Neiman Marcus 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

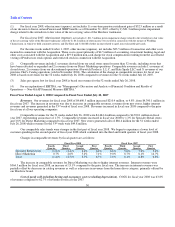

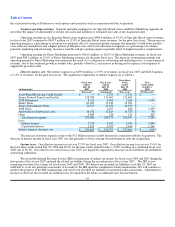

of $4.5 million of accounting, investment banking, legal and other costs associated with the Acquisition and a $19.0 million

non-cash charge for stock compensation resulting from the accelerated vesting of Predecessor stock options and restricted

stock in connection with the Acquisition.

Inflation and Deflation

We believe changes in revenues and net earnings that have resulted from inflation or deflation have not been material during

the periods presented. In recent years, we have experienced certain inflationary conditions related to 1) increases in product costs due

primarily to changes in foreign currency exchange rates that have reduced the purchasing power of the U.S. dollar and 2) increases in

SG&A. We purchase a substantial portion of our inventory from foreign suppliers whose costs are affected by the fluctuation of their

local currency against the dollar or who price their merchandise in currencies other than the dollar. Fluctuations in the Euro-U.S.

dollar exchange rate affect us most significantly; however, we source goods from numerous countries and thus are affected by changes

in numerous currencies and, generally, by fluctuations in the U.S. dollar relative to such currencies. Accordingly, changes in the value

of the dollar relative to foreign currencies may increase our cost of goods sold and if we are unable to pass such cost increases to our

customers, our gross margins, and ultimately our earnings, would decrease. Foreign currency fluctuations could have a material

adverse effect on our business, financial condition and results of operations in the future. We attempt to offset the effects of inflation

through price increases and control of expenses, although our ability to increase prices may be limited by competitive factors. We

attempt to offset the effects of merchandise deflation, which has occurred on a limited basis in recent years, through control of

expenses. There is no assurance, however, that inflation or deflation will not materially affect our operations in the future.

LIQUIDITY AND CAPITAL RESOURCES

Our cash requirements consist principally of:

• the funding of our merchandise purchases;

• capital expenditures for new store construction, store renovations and upgrades of our management information systems;

• debt service requirements;

• income tax payments; and

• obligations related to our Pension Plan.

Our primary sources of short-term liquidity are comprised of cash on hand and availability under our Asset-Based Revolving

Credit Facility. The amounts of cash on hand and borrowings under the Asset-Based Revolving Credit Facility are influenced by a

number of factors, including revenues, working capital levels, vendor terms, the level of capital expenditures, cash requirements

related to financing instruments and debt service obligations, Pension Plan funding obligations and tax payment obligations, among

others.

Our working capital requirements fluctuate during the fiscal year, increasing substantially during the first and second quarters

of each fiscal year as a result of higher seasonal levels of inventories. We have typically financed the increases in working capital

needs during the first and second fiscal quarters with available cash balances, cash flows from operations and, if necessary, with cash

provided from borrowings under our credit facilities. In fiscal years 2008 and 2007, we have made no borrowings under our Asset-

Based Revolving Credit Facility.

We believe that operating cash flows, available vendor financing and amounts available pursuant to our senior secured Asset-

Based Revolving Credit Facility will be sufficient to fund our operations, anticipated capital expenditure requirements, debt service

obligations, contractual obligations and commitments and Pension Plan funding requirements through the end of fiscal year 2009.

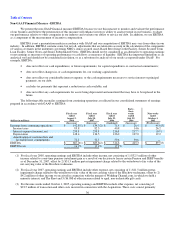

At August 2, 2008, cash and cash equivalents were $239.2 million compared to $141.2 million at July 28, 2007. Net cash

provided by operating activities was $285.3 million in fiscal year 2008 compared to $258.9 million in fiscal year 2007. Cash flows

provided by operating activities were higher in fiscal year 2008 than in the prior fiscal year primarily due to:

37