Neiman Marcus 2007 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

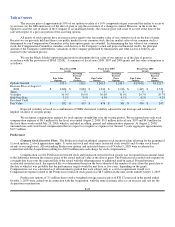

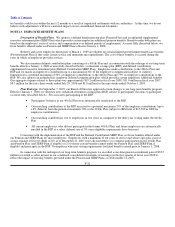

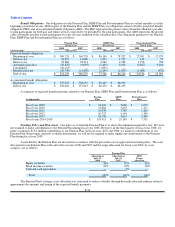

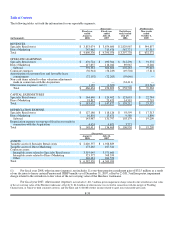

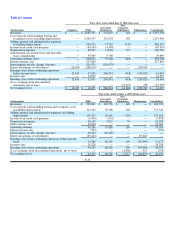

Assumptions. Significant assumptions related to the calculation of our obligations pursuant to our employee benefit plans

include the discount rate used to calculate the present value of benefit obligations to be paid in the future, the expected long-term rate

of return on assets held by the Pension Plan, the average rate of compensation increase by Pension Plan and SERP Plan participants

and the health care cost trend rate for the Postretirement Plan. We review these assumptions annually based upon currently available

information. The assumptions we utilized in calculating the projected benefit obligations and periodic expense of our Pension Plan,

SERP Plan and Postretirement Plan are as follows:

July 31,

2008

July 31,

2007

July 31,

2006

October 1,

2005

Pension Plan:

Discount rate 6.75% 6.25% 6.25% 5.75%

Expected long-term rate of return on

plan assets 8.00% 8.00% 8.00% 8.00%

Rate of future compensation

increase 4.50% 4.50% 4.50% 4.50%

SERP Plan:

Discount rate 6.75% 6.25% 6.25% 5.75%

Rate of future compensation

increase 4.50% 4.50% 4.50% 4.50%

Postretirement Plan:

Discount rate 6.75% 6.25% 6.25% 5.75%

Initial health care cost trend rate 8.00% 8.00% 8.00% 8.00%

Ultimate health care cost trend rate 8.00% 8.00% 5.00% 5.00%

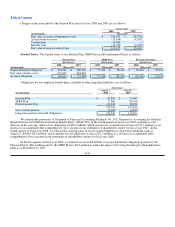

Discount rate. The assumed discount rate utilized is based on a broad sample of Moody's high quality corporate bond yields

as of the measurement date. The projected benefit payments are matched with the yields on these bonds to determine an appropriate

discount rate for the plan. The discount rate is utilized principally in calculating the present value of our pension obligation and net

pension expense. As a result of the increase in the discount rate from 6.25% at July 31, 2007 to 6.75% at July 31, 2008, the projected

benefit obligations related to our employee benefit plans decreased approximately $32.3 million.

The estimated effect of a 0.25% decrease in the discount rate would increase the Pension Plan obligation by $12.9 million,

increase the SERP Plan obligation by $2.4 million and increase the Postretirement Plan obligation by $0.7 million. The estimated

effect of a 0.25% decrease in the discount rate would increase the annual Pension Plan expense by $0.2 million and increase the SERP

Plan annual expense and the Postretirement Plan annual expense by an immaterial amount.

Expected long-term rate of return on plan assets. The assumed expected long-term rate of return on assets is the weighted

average rate of earnings expected on the funds invested or to be invested to provide for the pension obligation. During fiscal year

2008, we utilized 8.0% as the expected long-term rate of return on plan assets. We periodically evaluate the allocation between

investment categories of the assets held by the Pension Plan. We estimate the expected average long-term rate of return on assets

based on our future asset performance expectations using currently available market and other data and the counsel of our outside

actuaries and advisors. This rate is utilized primarily in calculating the expected return on plan assets component of the annual pension

expense. To the extent the actual rate of return on assets realized over the course of a year is greater than the assumed rate, that year's

annual pension expense is not affected. Rather this gain reduces future pension expense over a period of approximately 10 to 16 years.

To the extent the actual rate of return on assets is less than the assumed rate, that year's annual pension expense is likewise not

affected. Rather this loss increases pension expense over approximately 10 to 16 years.

Rate of future compensation increase. The assumed average rate of compensation increase is the average annual

compensation increase expected over the remaining employment periods for the participating employees. We utilized a rate of 4.5%

for fiscal year 2008. This rate is utilized principally in calculating the obligation and annual expense for the Pension and SERP Plans.

The estimated effect of a 0.25% increase in the assumed rate of compensation increase would increase the projected benefit obligation

for the Pension Plan by $0.5 million and increase the SERP Plan projected benefit obligation by $0.4 million. The estimated effect of

a 0.25% increase in the assumed rate of compensation increase would increase annual Pension Plan expense by $0.1 million and

increase the SERP Plan annual expense by an immaterial amount.

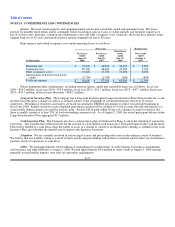

Health care cost trend rate. The assumed health care cost trend rate represents our estimate of the annual rates of change in

the costs of the health care benefits currently provided by the Postretirement Plan. The health care cost trend rate implicitly considers

estimates of health care inflation, changes in health care utilization and delivery patterns, technological advances and changes in the

health status of the plan participants. We utilized a health care cost trend rate of 8% as of July 31, 2008, remaining constant over time

to yield an ultimate health care cost trend rate of 8%. If the assumed health care cost trend rate were increased one percentage point,

Postretirement Plan costs for fiscal year 2008 would have been $0.2 million higher and the accumulated postretirement benefit

obligation as of August 2, 2008 would have been $2.5 million higher. If the assumed health care trend rate were decreased one

percentage point, Postretirement Plan costs for 2008 would have been $0.2 million lower and the accumulated postretirement benefit

obligation as of August 2, 2008 would have been $2.1 million lower.

F-36