Salesforce.com 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Enterprise Edition and Unlimited Edition, varies from period to period, but has remained within a consistent

range over the past eight quarters. Changes in the net price per user per month has not been a significant driver of

revenue growth for the periods presented. Professional services and other revenues were $359.8 million, or seven

percent of total revenues, for fiscal 2015, compared to $246.5 million, or six percent of total revenues, for the

same period a year ago, an increase of $113.4 million, or 46 percent. The increase in professional services and

other revenues was primarily attributable to the impact of, in fiscal 2015, including ExactTarget revenue for the

full fiscal year, as compared to fiscal 2014, which only included ExactTarget revenue as of its acquisition date in

July 2013.

Revenues in Europe and Asia Pacific accounted for $1,505.3 million, or 28 percent of total revenues, for

fiscal 2015, compared to $1,171.2 million, or 29 percent of total revenues, during the same period a year ago, an

increase of $334.1 million, or 29 percent. The increase in revenues on a total dollar basis outside of the Americas

was the result of the increasing acceptance of our service, our focus on marketing our services internationally,

additional resources and consistent attrition rates as a result of the reasons stated above. Revenues outside of the

Americas increased on a total dollar basis in fiscal 2015 despite an overall strengthening of the U.S. dollar, which

reduced aggregate international revenues by $31.5 million compared to the same period a year ago. We expect

revenues outside of the Americas to continue to be negatively impacted in fiscal 2016 by the strengthening of the

U.S. dollar relative to the Euro, Japanese yen, Australian dollar and British pound.

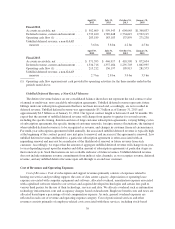

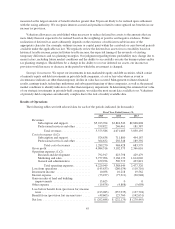

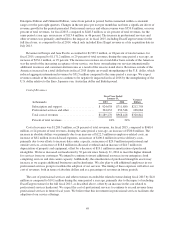

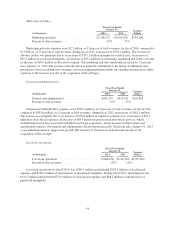

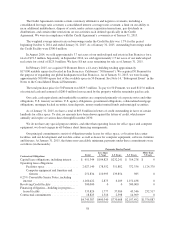

Cost of Revenues.

Fiscal Year Ended

January 31, Variance

Dollars(in thousands) 2015 2014

Subscription and support ...................... $ 924,638 $711,880 $212,758

Professional services and other ................. 364,632 256,548 108,084

Total cost of revenues ........................ $1,289,270 $968,428 $320,842

Percent of total revenues ...................... 24% 24%

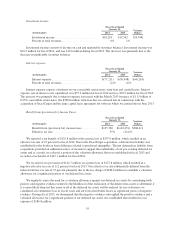

Cost of revenues was $1,289.3 million, or 24 percent of total revenues, for fiscal 2015, compared to $968.4

million, or 24 percent of total revenues, during the same period a year ago, an increase of $320.8 million. The

increase in absolute dollars was primarily due to an increase of $122.3 million in employee-related costs, an

increase of $8.2 million in stock-based expenses, an increase of $100.6 million in service delivery costs,

primarily due to our efforts to increase data center capacity, an increase of $29.9 million in professional and

outside services, an increase of $18.8 million in allocated overhead and an increase of $44.7 million in

depreciation of property and equipment, offset by a decrease of $19.1 million in amortization of purchased

intangibles. We have increased our headcount by 30 percent since January 31, 2014 to meet the higher demand

for services from our customers. We intend to continue to invest additional resources in our enterprise cloud

computing services and data center capacity. Additionally, the amortization of purchased intangible assets may

increase as we acquire additional businesses and technologies. We also plan to add additional employees in our

professional services group to facilitate the adoption of our services. The timing of these expenses will affect our

cost of revenues, both in terms of absolute dollars and as a percentage of revenues in future periods.

The cost of professional services and other revenues exceeded the related revenue during fiscal 2015 by $4.8

million as compared to $10.1 million during the same period a year ago, primarily due to the impact of including

ExactTarget revenue for the full fiscal 2015, as described above, offset by an increase in the cost related to

professional services headcount. We expect the cost of professional services to continue to exceed revenue from

professional services in future fiscal years. We believe that this investment in professional services facilitates the

adoption of our service offerings.

49