Neiman Marcus 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

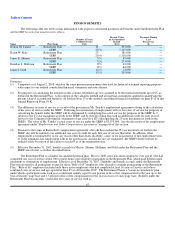

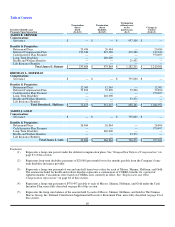

The SERP is an unfunded, nonqualified plan under which benefits are paid from our general assets to supplement Retirement

Plan benefits and Social Security. Prior to 2008, executive, administrative and professional employees (other than those employed as

salespersons) with an annual base salary at least equal to a minimum established by the Company ($160,000 as of July 28, 2007) were

eligible to participate. Similar to the Retirement Plan, effective December 31, 2007, eligibility and benefit accruals under the SERP

were frozen for all participants except for those "Rule of 65" employees who elected to continue participating in the Retirement Plan.

At normal retirement age (age 65), a participant with 25 or more years of service is entitled to payments under the SERP sufficient to

bring his or her combined annual benefit from the Retirement Plan and SERP, computed as a straight life annuity, up to 50 percent of

the participant's highest consecutive 60 month average of annual pensionable earnings, less 60 percent of his or her estimated annual

primary Social Security benefit. If the participant has fewer than 25 years of service, the combined benefit is proportionately reduced.

Benefits under the SERP become fully vested after five years of service with us. The SERP is designed to comply with the

requirements of Section 409A of the Internal Revenue Code.

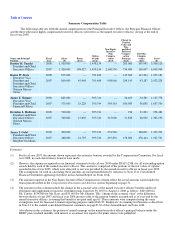

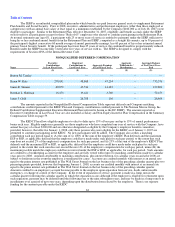

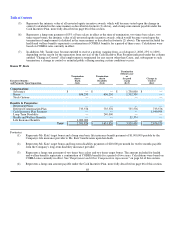

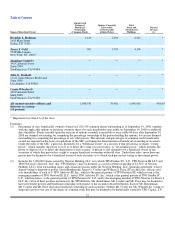

NONQUALIFIED DEFERRED COMPENSATION

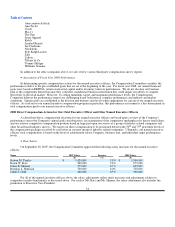

Name

Executive

Contributions

in Last Fiscal Year

Registrant

Contributions in

Last Fiscal Year

Aggregate Earnings

in Last Fiscal Year

Aggregate

Withdrawals /

Distributions

Aggregate Balance

at Last Fiscal Year-

End

($) ($) ($) ($) ($)

Burton M. Tansky — — — — —

Karen W. Katz 278,841 48,868 47,234 — 735,576

James E. Skinner 69,078 47,534 14,185 — 239,864

Brendan L. Hoffman 16,470 19,421 3,769 — 72,455

James J. Gold — 26,708 156 — 26,864

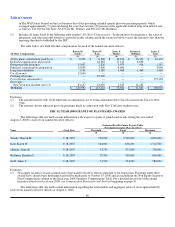

The amounts reported in the Nonqualified Deferred Compensation Table represent deferrals and Company matching

contributions credited pursuant to the KEDC Plan and Company contributions credited pursuant to The Neiman Marcus Group, Inc.

Defined Contribution Supplemental Executive Retirement Plan (referred to herein as the DC SERP). The amounts reported as

Executive Contributions in Last Fiscal Year are also included as Salary and Non-Equity Incentive Plan Compensation in the Summary

Compensation Table on page 59.

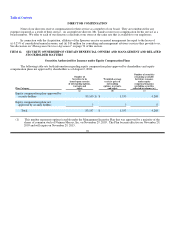

The KEDC Plan allows eligible employees to elect to defer up to 15% of base pay and up to 15% of annual performance

bonus each year. Eligible employees generally are those employees who have completed one year of service with the Company, have

annual base pay of at least $300,000 and are otherwise designated as eligible by the Company's employee benefits committee;

provided, however, that effective January 1, 2008, only those persons who were eligible for the KEDC as of January 1, 2007 are

permitted to continue participating in the KEDC. No new participants will be added. The Company also credits a matching

contribution each pay period equal to (A) the sum of (i) 100% of the sum of the employee's KEDC Plan deferrals and the maximum

ESP or RSP, as applicable, deferral that the employee could have made under such plan for such pay period, to the extent that such

sum does not exceed 2% of the employee's compensation for such pay period, and (ii) 25% of the sum of the employee's KEDC Plan

deferrals and the maximum ESP or RSP, as applicable, deferral that the employee could have made under such plan for such pay

period, to the extent that such sum does not exceed the next 4% of the employee's compensation for such pay period, minus (B) the

maximum possible match the employee could have received under the ESP or RSP, as applicable, for such pay period. Such amounts

are credited to a bookkeeping account for the employee and are fully vested with respect to matching contributions made for calendar

years prior to 2008. Amounts attributable to matching contributions, plus interest thereon, for calendar years on and after 2008 are

subject to forfeiture in the event the employee is terminated for cause. Accounts are credited monthly with interest at an annual rate

equal to the prime interest rate published in The Wall Street Journal on the last business day of the preceding calendar quarter plus two

percentage points provided, however that beginning January 1, 2008, accounts are credited monthly with interest at an annual rate

equal to the prime interest rate published in The Wall Street Journal on the last business day of the preceding calendar quarter.

Amounts credited to an employee's account become payable to the employee upon separation from service, death, unforeseeable

emergency, or change of control of the Company. In the event of separation of service, payment is made in a lump sum in the

calendar quarter following the calendar quarter in which the separation occurs although if the employee is eligible for retirement upon

such separation, payment may be deferred until the following year or the nine subsequent years, and may be made in a lump sum or in

installments over a period of up to ten years, depending upon the distribution form elected by the employee. There is no separate

funding for the amounts payable under the KEDC

63