Neiman Marcus 2007 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206

|

|

Table of Contents

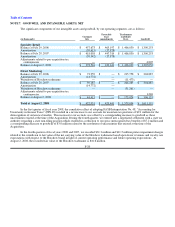

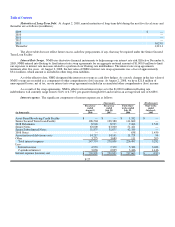

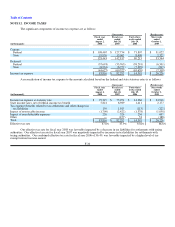

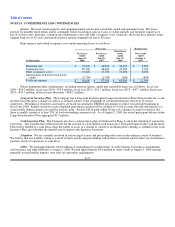

NOTE 12. INCOME TAXES

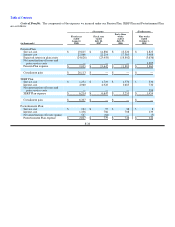

The significant components of income tax expense are as follows:

(Successor)

(Predecessor)

(in thousands)

Fiscal year

ended

August 2,

2008

Fiscal year

ended

July 28,

2007

Forty-three

weeks ended

July 29,

2006

Nine weeks

ended

October 1,

2005

Current:

Federal $ 108,467 $ 127,754 $ 71,807

$ 31,022

State 19,976 15,063 8,408

2,522

128,443 142,817 80,215

33,544

Deferred:

Federal (37,693) (53,763) (58,291) (6,501)

State (6,934)(6,759)(7,329) (817)

(44,627)(60,522)(65,620) (7,318)

Income tax expense $ 83,816 $ 82,295 $ 14,595

$ 26,226

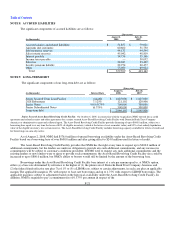

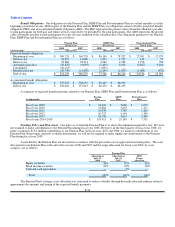

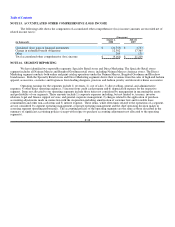

A reconciliation of income tax expense to the amount calculated based on the federal and state statutory rates is as follows:

(Successor)

(Predecessor)

(in thousands)

Fiscal year

ended

August 2,

2008

Fiscal year

ended

July 28,

2007

Forty-three

weeks ended

July 29,

2006

Nine weeks

ended

October 1,

2005

Income tax expense at statutory rate $ 79,319 $ 75,954 $ 14,366

$ 24,910

State income taxes, net of federal income tax benefit 5,821 6,989 1,411

2,177

Tax expense (benefit) related to tax settlements and other changes in

tax liabilities 159 1,925 (113)

(222)

Impact of non-taxable income (1,709) (2,422) (1,378) (1,058)

Impact of non-deductible expenses 226 326 256

607

Other — (477)53

(188)

Total $ 83,816 $ 82,295 $ 14,595

$ 26,226

Effective tax rate 37.0% 37.9% 35.6% 36.8%

Our effective tax rate for fiscal year 2008 was favorably impacted by a decrease in tax liabilities for settlements with taxing

authorities. Our effective tax rate for fiscal year 2007 was negatively impacted by increases in tax liabilities for settlements with

taxing authorities. Our combined effective tax rate for fiscal year 2006 of 36.4% was favorably impacted by a higher level of tax-

exempt interest income earned.

F-30