Neiman Marcus 2007 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

tax benefits could occur within the next 12 months as a result of negotiated settlements with tax authorities. At this time, we do not

believe such adjustments will have a material impact on our consolidated financial statements.

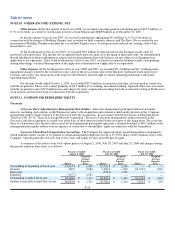

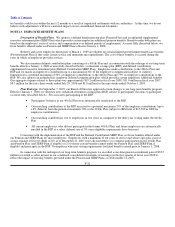

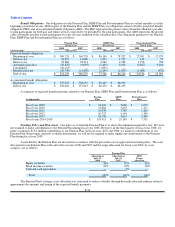

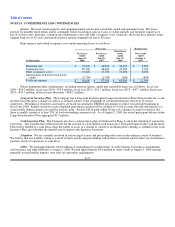

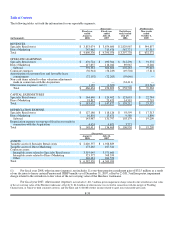

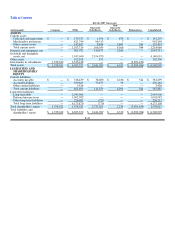

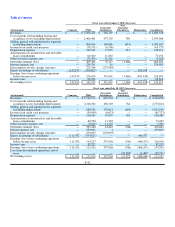

NOTE 13. EMPLOYEE BENEFIT PLANS

Description of Benefit Plans. We sponsor a defined benefit pension plan (Pension Plan) and an unfunded supplemental

executive retirement plan (SERP Plan) which provides certain employees additional pension benefits. Benefits under both plans are

based on the employees' years of service and compensation over defined periods of employment. As more fully described below, we

froze benefits offered under our Pension and SERP Plans effective January 1, 2008.

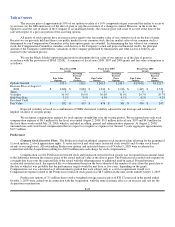

Retirees and active employees hired prior to March 1, 1989 are eligible for certain limited postretirement health care benefits

(Postretirement Plan) if they meet certain service and minimum age requirements. The cost of these benefits is accrued during the

years in which an employee provides services.

We also maintain defined contribution plans consisting of a 401(k) Plan and, in connection with the redesign of our long-term

benefits effective January 1, 2008 as more fully described below, a retirement savings plan (RSP) and defined contribution

supplemental executive retirement plan (Defined Contribution SERP Plan). Employees make contributions to the 401(k) Plan and

RSP and we match an employee's contribution up to a maximum of 6% of the employee's compensation subject to statutory

limitations for a potential maximum of 50% of employee contributions to the 401(k) Plan and 75% of employee contributions to the

RSP. We also sponsor an unfunded key employee deferred compensation plan, which provides certain employees additional benefits.

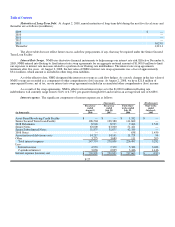

Our aggregate expense related to these plans was approximately $19.2 million in fiscal year 2008, $11.0 million in fiscal year 2007,

$8.7 million for the forty-three weeks ended July 29, 2006 and $1.8 million for the nine weeks ended October 1, 2005.

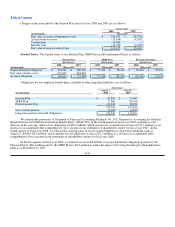

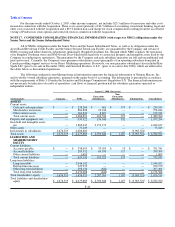

Plan Redesign. On September 7, 2007, our Board of Directors approved certain changes to our long-term benefits program.

Effective January 1, 2008, we offered a new, enhanced retirement savings plan (RSP) subject to participants' elections to participate

(as more fully described below). For associates participating in the RSP:

• Participants' balances in our 401(k) Plan were automatically transferred to the RSP.

• Our matching contributions to the RSP increased to a potential maximum 75% of the employee contributions (up to

a 6% deferral) from the potential maximum 50% to the 401(k) Plan (subject to IRS limit of $15,500 in 2008 for

employee contributions).

• Our matching contributions vest to employees in two years as compared to the three year vesting under the 401(k)

Plan.

• All current employees, who did not participate in the former 401(k) Plan, and future employees are automatically

enrolled in the RSP at a salary deferral rate of 3% once eligibility requirements have been met.

Concurrent with the implementation of the RSP and the Defined Contribution SERP Plan, we froze benefits offered under

our Pension and SERP Plans for most employees. Employees with a minimum of ten years of service and whose ages plus years of

service equaled at least 65 (Rule of 65) as of December 31, 2007 were allowed either 1) to continue participation in our 401(k) Plan

and Pension Plan (and SERP Plan, if eligible) or 2) to freeze certain benefits earned under the Pension Plan (and SERP Plan, if

eligible) and participate in the RSP. No employee who met vesting requirements forfeited benefits earned prior to January 1, 2008.

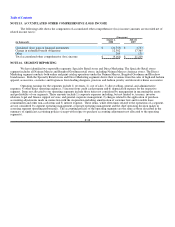

In connection with the redesign of our long-term benefits program, we recorded a one-time pension curtailment gain of $32.5

million (recorded as other income in our condensed consolidated statements of earnings) in the first quarter of fiscal year 2008 to

reflect the impact of freezing benefits provided under the Pension and SERP Plans as of December 31, 2007.

F-32