Neiman Marcus 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

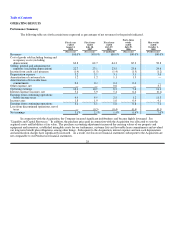

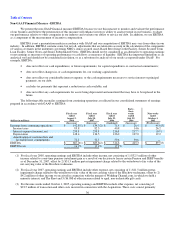

The net increase in COGS as a percentage of revenues in fiscal year 2008 was primarily due to decreased margins generated

by both our Specialty Retail stores and Direct Marketing operations of approximately 1.1% of revenues. The increase in COGS as a

percentage of revenues reflects the lower level of customer demand we experienced in fiscal year 2008. As a result, we generated a

lower level of full-price sales in fiscal year 2008 and incurred higher markdowns and sales promotions costs to liquidate on-hand

inventories held in excess of sales trends. In addition, our Direct Marketing operations realized lower margins on delivery and

processing revenues as a result of discounted and free shipping promotions.

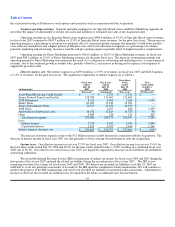

Selling, general and administrative expenses (excluding depreciation). SG&A expenses were 22.7% of revenues in fiscal

year 2008 compared to 23.1% of revenues in the prior fiscal year.

The net decrease in SG&A expenses as a percentage of revenues in fiscal year 2008 of approximately 0.4% of revenues was

primarily due to:

• Lower payroll costs, including estimated annual incentive compensation, of approximately 0.4% of revenues; and

• a decrease in marketing and advertising costs of approximately 0.2% of revenues incurred by Direct Marketing primarily due

to higher internet revenues, which have a lower expense to revenue ratio than catalog revenues.

These decreases in SG&A expenses, as a percentage of revenues, were partially offset by:

• higher benefits expenses of approximately 0.2% of revenues reflecting increases in long-term benefits; and

• a higher level of advertising and promotions costs of approximately 0.1% of revenues incurred by our Specialty Retail stores

during fiscal year 2008 in connection with 1) the celebration of the 100th anniversary of Neiman Marcus in October 2007 and

2) promotional events and activities conducted to facilitate the sell-through of on-hand inventories held in excess of sales

trends.

Income from credit card program. We earned HSBC Program Income of $65.7 million, or 1.4% of revenues, in fiscal year

2008 compared to $65.7 million, or 1.5% of revenues, in fiscal year 2007.

Depreciation expense. Depreciation expense was $148.4 million, or 3.2% of revenues, in fiscal year 2008 compared to

$136.5 million, or 3.1% of revenues, in fiscal year 2007.

Amortization expense. Amortization of intangible assets (customer lists and favorable lease commitments) aggregated $72.2

million, or 1.6% of revenues, in fiscal year 2008 compared to $72.3 million, or 1.6% of revenues, in fiscal year 2007.

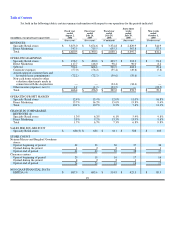

Other (income) expense, net. Other income, net was $1.2 million in fiscal year 2008 and was comprised of a pension

curtailment gain offset by an impairment charge for the Horchow tradename. In the first quarter of fiscal year 2008, we recorded a

one-time pension curtailment gain of $32.5 million, or 0.7% of revenues, as a result of our decision to freeze certain Pension and

SERP benefits as of December 31, 2007. In the fourth quarter of fiscal year 2008, we recorded a $31.3 million, or 0.7% of revenues,

pretax impairment charge related to the writedown to fair value of the net carrying value of the Horchow tradename based upon lower

revenues and royalty rate expectations with respect to the Horchow brand in light of current operating performance and future

operating expectations.

Other expense, net was $1.3 million in fiscal year 2007 and was comprised of income related to proceeds received from an

investment and gift card breakage, net of an impairment charge for the Horchow tradename. In the first quarter of fiscal year 2007, we

received consideration aggregating $4.2 million, or 0.1% of revenues, in connection with the merger of Wedding Channel.com, in

which we held a minority interest, and The Knot. We accounted for our investment in Wedding Channel.com under the cost method.

In prior years, we had previously reduced our carrying value of this investment to zero.

In the fourth quarter of fiscal year 2007, we recorded $6.0 million, or 0.1% of revenues, of other income for the breakage on

gift cards we previously sold and issued. The income was recognized based upon our analysis of the aging of these gift cards, our

determination that the likelihood of future redemption was remote and our determination that such balances were not subject to

escheatment laws applicable to our operations. Prior to the fourth quarter of fiscal year 2007, we had not recognized breakage on gift

cards pending, among other things, our final determination of the applicable escheatment laws applicable to our operations. Gift card

breakage during fiscal year 2008 was not significant.

In the fourth quarter of fiscal year 2007, we recorded a $11.5 million, or 0.3% of revenues, pretax impairment charge

31