Neiman Marcus 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

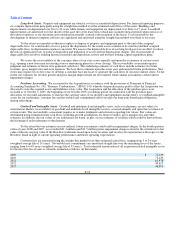

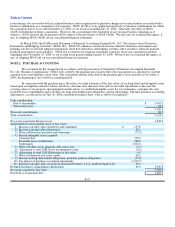

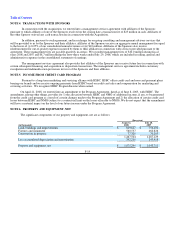

NOTE 7. GOODWILL AND INTANGIBLE ASSETS, NET

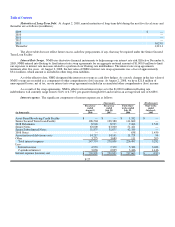

The significant components of our intangible assets and goodwill, by our operating segments, are as follows:

(in thousands)

Customer

lists

Favorable

lease

commitments

Tradenames

(indefinite

lives) Goodwill

Specialty Retail

Balance at July 29, 2006 $ 457,673 $ 465,197 $ 1,406,030 $ 1,300,253

Amortization (39,615)(17,878)

Balance at July 28, 2007 $ 418,058 $ 447,319 $ 1,406,030 $ 1,300,253

Amortization (39,542) (17,878)

Adjustments related to pre-acquisition tax

contingencies — — — 4,805

Balance at August 2, 2008 $ 378,516 $ 429,441 $ 1,406,030 $ 1,305,058

Direct Marketing

Balance at July 29, 2006 $ 73,959 $ — $ 215,758 $ 304,887

Amortization (14,772) —

Writedown of Horchow tradename — — (11,473)—

Balance at July 28, 2007 $ 59,187 $ — $ 204,285 $ 304,887

Amortization (14,772) —

Writedown of Horchow tradename — — (31,261) —

Adjustments related to pre-acquisition tax

contingencies 1,246

Balance at August 2, 2008 $ 44,415 $ — $ 173,024 $ 306,133

Total at August 2, 2008 $ 422,931 $ 429,441 $ 1,579,054 $ 1,611,191

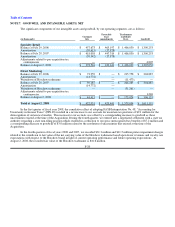

In the first quarter of fiscal year 2008, the cumulative effect of adopting FASB Interpretation No. 48, "Accounting for

Uncertainty in Income Taxes" (FIN 48) resulted in a net increase to our accruals for uncertain tax positions of $9.1 million for the

derecognition of certain tax benefits. This increase to our accruals was offset by a corresponding increase to goodwill as these

uncertainties existed at the time of the Acquisition. During the fourth quarter, we entered into a negotiated settlement with a state tax

authority regarding a state non-filing position which resulted in a reduction to our gross unrecognized tax benefits of $7.2 million and

a corresponding decrease to goodwill of $3.0 million related to the resolution of uncertainties that existed at the time of the

Acquisition.

In the fourth quarters of fiscal years 2008 and 2007, we recorded $31.3 million and $11.5 million pretax impairment charges

related to the writedown to fair value of the net carrying value of the Horchow tradename based upon lower revenues and royalty rate

expectations with respect to the Horchow brand in light of current operating performance and future operating expectations. At

August 2, 2008, the recorded fair value of the Horchow tradename is $16.6 million.

F-20