Neiman Marcus 2007 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

• Sarasota, Florida in Fall 2010 (80,000 square feet planned);

• Walnut Creek, California in Fall 2010 (107,000 square feet planned);

• Princeton, New Jersey in Fall 2011 (90,000 square feet planned); and

• San Jose, California in Fall 2011 (120,000 square feet planned).

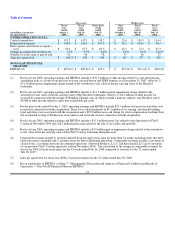

Bergdorf Goodman Stores. We operate two Bergdorf Goodman stores, both of which are located in Manhattan at 58th Street

and Fifth Avenue. The following table sets forth certain details regarding these stores:

Bergdorf Goodman Stores

Locations

Fiscal Year

Operations

Began

Gross Store

Sq. Feet

New York City (Main)(1) 1901 250,000

New York City (Men's)(1)* 1991 66,000

(1) Leased.

* Mortgaged to secure our senior secured credit facilities and the 2028 Debentures.

Clearance Centers. As of September 15, 2008, we operated 24 clearance centers that average approximately 27,700 square

feet each in size.

Distribution, support and office facilities. We own approximately 41 acres of land in Longview, Texas, where our primary

distribution facility is located. The Longview facility is the principal merchandise processing and distribution facility for Neiman

Marcus stores. We currently utilize a regional distribution facility in Dayton, New Jersey and five regional service centers in New

York, Florida, Texas and California. We also own approximately 50 acres of land in Irving, Texas, where our Direct Marketing

operating headquarters and distribution facility is located. In addition, we currently utilize another regional distribution facility in

Dallas, Texas to support our Direct Marketing operations.

Lease Terms. The terms of the leases for substantially all of our stores, assuming all outstanding renewal options are

exercised, range from 2 to 101 years. The lease on the Bergdorf Goodman Main Store expires in 2050, with no renewal options, and

the lease on the Bergdorf Goodman Men's Store expires in 2010, with two 10-year renewal options. Most leases provide for monthly

fixed rentals or contingent rentals based upon sales in excess of stated amounts and normally require us to pay real estate taxes,

insurance, common area maintenance costs and other occupancy costs.

For further information on our properties and lease obligations, see Item 7, "Management's Discussion and Analysis of

Financial Condition and Results of Operations" and Note 14 of the Notes to Consolidated Financial Statements in Item 15.

ITEM 3. LEGAL PROCEEDINGS

We are currently involved in various legal actions and proceedings that arose in the ordinary course of our business. We

believe that any liability arising as a result of these actions and proceedings will not have a material adverse effect on our financial

position, results of operations or cash flows.

On April 21, 2008, we entered into an amendment to the Program Agreement, dated as of June 8, 2005, by and among NMG,

Bergdorf Goodman, Inc., (a wholly owned subsidiary of NMG), HSBC Bank Nevada, N.A. and HSBC Private Label Corporation

(formerly known as Household Corporation) (collectively referred to as HSBC). The amendment was entered into subsequent to the

filing of a lawsuit by the Company against HSBC alleging a breach of the Program Agreement, as well as other claims, and an

application for the granting of a temporary restraining order and other injunctive relief. The amendment, among other things, provides

for 1) the allocation between HSBC and NMG of additional income, if any, to be generated from the credit card program as a result of

certain changes made to the Program Agreement, 2) the allocation of certain credit card losses between HSBC and NMG (subject to a

contractual limit on the losses allocable to NMG) and 3) the dismissal of the lawsuit and temporary restraining order without

prejudice. We do not expect that the amendment will have a material impact on the level of our future income under the Program

Agreement.

19