Neiman Marcus 2007 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

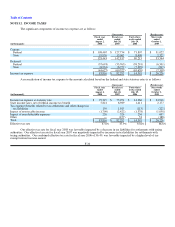

Table of Contents

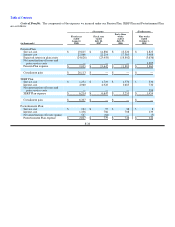

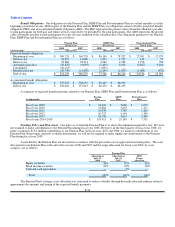

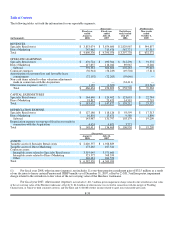

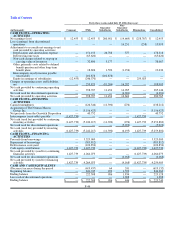

For the nine weeks ended October 1, 2005, other income (expense), net includes $23.5 million of transaction and other costs

incurred in connection with the Acquisition. These costs consist primarily of $4.5 million of accounting, investment banking, legal and

other costs associated with the Acquisition and a $19.0 million non-cash charge for stock compensation resulting from the accelerated

vesting of Predecessor stock options and restricted stock in connection with the Acquisition.

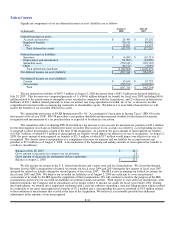

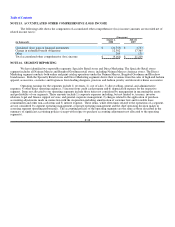

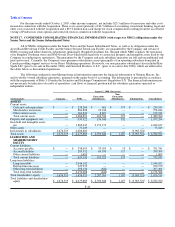

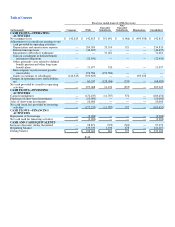

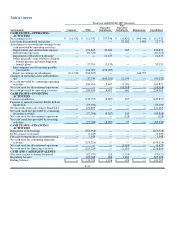

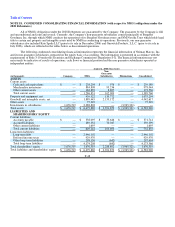

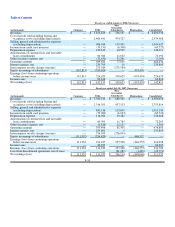

NOTE 17. CONDENSED CONSOLIDATING FINANCIAL INFORMATION (with respect to NMG's obligations under the

Senior Notes and the Senior Subordinated Notes)

All of NMG's obligations under the Senior Notes and the Senior Subordinated Notes, as well as its obligations under the

Asset-Based Revolving Credit Facility and the Senior Secured Term Loan Facility, are guaranteed by the Company and certain of

NMG's existing and future domestic subsidiaries (principally, Bergdorf Goodman, Inc. through which NMG conducts the operations

of its Bergdorf Goodman stores and NM Nevada Trust which holds legal title to certain real property and intangible assets used by the

Company in conducting its operations). The guarantees by the Company and each subsidiary guarantor are full and unconditional and

joint and several. Currently, the Company's non-guarantor subsidiaries consist principally of an operating subsidiary domiciled in

Canada providing support services to our Direct Marketing operations. Previously, our non-guarantor subsidiaries also included Kate

Spade LLC (prior to its sale in December 2006) and Gurwitch Products, L.L.C. (prior to its sale in July 2006), which are reflected in

the tables below as discontinued operations.

The following condensed consolidating financial information represents the financial information of Neiman Marcus, Inc.

and its wholly-owned subsidiary guarantors, prepared on the equity basis of accounting. The information is presented in accordance

with the requirements of Rule 3-10 under the Securities and Exchange Commission's Regulation S-X. The financial information may

not necessarily be indicative of results of operations, cash flows or financial position had the subsidiary guarantors operated as

independent entities.

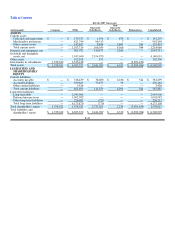

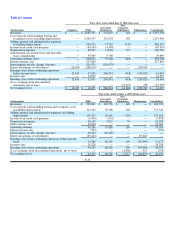

August 2, 2008 (Successor)

(in thousands) Company NMG

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations Consolidated

ASSETS

Current assets:

Cash and cash equivalents $ — $ 238,204 $ 601 $ 375 $ — $ 239,180

Merchandise inventories — 884,808 93,236 — — 978,044

Other current assets — 163,839 8,697 — — 172,536

Total current assets — 1,286,851 102,534 375 — 1,389,760

Property and equipment, net — 939,522 134,940 832 — 1,075,294

Goodwill and intangible assets,

net — 1,889,445 2,153,172 — — 4,042,617

Other assets — 75,249 — — — 75,249

Investments in subsidiaries 1,676,519 2,288,802 — — (3,965,321)—

Total assets $ 1,676,519 $ 6,479,869 $ 2,390,646 $ 1,207 $ (3,965,321) $ 6,582,920

LIABILITIES AND

SHAREHOLDERS'

EQUITY

Current liabilities:

Accounts payable $ — $ 338,095 $ 33,593 $ 53 $ — $ 371,741

Accrued liabilities — 289,352 69,930 117 — 359,399

Other current liabilities — 1,695 — — — 1,695

Total current liabilities — 629,142 103,523 170 — 732,835

Long-term liabilities:

Long-term debt — 2,946,102 — — — 2,946,102

Deferred income taxes — 929,970 — — — 929,970

Other long-term liabilities — 298,136 (642)— — 297,494

Total long-term liabilities — 4,174,208 (642)— — 4,173,566

Total shareholders' equity 1,676,519 1,676,519 2,287,765 1,037 (3,965,321)1,676,519

Total liabilities and shareholders'

equity $ 1,676,519 $ 6,479,869 $ 2,390,646 $ 1,207 $ (3,965,321)$ 6,582,920

F-40