Neiman Marcus 2007 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206

|

|

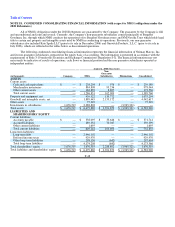

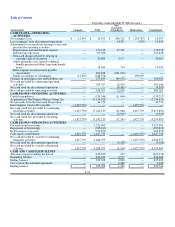

Table of Contents

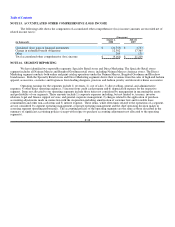

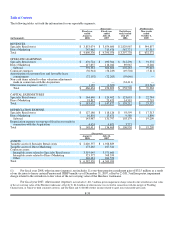

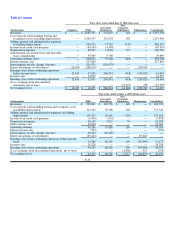

Fiscal year ended August 2, 2008 (Successor)

(in thousands) Company NMG

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations Consolidated

CASH FLOWS—OPERATING

ACTIVITIES

Net earnings (loss) $ 142,813 $ 142,813 $ 351,691 $ (1,066) $ (493,438) $ 142,813

Adjustments to reconcile net earnings to net

cash provided by operating activities:

Depreciation and amortization expense — 204,389 29,510 921 — 234,820

Deferred income taxes — (44,627) — — — (44,627)

Impairment of Horchow tradename — — 31,261 — — 31,261

Gain on curtailment of defined benefit

retirement obligations — (32,450) — — — (32,450)

Other, primarily costs related to defined

benefit pension and other long-term

benefit plans — 21,677 320 — — 21,997

Intercompany royalty income payable

(receivable) — 273,584 (273,584) — — —

Equity in earnings of subsidiaries (142,813) (350,625) — — 493,438 —

Changes in operating assets and liabilities,

net — 60,247 (128,006)(730)— (68,489)

Net cash provided by (used for) operating

activities — 275,008 11,192 (875)— 285,325

CASH FLOWS—INVESTING

ACTIVITIES

Capital expenditures — (172,237) (11,787) 572 — (183,452)

Purchases of short-term investments — (10,000) — — — (10,000)

Sales of short-term investments — 10,000 — — — 10,000

Net cash (used for) provided by investing

activities — (172,237)(11,787)572 — (183,452)

CASH FLOWS—FINANCING

ACTIVITIES

Repayment of borrowings — (3,900)— — — (3,900)

Net cash used for financing activities — (3,900)— — — (3,900)

CASH AND CASH EQUIVALENTS

Increase (decrease) during the period — 98,871 (595) (303) — 97,973

Beginning balance — 139,333 1,196 678 — 141,207

Ending balance $ — $ 238,204 $ 601 $ 375 $ — $ 239,180

F-44