NVIDIA 2003 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2003 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

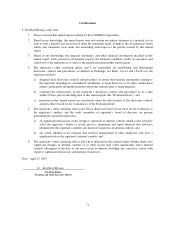

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

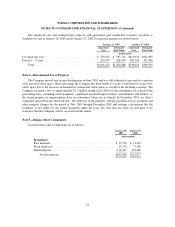

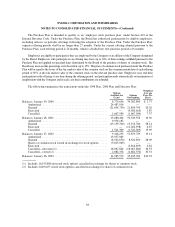

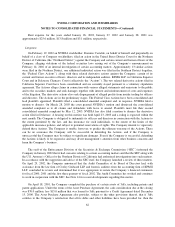

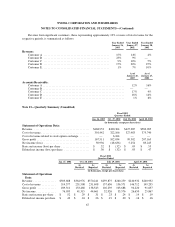

Note 10—Income Taxes

The provision for income taxes applicable to income before income taxes consists of the following:

Year Ended

January 26,

2003

Year Ended

January 27,

2002

Year Ended

January 28,

2001

(in thousands)

Current:

Federal .................................................. $ — $ — $ —

State .................................................... 135 134 205

Foreign .................................................. 20,555 38,673 10,136

Total current .............................................. 20,690 38,807 10,341

Deferred:

Federal .................................................. 20,569 (43,738) (15,866)

State .................................................... 9,319 (8,176) (11,335)

Foreign .................................................. — — —

Total deferred ............................................. 29,888 (51,914) (27,201)

Charge in lieu of taxes attributable to employer stock option plans ....... 9,180 88,932 63,199

Provision for income taxes .................................. $59,758 $ 75,825 $ 46,339

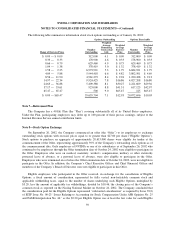

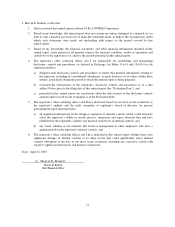

Income before income taxes consist of the following:

Year Ended

January 26,

2003

Year Ended

January 27,

2002

Year Ended

January 28,

2001

(in thousands)

Domestic .................................................... $ 20,764 $ 39,613 $105,147

Foreign ...................................................... 129,793 213,136 39,661

$150,557 $252,749 $144,808

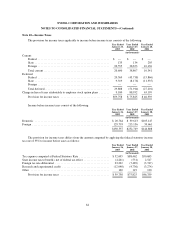

The provision for income taxes differs from the amount computed by applying the federal statutory income

tax rate of 35% to income before taxes as follows:

Year Ended

January 26,

2003

Year Ended

January 27,

2002

Year Ended

January 28,

2001

(in thousands)

Tax expense computed at Federal Statutory Rate ..................... $52,695 $88,462 $50,683

State income taxes (benefit), net of federal tax effect .................. (4,241) (531) 2,547

Foreign tax rate differential ...................................... 23,222 (7,489) (3,747)

Research and experimental credit ................................. (12,048) (4,736) (3,274)

Other ....................................................... 130 119 130

Provision for income taxes .................................. $59,758 $75,825 $46,339

64