Neiman Marcus 2007 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

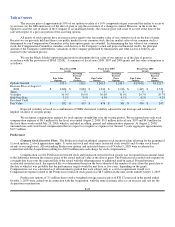

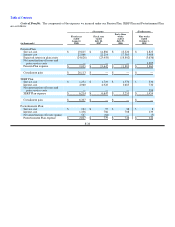

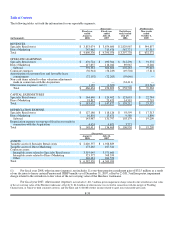

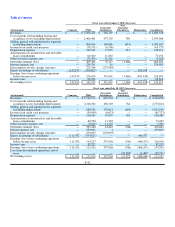

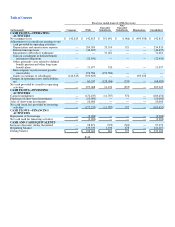

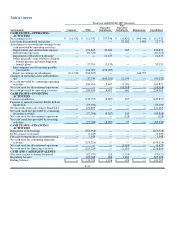

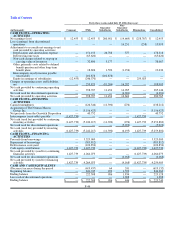

The following tables set forth the information for our reportable segments:

(Successor) (Predecessor)

(in thousands)

Fiscal year

ended

August 2,

2008

Fiscal year

ended

July 28,

2007

Forty-three

weeks ended

July 29,

2006

Nine weeks

ended

October 1,

2005

REVENUES

Specialty Retail stores $ 3,853,074 $ 3,674,600 $ 2,829,967 $ 544,857

Direct Marketing 747,462 715,476 567,771 87,515

Total $ 4,600,536 $ 4,390,076 $ 3,397,738 $ 632,372

OPERATING EARNINGS

Specialty Retail stores $ 476,724 $ 490,564 $ 312,296 $ 91,372

Direct Marketing 117,657 116,042 89,967 8,246

Subtotal 594,381 606,606 402,263 99,618

Corporate expenses (56,944) (56,229) (49,504) (5,811)

Amortization of customer lists and favorable lease

commitments (72,192) (72,265) (59,640) —

Non-cash items related to other valuation adjustments

made in connection with the Acquisition — — (34,411) —

Other income (expense), net (1) 1,189 (1,309)— (23,544)

Total $ 466,434 $ 476,803 $ 258,708 $ 70,263

CAPITAL EXPENDITURES

Specialty Retail stores $ 164,640 $ 124,402 $ 123,693 $ 22,784

Direct Marketing 18,812 23,475 14,519 2,791

Total $ 183,452 $ 147,877 $ 138,212 $ 25,575

DEPRECIATION EXPENSE

Specialty Retail stores $ 127,186 $ 118,126 $ 93,599 $ 17,313

Direct Marketing 16,801 13,671 9,580 1,896

Subtotal 143,987 131,797 103,179 19,209

Depreciation expense on step-up of fixed assets made in

connection with the Acquisition 4,424 4,671 3,771 —

Total $ 148,411 $ 136,468 $ 106,950 $ 19,209

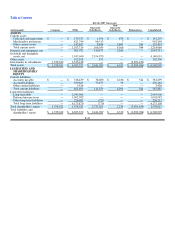

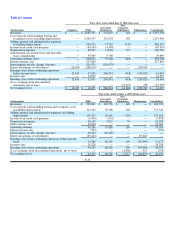

(Successor)

August 2,

2008

July 28,

2007

ASSETS

Tangible assets of Specialty Retail stores $ 2,020,557 $ 1,928,889

Tangible assets of Direct Marketing 173,265 167,541

Corporate assets:

Intangible assets related to Specialty Retail stores 3,519,045 3,571,660

Intangible assets related to Direct Marketing 523,572 568,359

Other 346,481 264,550

Total $ 6,582,920 $ 6,500,999

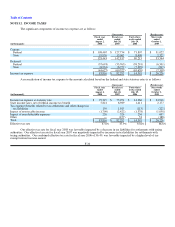

(1) For fiscal year 2008, other income (expense), net includes 1) a one-time pension curtailment gain of $32.5 million as a result

of our decision to freeze certain Pension and SERP benefits as of December 31, 2007, offset by 2) $31.3 million pretax impairment

charge related to the writedown to fair value of the net carrying value of the Horchow tradename.

For fiscal year 2007, other income (expense), net includes 1) $11.5 million pretax impairment charge related to the writedown to fair value

of the net carrying value of the Horchow tradename, offset by 2) $4.2 million of other income we received in connection with the merger of Wedding

Channel.com, in which we held a minority interest, and The Knot and 3) $6.0M of other income related to aged, non-escheatable gift cards.

F-39