Neiman Marcus 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

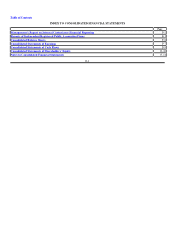

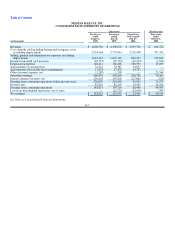

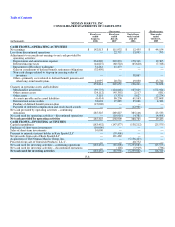

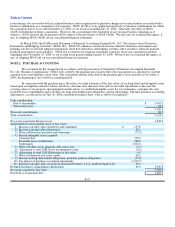

NEIMAN MARCUS, INC.

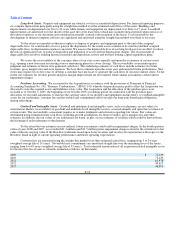

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

Common Accumulated

stocks Additional other Total

(in thousands)

Class

A

Class

B

paid-in

capital

comprehensive

income (loss)

Retained

earnings

Treasury

stock

shareholders'

equity

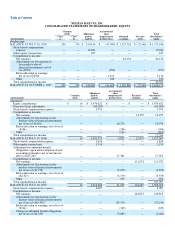

Predecessor:

BALANCE AT JULY 30, 2005 298 199 $ 520,414 $ (47,030) $ 1,125,726 $ (25,661) $ 1,573,946

Stock based compensation

expense — — 19,032 — — — 19,032

Other equity transactions — — 637 — — — 637

Comprehensive income:

Net earnings — — — — 44,154 — 44,154

Adjustments for fluctuations in

fair market value of

financial instruments, net of

tax ($593) — — — (950) — — (950)

Reclassification to earnings,

net of tax of $706 — — — 1,114 — — 1,114

Other — — — 246 — — 246

Total comprehensive income 44,564

BALANCE AT OCTOBER 1, 2005 298 199 $ 540,083 $ (46,620)$ 1,169,880 $ (25,661)$ 1,638,179

(in thousands)

Common

stock

Additional

paid-in

capital

Accumulated

other

comprehensive

income (loss)

Retained

earnings

Total

shareholders'

equity

Successor:

Equity contributions $ 10 $ 1,470,622 $ — $ — $ 1,470,632

Carryover basis adjustment — (69,200) — — (69,200)

Stock based compensation expense — 3,951 — — 3,951

Comprehensive income:

Net earnings — — — 12,455 12,455

Adjustments for fluctuations in fair

market value of financial instruments,

net of tax of $6,696 — — 10,276 — 10,276

Reclassification to earnings, net of tax of

($186) — — (286) — (286)

Other — — (161) — (161)

Total comprehensive income 22,284

BALANCE AT JULY 29, 2006 10 1,405,373 9,829 12,455 1,427,667

Stock based compensation expense — 5,859 — — 5,859

Other equity transactions — 1,154 — — 1,154

Adjustment for unfunded benefit

obligations (upon initial adoption of new

accounting principle), net of income tax

effect of $11,289 — — 17,365 — 17,365

Comprehensive income:

Net earnings — — — 111,932 111,932

Adjustments for fluctuations in fair

market value of financial instruments,

net of tax of ($1,758) — — (2,678) — (2,678)

Reclassification to earnings, net of tax of

($2,327) — — (3,579) — (3,579)

Other — — 292 — 292

Total comprehensive income 105,967

BALANCE AT JULY 28, 2007 10 1,412,386 21,229 124,387 1,558,012

Stock based compensation expense — 6,087 — — 6,087

Comprehensive income:

Net earnings — — — 142,813 142,813

Adjustments for fluctuations in fair

market value of financial instruments,

net of tax of ($16,355) — — (25,159) — (25,159)

Reclassification to earnings, net of tax of

($214) — — (329) — (329)

Change in unfunded benefit obligations,

net of tax of ($3,239) — — (5,063) — (5,063)