from offering its service to others,

could be material to the Company’s financial condition or cash flows, or both, or could otherwise adversely

affect the Company’s operating results.

The Company makes a provision for a liability relating to legal matters when it is both probable that a

liability has been incurred and the amount of the loss can be reasonably estimated. These provisions are reviewed

at least quarterly and adjusted to reflect the impacts of negotiations, estimated settlements, legal rulings, advice

of legal counsel and other information and events pertaining to a particular matter. In management’s opinion,

110