Neiman Marcus 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

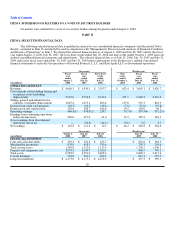

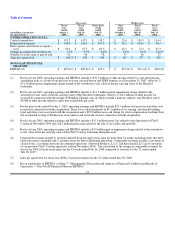

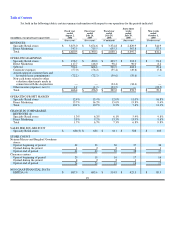

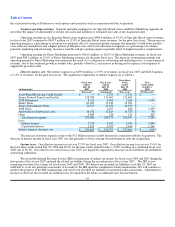

allowances are recorded as a reduction of our advertising costs when earned. Vendor allowances earned and recorded as a reduction to

selling, general and administrative expenses aggregated approximately $75.7 million, or 1.6% of revenues, in fiscal year 2008, $63.4

million, or 1.4% of revenues, in fiscal year 2007 and $61.7 million, or 1.5% of revenues, in fiscal year 2006 (including $18.6 million for

the Predecessor prior to the Acquisition).

We also receive allowances from certain merchandise vendors in conjunction with compensation programs for employees who

sell the vendor's merchandise. These allowances are netted against the related compensation expense that we incur. Amounts received

from vendors related to compensation programs were $71.6 million, or 1.6% of revenues, in fiscal year 2008, $65.4 million, or 1.5% of

revenues, in fiscal year 2007 and $59.5 million, or 1.5% of revenues, in fiscal year 2006 (including $10.1 million for the Predecessor prior

to the Acquisition).

Changes in our selling, general and administrative expenses are affected primarily by the following factors:

• changes in the number of sales associates primarily due to new store openings and expansion of existing stores, including

increased health care and related benefits expenses;

• changes in expenses incurred in connection with our advertising and marketing programs; and

• changes in expenses related to insurance and long-term benefits due to general economic conditions such as rising health

care costs.

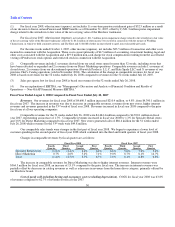

Income from credit card program. Pursuant to a long-term marketing and servicing alliance with HSBC, HSBC offers credit

card and non-card payment plans bearing our brands and we receive ongoing payments from HSBC based on net credit card sales and

compensation for marketing and servicing activities (HSBC Program Income). We recognize HSBC Program Income when earned. In

the future, the HSBC Program Income may be:

• increased or decreased based upon the level of utilization of our proprietary credit cards by our customers;

• increased or decreased based upon future changes to our historical credit card program related to, among other things, the

interest rates applied to unpaid balances and the assessment of late fees; and

• decreased based upon the level of future services we provide to HSBC.

25