Neiman Marcus 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

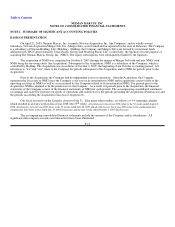

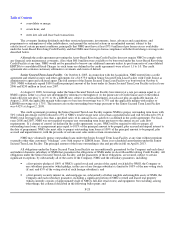

In the fourth quarter of fiscal year 2007, we recorded $6.0 million of other income for the breakage on gift cards we

previously sold and issued. The income was recognized based upon our analysis of the aging of these gift cards, our determination

that the likelihood of future redemption is remote and our determination that such balances are not subject to escheatment laws

applicable to our operations. Prior to the fourth quarter of fiscal year 2007, we had not recognized breakage on gift cards pending,

among other things, our final determination of the applicable escheatment laws applicable to our operations.

Gift card breakage recognized during fiscal year 2008 was not significant. We do not believe gift card breakage will have a material

impact on our future operations.

Loyalty Programs. We maintain customer loyalty programs in which customers accumulate points for qualifying purchases.

Upon reaching certain levels, customers may redeem their points for gifts. Generally, points earned in a given year must be redeemed

no later than 90 days subsequent to the end of the annual program period.

The estimates of the costs associated with the loyalty programs require us to make assumptions related to customer

purchasing levels, redemption rates and costs of awards to be chosen by our customers. Our customers redeem a substantial portion of

the points earned in connection with our loyalty programs for gift cards. At the time the qualifying sales giving rise to the loyalty

program points are made, we defer the portion of the revenues on the qualifying sales transactions equal to the estimate of the retail

value of the gift cards to be issued upon conversion of the points to gift cards. We record the deferral of revenues related to gift card

awards under our loyalty programs as a reduction of revenues. In addition, we charge the cost of all other awards under our loyalty

programs to cost of goods sold.

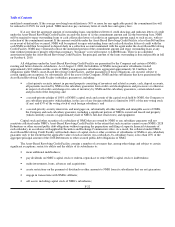

Stock-Based Compensation - Predecessor. In December 2004, the FASB issued SFAS No. 123(R), "Share-Based Payment"

(SFAS 123(R)). This standard requires all share-based payments to employees, including grants of employee stock options, to be

recognized in the financial statements based on their fair values. We adopted SFAS 123(R) as of the beginning of our first quarter of

fiscal year 2006 using the modified prospective method, which required us to record stock compensation for all unvested and new

awards as of the adoption date.

In connection with the adoption of the provisions of SFAS 123(R), we recorded non-cash charges for stock compensation of

approximately $19.0 million in the period from July 31, 2005 to October 1, 2005 primarily as a result of the accelerated vesting of all

Predecessor options and restricted stock in connection with the Acquisition.

Income Taxes. We use the asset and liability method of accounting for income taxes. Under this method, deferred tax assets

and liabilities are determined based on differences between financial reporting and tax basis of assets and liabilities and are measured

using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. We are routinely under audit

by federal, state or local authorities in the area of income taxes. We regularly evaluate the likelihood of realization of tax benefits

derived from positions we have taken in various federal and state filings after consideration of all relevant facts, circumstances and

available information. For those tax benefits we believe more likely than not will be sustained, we recognize the benefit we believe is

cumulatively greater than 50% likely to be realized. To the extent we were to prevail in matters for which accruals have been

established or be required to pay amounts in excess of recorded reserves, our effective tax rate in a given financial statement period

could be materially impacted.

Recent Accounting Pronouncements. In September 2006, the FASB issued Statement of Financial Accounting Standards

No. 157, "Fair Value Measurements" (SFAS 157), which provides guidance for using fair value to measure certain assets and

liabilities. SFAS 157 will apply whenever another standard requires or permits assets or liabilities to be measured at fair value. The

standard does not expand the use of fair value to any new circumstances. SFAS 157 is effective for financial statements issued for

fiscal years beginning after November 15, 2007, or our fiscal year ending August 1, 2009. We have not yet evaluated the impact, if

any, of adopting SFAS 157 on our consolidated financial statements.

In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159, "The Fair Value Option for

Financial Assets and Financial Liabilities" (SFAS 159). SFAS 159 expands opportunities to use fair value measurement in financial

reporting and permits entities to choose to measure many financial instruments and certain other items at fair value. This Statement is

effective for fiscal years beginning after November 15, 2007, or our fiscal year ending August 1, 2009. We have not yet evaluated the

impact, if any, of adopting SFAS 159 on our consolidated financial statements.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141(R), "Business Combinations"

(SFAS 141(R)), which addresses the recognition and accounting for identifiable assets acquired, liabilities assumed and non-

controlling interests in business combinations. In addition, SFAS 141(R) changes the accounting treatment for certain acquisition-

related items, including requirements to expense acquisition-related costs as incurred, expense

F-16